April inflation cools following a hot Q1

15 May. 2024 | Comments (0)

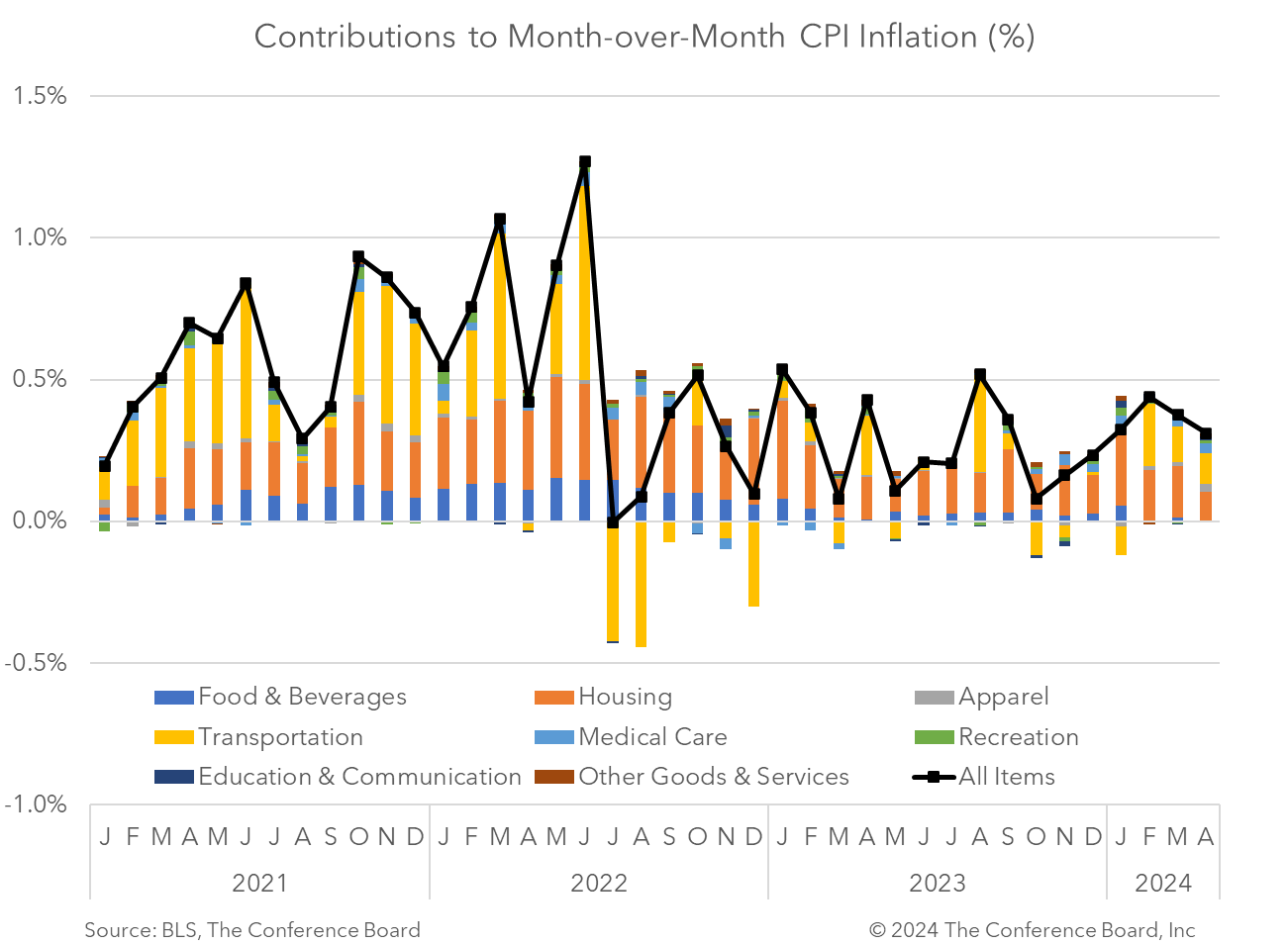

The April Consumer Price Index (CPI) showed that inflation rose by 3.4% from a year earlier, vs. 3.5% in March and 6.4% at the beginning of 2023. Meanwhile, core CPI, which excludes volatile food and energy prices, rose by 3.6% from a year earlier, vs. 3.8% y/y in March and 5.5% y/y at the beginning of 2023.

Following hotter-than-expected inflation data in Q1 2024, these April numbers showed some welcome relief. Despite another rise in gasoline prices, the headline CPI cooled in month-on-month terms and the year-on-year reading came in 0.1 percentage points lower as well. Goods inflation rose modestly from the month prior, but stubborn services inflation cooled somewhat. Shelter prices, including both rent and Owners Equivalent Rent (OER) are continuing to cool in year-on-year terms, but month-on-month increases have yet to converge to their pre-pandemic norms. Meanwhile, prices for insurance continued to rise – especially motor vehicle insurance.

Today’s data will be welcomed by the Fed, but aren’t enough to negate the spike in inflation seen at the onset of the year. Optimism about imminent Fed cuts has given way to an expectation that a “higher for longer” interest rate environment is more likely. While we do expect inflation to gradually ebb we don’t think the Fed’s 2% target is likely until Q2 2025. However, we forecast that enough progress will be achieved by the end of 2024 that the Fed will begin to cut interest rates in November.

DATA DETAILS

Headline CPI rose by 0.3% m/m and 3.4% y/y, vs. March’s 0.4% m/m and 3.5% y/y. Month-on-month shelter and gasoline price increases accounted for more than 70% of the all items increases, according to the Bureau of Labor Statistics (BLS). Gasoline prices rose 2.8% from the month prior. Within the shelter category, rent prices rose 0.35% m/m (the slowest since Aug 2021) and Owner Equivalent Rent (OER) increased by 0.42% m/m, vs. 0.44% in March. In year-on-year terms inflation for both of these shelter types continued to cool to their lowest rates since mid-2022. Food prices were flat in the month, with food at home declining modestly and food away from home rising slightly.

Core CPI rose by 0.3% m/m and 3.6% y/y, vs. March’s 0.4% m/m and 3.8% y/y. According to the BLS, the core CPI was driven by shelter, but auto insurance, medical care and apparel were also contributors. Insurance prices continued to rise in the month, but less rapidly. Meanwhile several categories saw price decreases from the month prior, including new and used vehicles.

-

About the Author:Erik Lundh

Erik Lundh is Senior Global Economist for The Conference Board Economy, Strategy & Finance Center, where he focuses on monitoring global economic developments and overseeing the organization&rsquo…

0 Comment Comment Policy