Tepid Job Gains Highlight Hiring Difficulties

04 Jun. 2021 | Comments (0)

Commentary on today’s U.S. Bureau of Labor Statistics Employment Situation Report

By Frank Steemers, Senior Economist, The Conference Board

Fewer jobs were added in May relative to consensus, suggesting that the labor market recovery continues to lag behind that of the broader economy. However, the tepid employment gains highlight labor demand and supply mismatches that are prompting firms to raise wages to attract workers.

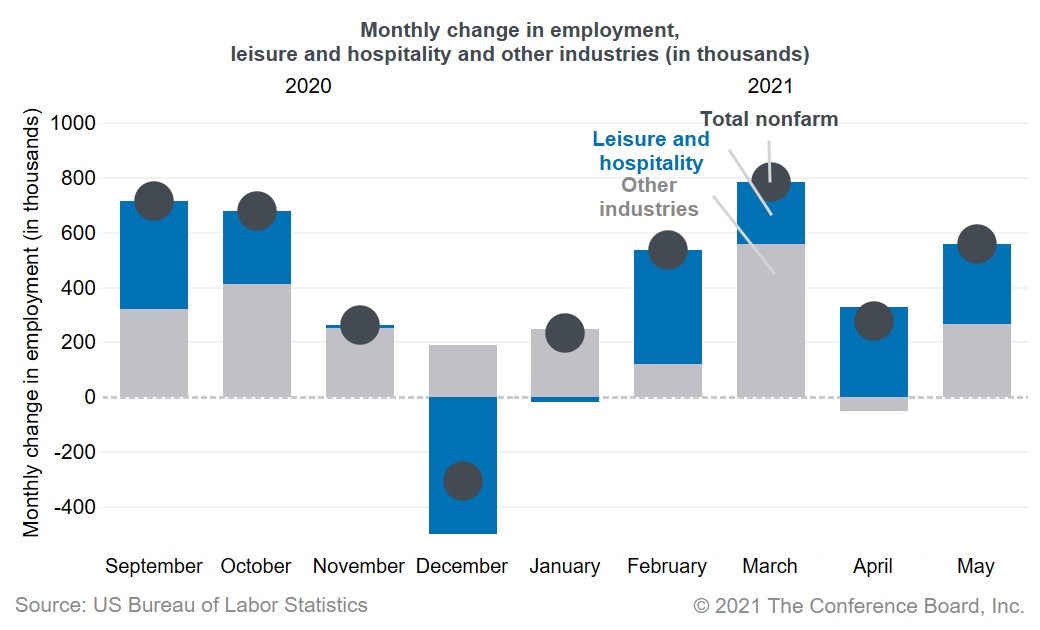

Nonfarm payrolls increased by 559,000 in May, after an upwardly revised increase of 278,000 in April. The published unemployment rate dropped from 6.1 to 5.8 percent, and the true rate, after adjusting for the misclassification error, decreased from 6.4 percent to 6.1 percent in May. Average hourly earnings increased by a stunning 7.4 percent, annual rate, in the past two months, indicating severe labor shortages. The labor force participation rate decreased from 61.7 to 61.6 percent in May. The number of jobs is still 7.6 million below February 2020 levels, with women representing 55 percent of these employment losses.

The leisure and hospitality industry continues to drive overall employment growth with 292,000 jobs gained in May, of which the majority was in food services and drinking places (186,000 jobs). Away from food and beverage places, a total of 267,000 jobs were added in May, after declining in April. Still, the construction and retail sectors remained weak in May, shedding jobs for a second consecutive month.

This month’s jobs report shows that more jobs are being added to the economy as the economy reopens. However, there are still many job openings that employers are struggling to fill, most notably in leisure and hospitality and other in-person services. This appears to be difficult, as much rehiring needs to happen at the same time instead of being spread across the year as is the case during normal years. Finding qualified workers and filling open positions take time, and rising wages are only partly helping to speed up this process.

While the demand for workers is high, supply continues to be constrained due to pandemic-related circumstances such as childcare challenges, elevated unemployment benefits (which has increased bargaining power for some unemployed workers), and the fear of contracting COVID-19. Labor force participation is still well below prepandemic rates and has not yet picked up meaningfully since the summer. This means that labor shortages, especially for in-person services, could remain for the better part of 2021.

Since current labor shortages are mostly temporary and a result of the rapid reopening of the economy, towards the end of 2021 we should experience loosening labor markets. However, after a pause in 2022, tight labor markets may return as the unemployment rate will be lower, and a shrinking US working-age population means we will reach tight labor markets sooner than in previous decades.

-

About the Author:Frank Steemers

The following is a bio or a former employee/consultant Frank Steemers is a Senior Economist at The Conference Board where he analyzes labor markets in the US and other mature economies. Based in New …

0 Comment Comment Policy