We need to look at productivity by industry to understand the depth of this crisis

11 May. 2020 | Comments (0)

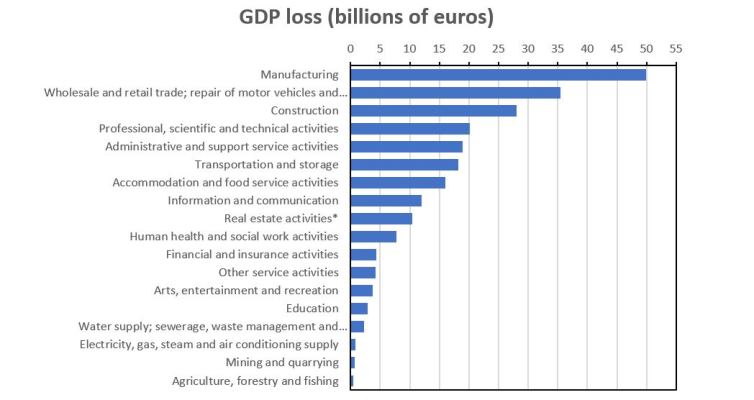

As of May 4, 42 percent of the total French workforce [1] was either fully or partially unemployed, representing 12 percent of total annual hours worked and with an output equivalent of 11 percent of annual GDP. Half of that GDP loss is associated with just three industries: manufacturing, wholesale and retail trade and construction.

In an April 15 blog we showed that a substantial number of workers in France are supported by chomage partiel (short-term work in English), a government scheme that offers partial pay to those who have lost some or all wages because of the COVID-19 economic lockdown, but are still officially employed. As of May 4 there were 12.1 million workers in chomage partiel, representing 42 percent of the total workforce. [2]

Not all industries are equally affected, and not all industries have the same levels of productivity. To determine how the labor market loss contributes to the loss in GDP, we take a two-steps approach, considering not only the degree to which an industry was affected by the pandemic, but also the varying productivity levels among industries. In general, the lower an industry’s average GDP per hour before the crisis, the less that industry’s losses now contribute to GDP drops.

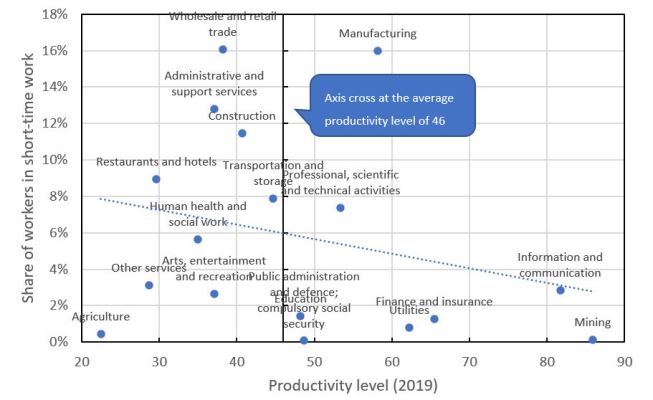

In 2019, on average, an hour worked in the French economy produced 46 euros of value added. [3] As shown in Chart 1, a large portion of the workforce is in sectors that are below that average, such as wholesale and retail trade. In general, labor-intensive sectors have lower levels of GDP per hour, while capital-intensive sectors such as mining and manufacturing have higher levels of GDP per hour. (Total economy GDP equals the sectoral sum of GDP per hour multiplied by hours worked.)

Chart 1: GDP (nominal value added) per hour worked in euros, with the share of sectoral employment in the total, all for 2019.

Notes: Values for Real Estate activities and Electricity, gas, steam and air conditioning supply are not shown. These sectors have values of 190 and 187 respectively; share in total employment calculated on the basis of persons employed. Source: The Conference Board calculations using Eurostat National Accounts and Short-Term Business statistics data.

