Healthy consumer spending supported by strong labor markets

27 Aug. 2021 | Comments (0)

July Personal Income & Outlays data released this morning, show an economy that is still recovering. Amid shifting demand from goods to services spending, personal consumer expenditures growth slowed.

According to Personal Income & Outlays data, overall personal income rose 1.1 percent (in nominal terms) month-over-month (m/m) in July as government social benefits and compensation of employees increased. Strong employment gains and wage growth are likely to continue to support personal income and consumer spending even as some government supports expire over the coming months.

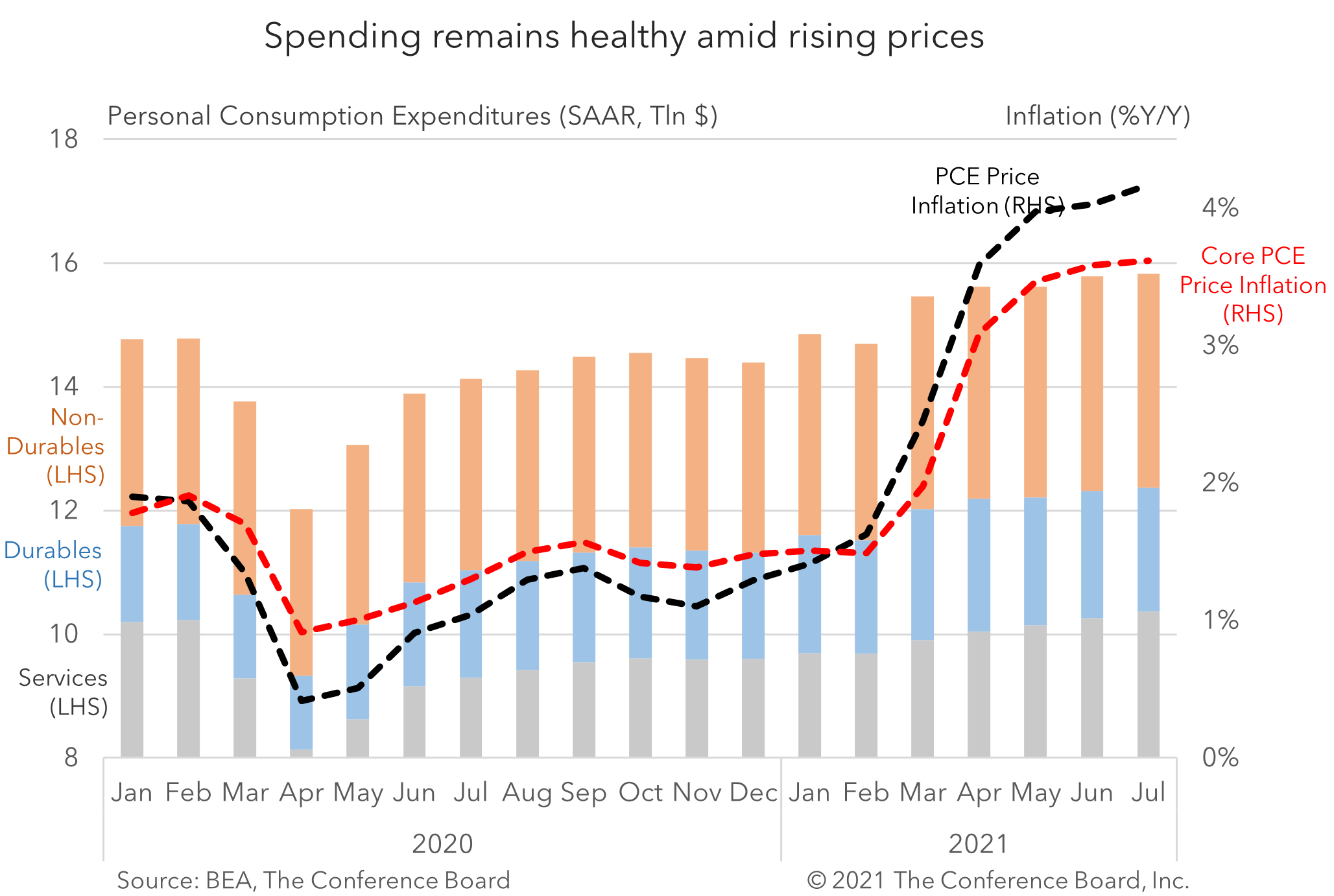

Personal consumption expenditures rose 0.3 percent m/m in July following a 1.1 percent m/m increase in June. Spending on services rose by 1.0 percent m/m offsetting decreasing spending on goods which declined by 1.1 percent m/m. Robust service spending growth was widespread among all categories with spending on food services and accommodations rising the most as consumers returned to their normal activities this summer. In contrast to services, spending on durable goods declined by 2.3 percent m/m and spending on non-durable goods declined by 0.4 percent m/m. Motor vehicles and parts, recreational goods and vehicles, as well as clothing and footwear led the declines in spending on goods. Supported by acceleration of vaccination campaigns and more people returning to work, pent-up demand for services is likely to remain strong. However, economic activity in in-person services could be negatively affected by the new wave of infections resulting in slightly slower job growth which could dampen spending further. Early data for August already shows some softening in air travel, box office sales, and business confidence which could affect the outlook for employment and spending.

Finally, PCE inflation remained high. Headline PCE price inflation accelerated to 4.2 percent year-over-year (y/y) in July, vs. 4.0 percent y/y in June. Rising prices mean that real consumer spending growth could be levelling off in the near term. The BEA also reported that Core PCE Inflation, excluding food and energy prices, remained at 3.6 percent y/y in July, same as in June. Critically, the month-over-month growth rates for these key inflation metrics continued to be either flat or falling. Headline PCE inflation was 0.4 percent m/m in July, vs. 0.5 percent m/m in June and Core PCE inflation was 0.3 percent m/m in July, vs. 0.5 percent m/m in June. While elevated year-over-year inflation rates are likely to persist through 2021 and into 2022 due to base effects, the month-over-month inflation rates seen in July suggest that the period of peak inflationary momentum may have passed.

-

About the Author:Ataman Ozyildirim

The following is the bio of a former employee/consultant Ataman Ozyildirim, PhD, is the Senior Director, Economics at The Conference Board. He specializes in the development of economic indicators an…

0 Comment Comment Policy