Job growth accelerated before Delta

06 Aug. 2021 | Comments (0)

Commentary on July US Bureau of Labor Statistics Employment Situation Report

by Gad Levanon, Head of the Labor Market Institute, The Conference Board

Job growth accelerated further during June and July, as in-services industries continued to reopen. The labor market remains very tight and wage growth is still unusually high, especially in blue-collar and manual services-related industries. Going forward, we expect economic activity in in-person services to be negatively affected by the new wave of infections. We expect job growth to slightly slow down as a result, but remain very strong.

Nonfarm payroll employment increased by 943,000 in July, after an upward revised increase of 938,000 in June. The published unemployment rate ticked down from 5.9 to 5.4 percent, and the true rate, after adjusting for the misclassification error, went from 6.1 to 5.7 percent.

The labor force participation rate for the 25-54 age group increased again to 81.8 percent but remains well below the 82.9 percent in February 2020. The number of jobs is still 5.7 million below February 2020 levels, with women representing 54 percent of these employment losses.

July’s job gains were once again driven by the leisure and hospitality industry, which added 380,000 jobs—representing 40 percent of all jobs gained in the month.

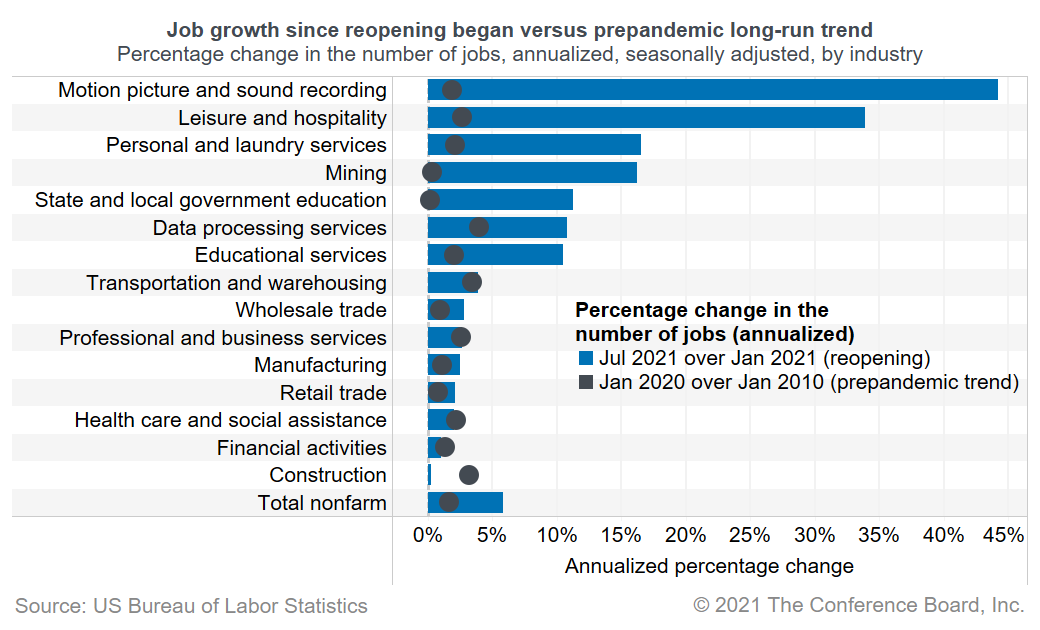

The employment recovery after April 2020 was historically strong across almost every industry. In contrast, the unusually strong growth in the past six months is more constrained to several industries such as leisure and hospitality, mining, personal care, and education (both government and private). In most other industries, the growth rate in the past six months is not that different from its typical rate prior to the pandemic (see chart below).

Wages are still increasing rapidly. Average hourly earnings are up 5.8 percent (annual rate) over the past four months, signaling employers are offering stronger incentives to attract qualified workers. Much of the acceleration in wages comes from earnings of blue-collar and manual services industries. During the last four months, average hourly earnings increased by 17 percent (annual rate) in the leisure and hospitality sector and by 14.7 percent in transportation and warehousing.

The rapid increase in the number infections had little to no impact on July’s job numbers, which were collected in the week of July 12. However, going forward we do expect economic activity in in-person services to be negatively affected by the new wave of infections. We expect job growth to slightly slow down as a result, but remain very strong.

Today’s jobs report and the latest responses to the question about the difficulty of finding a job from The Conference Board July Consumer Confidence Survey suggest that the labor market remained historically tight in July, and significant wage pressures are likely to continue in the coming months. Strong wage growth will boost consumer purchasing power and confidence, but at the same time contribute to inflationary pressures and squeeze corporate profits.

-

About the Author:Gad Levanon, PhD

The following is a biography of former employee/consultant Gad Levanon is the former Vice President, Labor Markets, and founder of the Labor Market Institute. He led the Help Wanted OnLine©…

0 Comment Comment Policy