Temporary unemployment is in general more prevalent in sectors with lower productivity levels (Chart 2): construction, wholesale and retail trade, accommodation and food service activities, and administrative and support service activities. These four sectors capture more than half of the workers in chomage partiel and have productivity levels below that of the total economy average. However, there are also two sectors that count many workers in chomage partiel but have a high level of productivity: manufacturing and professional, scientific, and technical activities.

Chart 2: Scatter plot showing workers in short-time work as a share of the total on the y-axis and the productivity level in 2019 on the x-axis for 17 industries in the French economy (first letter NACE categories)

Differences in GDP per hour are driving the differences in GDP loss by sector, and this leads in some cases to counterintuitive results. For example, one would expect the hospitality sector (restaurants and hotels) to be the driving force of the GDP losses, which have reached almost 240 billion euros, or 11 percent of 2019 GDP. Indeed, the French statistics office calculated that as of 23 April, the hospitality sector was operating at only 10 percent of normal capacity, as opposed to 65 percent for the economy as a whole. However, because of its relatively low productivity levels (see Chart 1) the hospitality sector is in only the middle range of sectors in terms of contributing to the overall GDP loss.

By contrast, the manufacturing sector is contributing three times as much to GDP loss as hospitality. Something similar is happening with the GDP loss associated with administrative and support service activities, which represents a large chunk of total workers in temporary unemployment (12.8 percent) but isn’t among the main sectors contributing to the overall loss in GDP. Manufacturing is the largest contributor to overall GDP loss because of its overall high productivity levels.

Chart 3: France: GDP loss in billions of euros by industry

*Productivity level data for this sector excludes the value accrued to owner-occupied housing (NACE rev.2 code L68A), which accounts for about 8 percent of GDP, but which has no employment equivalent. Source: The Conference Board calculations using Eurostat National Accounts and Short-Term Business statistics data.

There are three lessons we can learn about the current crisis, thanks to the detailed figures kindly published by the French Ministry of Labor. One, the GDP loss caused by the lockdown is in the range of 11 percent between March and June. This is a large figure, and it is materializing because losses are not due only to the complete shutdown of hotels and restaurants. Two, the other sectors that have substantially reduced their hours worked tend to have high productivity per hour worked, which magnifies their output losses. Three, unlike in the US, where 33 million workers have already filed for unemployment benefits, the shock in France (and in Germany and Italy) is absorbed by a reduction of hours worked instead of layoffs. Chomage partiel will cushion the labor market impact of the crisis, limiting the increase in unemployment compared to what is currently happening in the US.

Unfortunately, though, not all workers currently in the short-term scheme will still have a job by the end of the year. Under any scenario, the French as well as the European economy will shrink in 2020. A contraction in GDP will inevitably lead to job losses. Moreover, social distancing rules will not allow most sectors to return to pre-COVID-19 outbreak rhythms, meaning that they will not fully recover even if demand for goods and services comes back once the lockdown is lifted.

[1] Public and private combined, compared with the 2019 total

[2] Figures are available from the website of the French ministry of Labor, at https://dares.travail-emploi.gouv.fr/dares-etudes-et-statistiques/tableaux-de-bord/marche-du-travail-pendant-le-covid-19/

[3] Throughout this blog we refer to the total economy inclusive of public and private sectors but exclude the value accruing to owner occupied housing (NACE rev.2 code L68A), which accounts for about 8 percent of GDP.

[4] See ‘Points de conjuncture 2020’, 23 April, available at https://www.insee.fr/fr/statistiques/4481462?sommaire=4473296

-

About the Author:Klaas de Vries

The following is a bio of a fomer employee/consultant Klaas de Vries is a Senior Economist with The Conference Board. He closely follows developments in the global economy and researches the structur…

-

About the Author:Ilaria Maselli

The following is a biography of former employee/consultant Ilaria Maselli is the former senior economist for Europe at The Conference Board. Maselli monitored the monthly business cycle of the E…

0 Comment Comment Policy