Hot CPI May Contribute to Keeping Fed on Pause

12 Feb. 2025 | Comments (0)

Upward surprises in both month-over-month and year-over-year Headline and Core CPI measures in January will likely contribute to keeping the Fed firmly on hold in the coming months. In his semi-annual monetary policy testimony before Congress, Fed Chair Jerome Powell made it clear that the central bank remains resolute to bring inflation down to its 2% inflation target.

Yet, the January hot inflation print is not as bad underneath the surface as it may look at a first glance. While seasonality issues may be boosting the January readings, making inflation sticky, inflation remains on a downward trend.

Trusted Insights for What’s Ahead®

Hotter-than-expected January CPI suggests the Fed will likely remain on hold in the coming months.

Increases in the usual suspects, such as auto insurance, boosted the month-over-month print. Meanwhile rising lodging away from home and used car prices have exacerbated the rise in the January CPI. These increases may have been driven by the impact of California wildfires and should subside in future readings.

Incorporating the usual impact on the January print as firms reset non-seasonally adjusted prices in the beginning of the year, which may not be fully captured by the seasonal factors, may result in overestimating inflation in January.

We project both Headline and Core PCE, which CPI feeds into, to stabilize at 2.0 percent year-over year going into 2026. The Conference Board estimates proposed tariffs may substantially lower GDP growth and raise inflation if implemented.

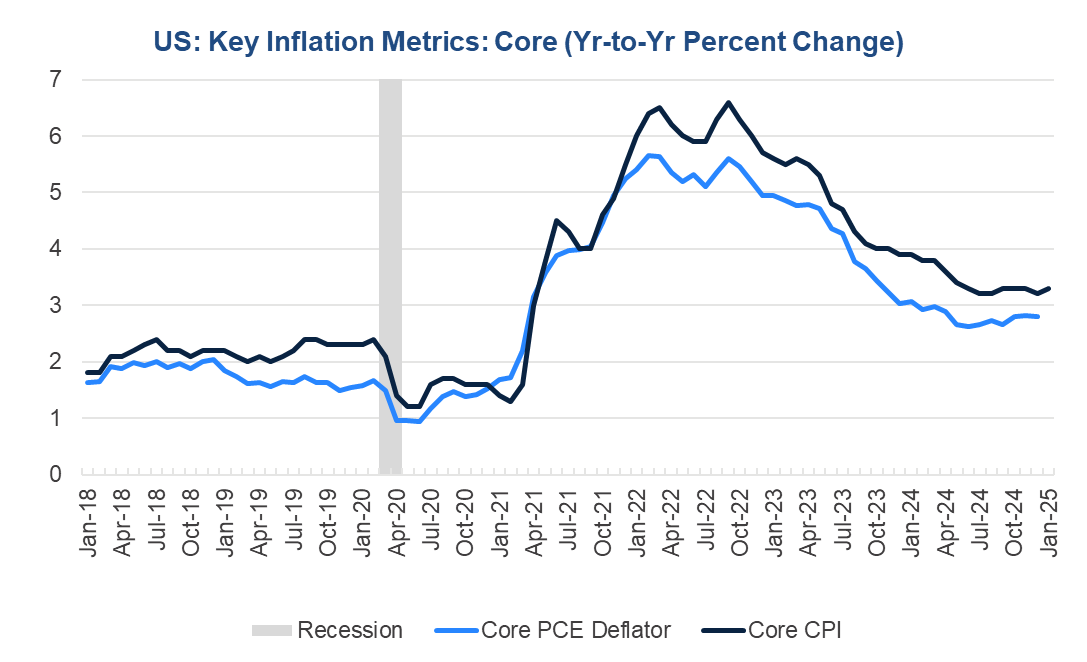

Figure 1. Core CPI inflation up in January

Sources: Bureau of Labor Statistics, Bureau of Economic Analysis, and The Conference Board.

