Consumer Pullback amid Falling Optimism

28 Feb. 2025 | Comments (0)

Consumer Pullback amid Falling Optimism Augurs Growth Slow-down

A sharp pullback in consumer spending in the beginning of the year, despite rising income, corroborates declining consumer confidence and supports our projections for economic growth to slow this year and for the next Fed move to be a rate cut.

Trusted Insights for What’s Ahead®

- A broadbased decline in personal spending across both goods and services categories likely reflects growing consumer concerns about their income and employment prospects.

- Upward revisions to already robust spending in December suggest there was some front-loading of demand that would have occurred in early 2025. The weakness seen in these January data may be over-stated and spending should recover, at least partially, in the coming months.

- The PCE price index data, showing receding inflation, provides some relief and if inflation continues to subside should allow the Fed to resume interest rate cuts later this year.

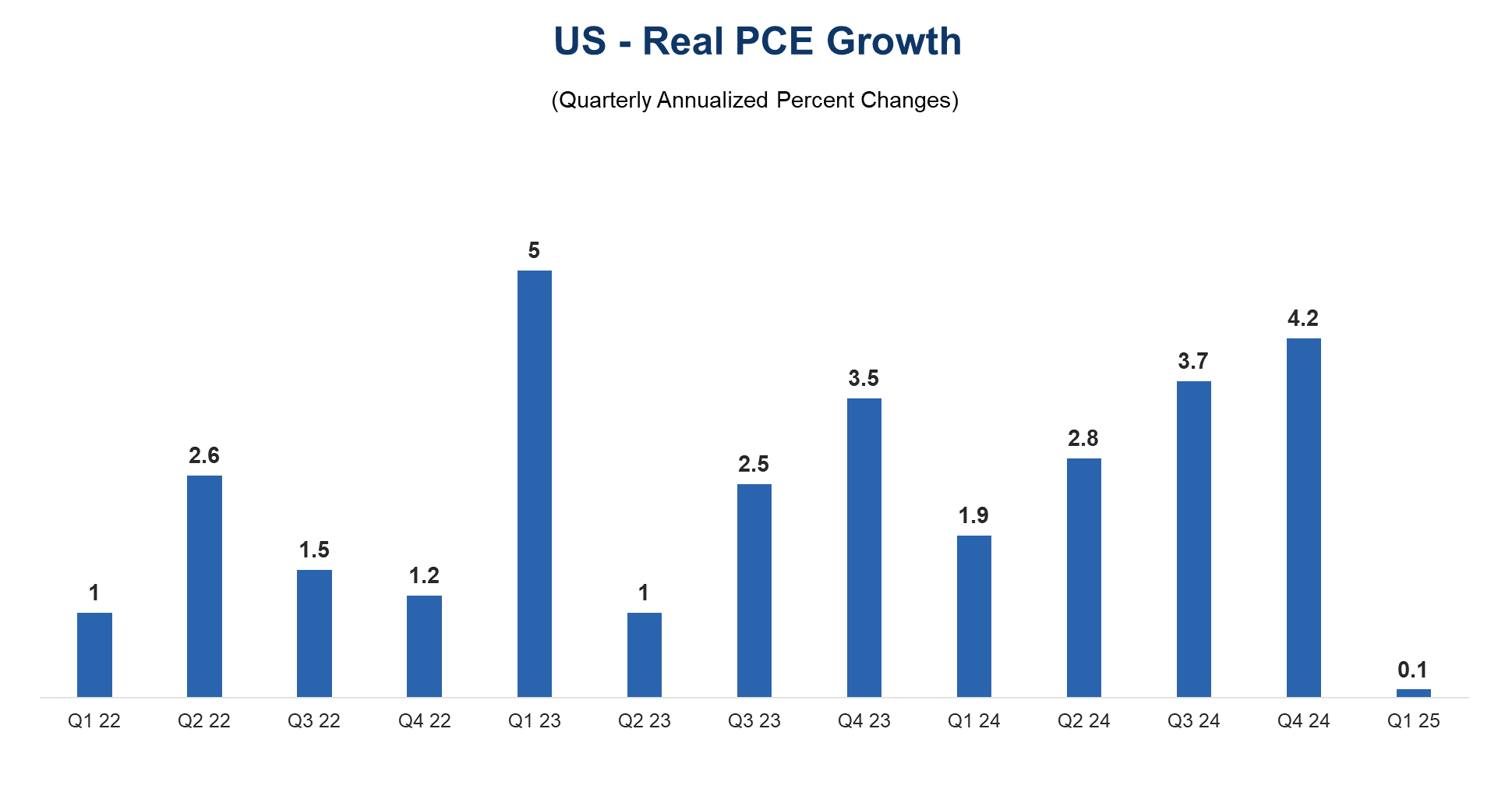

Figure 1. Spending Growth Sharply Slows in Q1

Sources: Bureau of Economic Analysis and The Conference Board.

Report Highlights

- The Bureau of Economic Analysis revealed that personal income grew at 0.9% in January, while personal spending declined by 0.2%.

- The 2.5% cost-of-living adjustment (COLA) for social security recipients, paired with higher Medicare and Medicaid receipts, accounted for nearly one-third of monthly growth in personal income. The adjustment only happens once a year and it usually distorts the January tally. Wages grew by 0.4 %, consistent with the recent pace.

- Inflation-adjusted consumption growth slowing to almost a halt in Q1 based on January numbers from 4.2% quarter-over-quarter seasonally adjusted annual rate in Q4 suggests consumers will likely be more cautious and tighten their purse strings this year.

- Both total Personal Consumption Expenditure (PCE) deflator and core PCE deflator, which excludes food and energy from the total, rose by 0.3% in January. On a year over-year basis inflation slowed to 2.5% from 2.6% for the total, and to 2.6% from 2.9% for the core.

- A sharp increase in nominal household income, coupled with a decline in spending, pushed the savings rate to the highest level since June.

- Spending fell across major categories of goods and services with large declines in auto, furniture and recreation services.