Report Highlights

Broadbased Increase in Headline Inflation

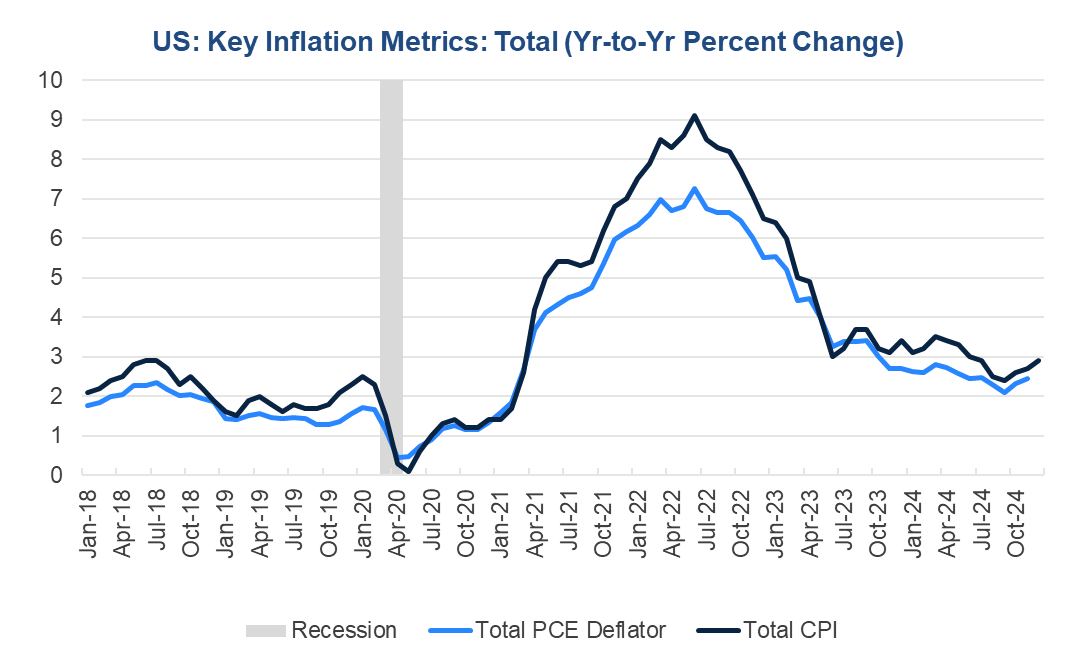

Total CPI rose by 0.5 percent month-over-month in January, as it kept picking up from a series of 0.2 percent prints in the middle of 2024. Driving the increase were prices for food (particularly eggs) and energy (including gasoline), while Core CPI inflation, or total prices less food and energy, also picked up to 0.4 percent from 0.2 percent in the prior month.

On a year-over-year basis, CPI inflation rose to 3.0 percent from 2.9 percent, the highest reading since June 2024. The year-over-year rate of Core CPI accelerated to 3.3 percent from 3.2 percent.

Figure 2. Total CPI inflation picks up pace

Sources: Bureau of Labor Statistics, Bureau of Economic Analysis, and The Conference Board.