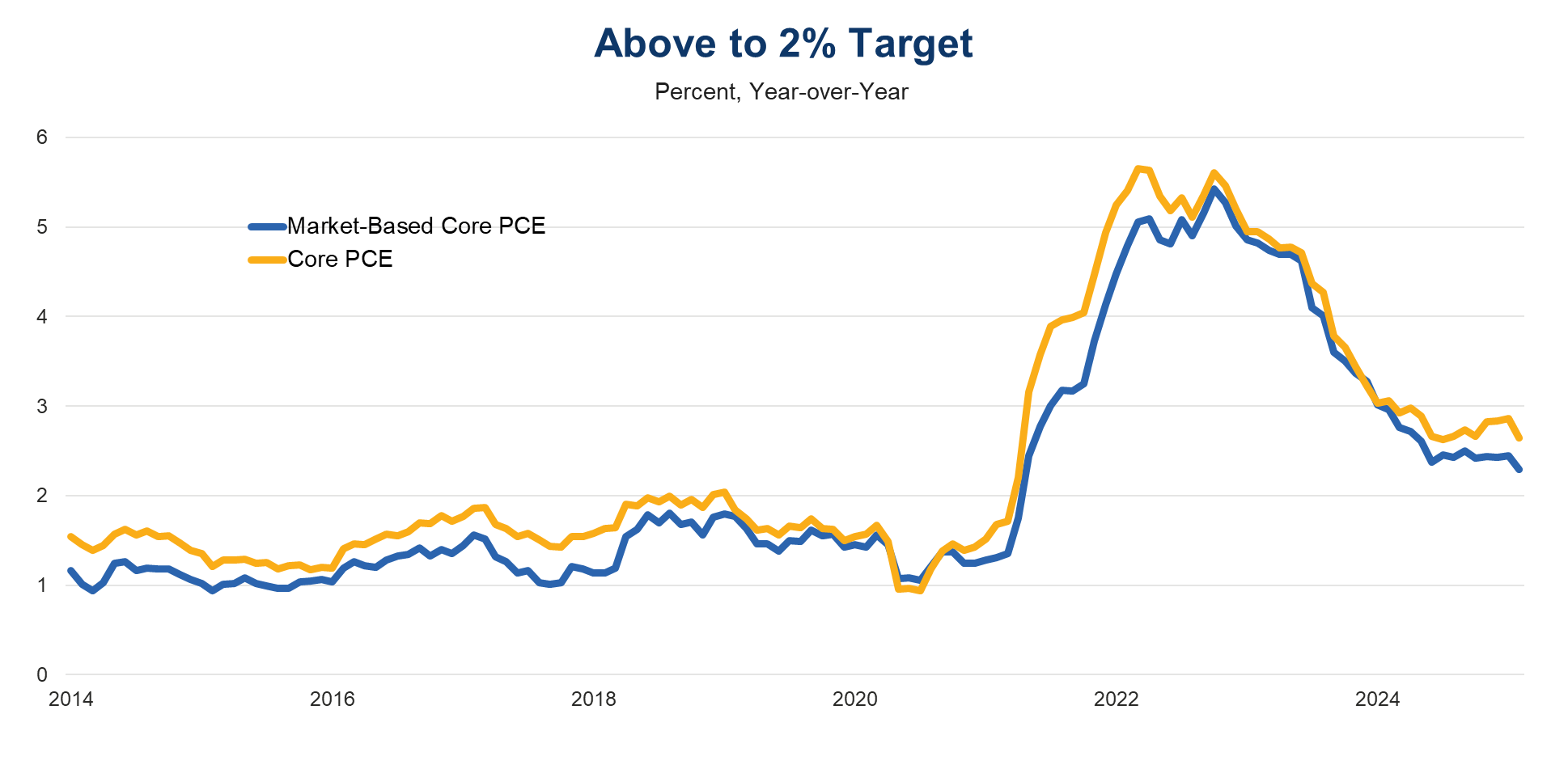

Inflation Recedes

Consumer inflation slowed in January, but both market-based prices and imputed prices (see below) remain above the Fed’s 2% inflation target. Market-based core PCE, the index which measures directly observed prices (as opposed to imputed prices such as some housing and financial services costs) increased by 2.3%, down from a 2.4% pace prior (Figure 2). Overall core PCE increased by 2.6%, less than a 2.9% pace observed in December. These recent developments further support our expectations that the Fed will hold interest rates steady in H1, but will likely resume interest rate cuts in H2.

Figure 2. Core Inflation Stuck above 2% Inflation Target

Sources: Bureau of Economic Analysis and The Conference Board.

Details of Consumer Spending Reveal Broad-based Pullback

Nominal consumer spending declined by 0.2% month-over-month in January on the back of an upwardly revised 0.8% gain in December (previously estimated at 0.7%). Real spending dropped by 0.5% in January after a 0.5% increase in December. The details revealed declines in durable goods spending, namely in autos and furniture, food and recreation services.

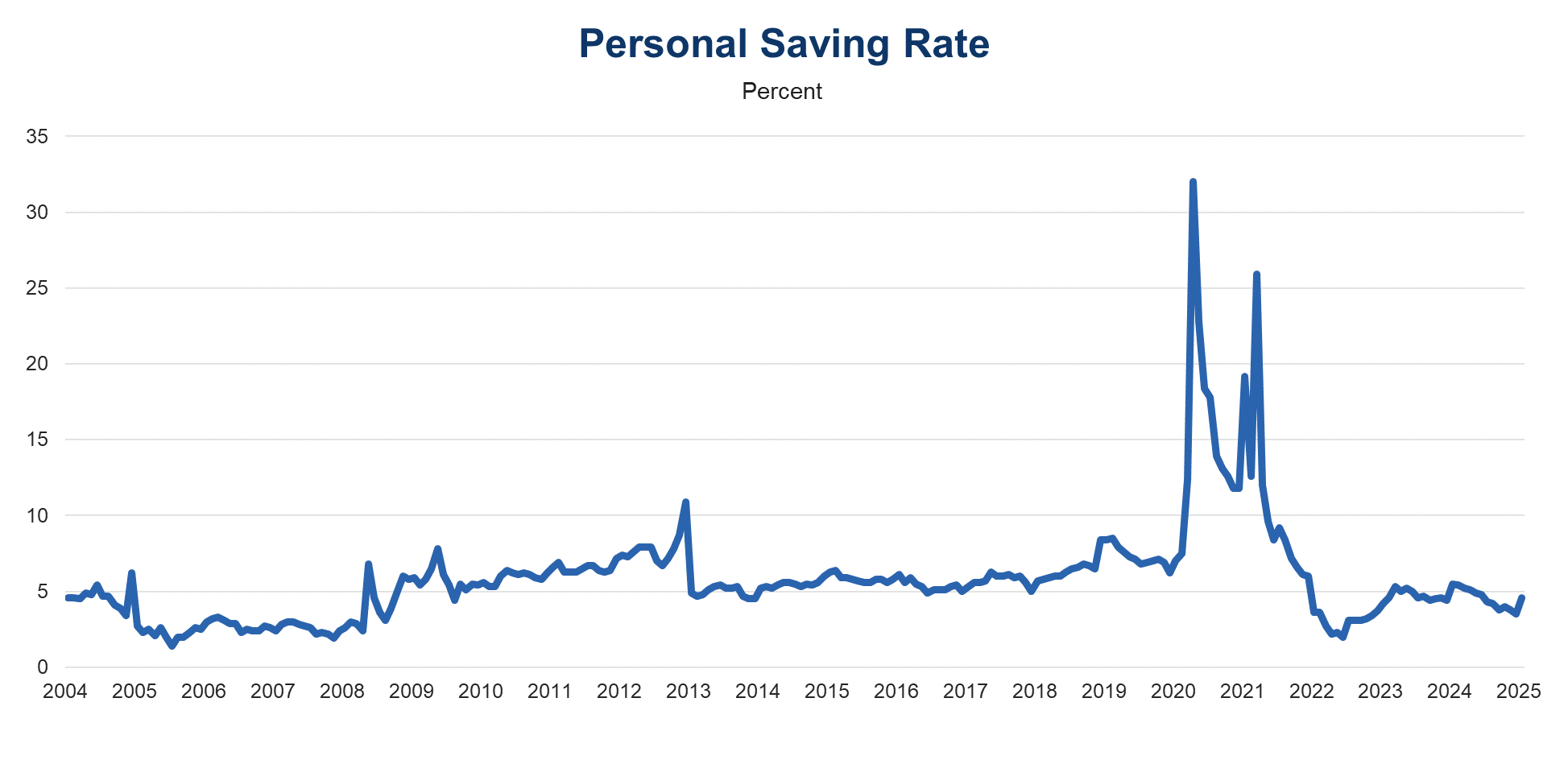

Consistent with the latest decline in The Conference Board Consumer Confidence Index (CCI), the personal saving rate jumped to 4.6% from December’s 3.5% as spending declined and income rose. The saving rate remains low relative to pre-Covid standards, however. (Figure 3).

Figure 3. Becoming More Frugal

Sources: Bureau of Economic Analysis and The Conference Board.

-

About the Author:Yelena Shulyatyeva

Yelena Shulyatyeva is a Senior US Economist for The Conference Board Economy, Strategy & Finance Center, where she focuses on analyzing macroeconomic developments in order to better understand the…

0 Comment Comment Policy