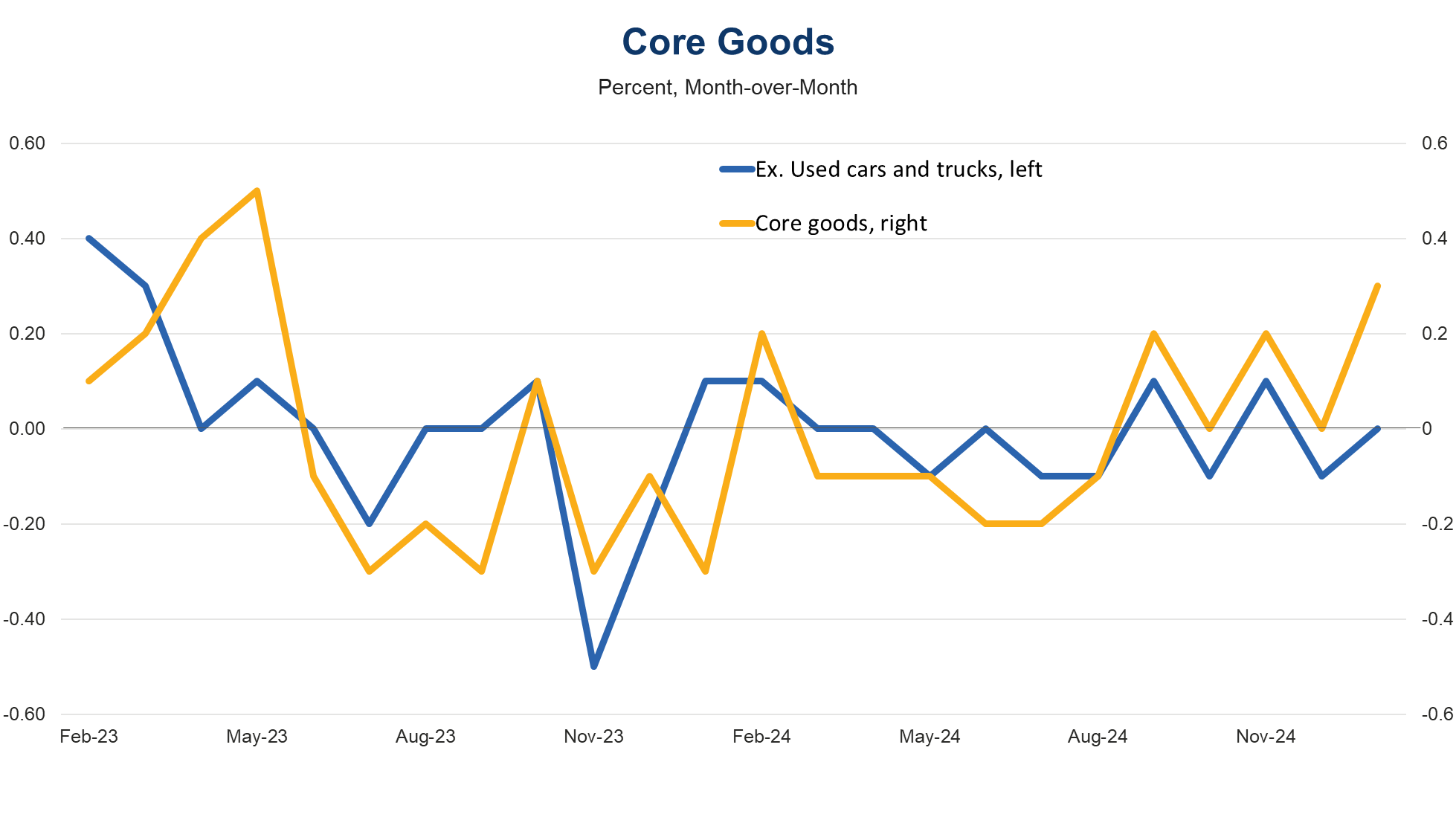

Core goods prices jumped higher (0.3 percent) mainly driven by an outsized monthly gain in used vehicle prices (a 2.2 percent gain). On a year-over-year basis, core goods posted only a minor decline (-0.1 percent) following a series of negative readings over more than a year. While core goods no longer a source of deflation, core services inflation needs to subside to a larger extent for more substantial progress in overall inflation.

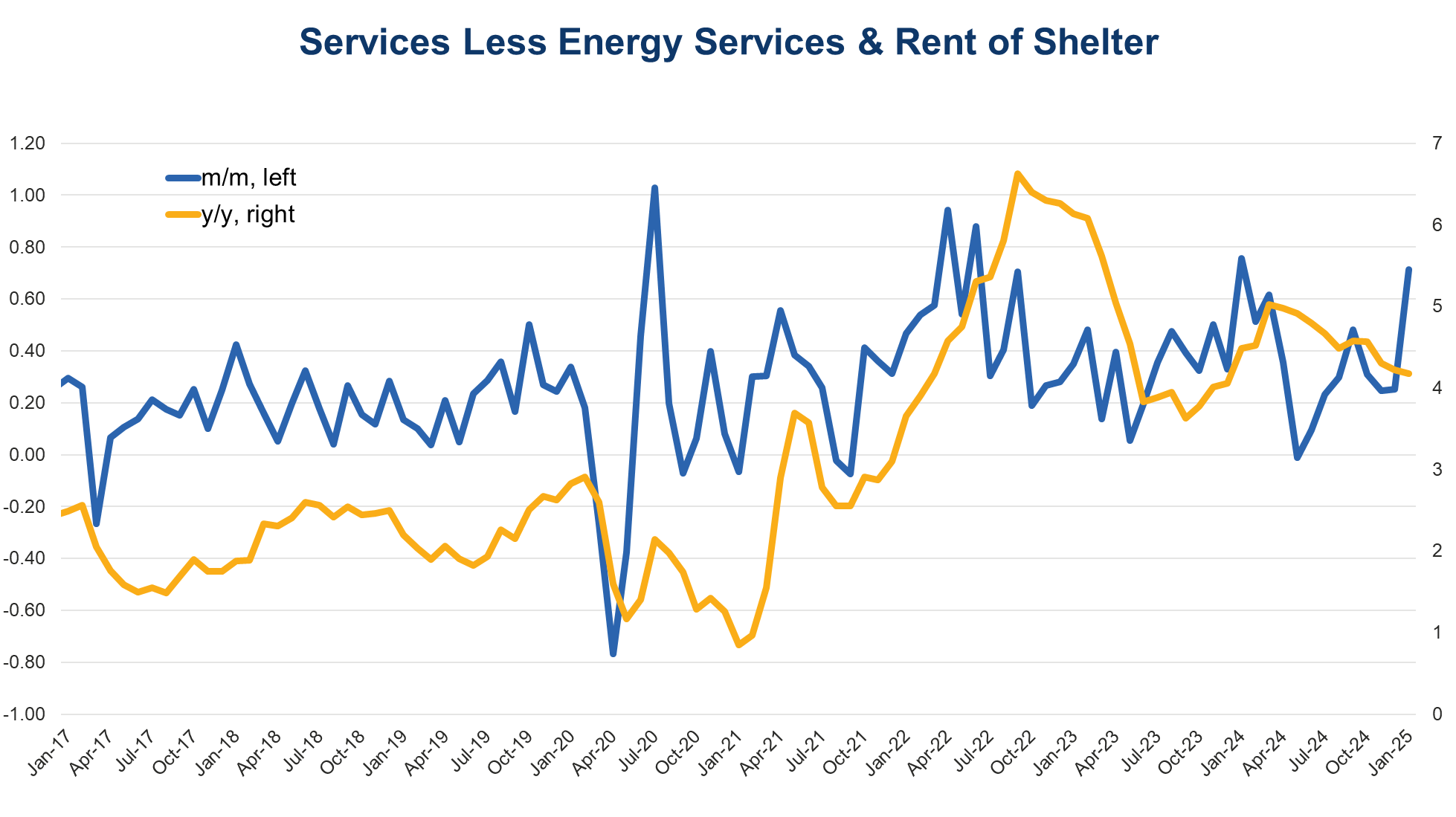

Core services jumped 0.5 percent month-over-month (rising from 0.3 percent in the previous three months) as lodging away from home, airline fares and auto insurance -- all jumped in the month. Notably both rent of primary residence (RPR) and owners’ equivalent rent (OER) posted steady increases (0.3 percent month-over-month) consistent with the recent trends. On a year-over-year basis core services continued to subside (4.3 percent versus 4.4 percent prior), but only slowly and remain significantly above pre-covid norms.

Core Goods Boosted by Car Prices, Services Inflation Picks Up

A sharp increase in used car prices led to a pick-up in core goods inflation. Indeed, prices in this category jumped by 2.2 percent in January, the most since May 2023, potentially driven by strong replacement demand for cars on the back of California wildfires. Excluding this component, core goods prices remained flat in January.

Figure 3. Used car prices boost core goods

Sources: Bureau of Labor Statistics, Bureau of Economic Analysis, and The Conference Board.

Meanwhile, services inflation remains stubborn. Core services inflation picked up to 0.5 percent month-over month in January – the highest increase since March 2024 -- driven by a wide range of increases in the components. Rent of shelter was not the culprit this time as both RPR and OER posted steady gains consistent with the prior pace. Excluding rent of shelter, core services inflation picked up to 0.7 percent from 0.3 percent prior pointing to a possible increase in core services excluding housing in the comparable PCE measure released later this month. On a year-over-year basis, inflation in this component remained unchanged at 4.2 percent, a touch lower that 4.5 percent in January 2024.

While the latest jump in the month-over-month measures of CPI may look concerning, the latest data does not necessarily alter a broader disinflationary trend, unless hot January readings are sustained.

Figure 4. Services keeping core inflation sticky

Sources: Bureau of Labor Statistics, and The Conference Board.

-

About the Author:Yelena Shulyatyeva

Yelena Shulyatyeva is a Senior US Economist for The Conference Board Economy, Strategy & Finance Center, where she focuses on analyzing macroeconomic developments in order to better understand the…

0 Comment Comment Policy