Retail Sales Rose in August Despite Inflation Headwinds

15 Sep. 2022 | Comments (0)

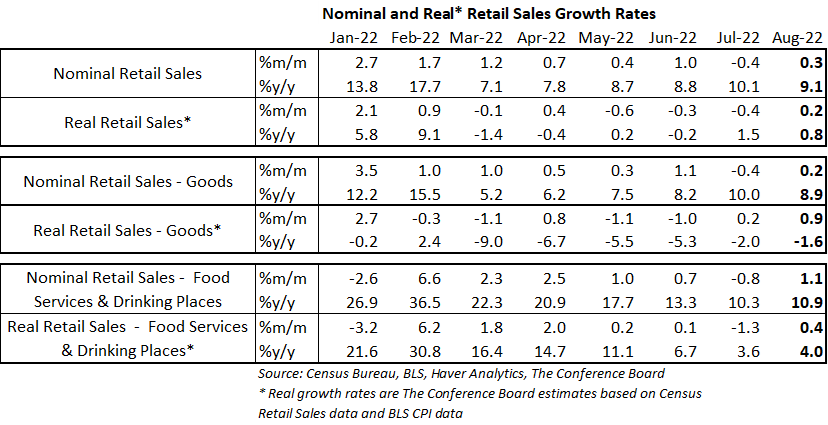

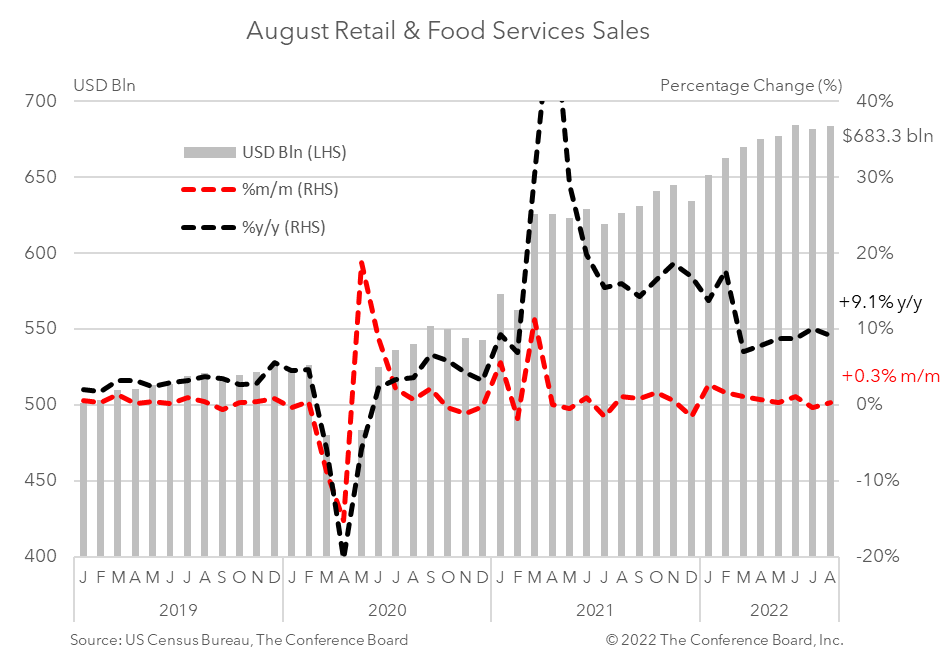

The latest retail sales data show a consumer that continues to resist high inflation. Retail spending rose by $2.0 billion to $683.3 billion in August — rising 0.3 percent month-over-month and 9.1 percent from a year earlier. When adjusted for inflation sales rose about 0.2 percent from the previous month.* Gasoline sales fell sharply for the month, reflecting lower prices at the pump, while sales at restaurants and bars expanded. Looking ahead, we expect consumer spending growth to fall into negative territory as the economy slips into recession.

Consumer demand for goods was somewhat muted in August driven by falling gasoline prices. Spending on goods rose 0.2 percent from the previous month in nominal terms, following -0.4 percent growth in July. Spending on motor vehicles and parts rose 2.8 percent in August from July, while retail sales excluding motor vehicles and parts fell by 0.5 percent month-over-month. Spending at gasoline stations dropped 4.2 percent for the month as crude oil prices continued to slip from their June highs. Retail sales less motor vehicles, gasoline, and building supplies (known as “Retail Control”) were flat from the previous month. Online sales were weak as spending at non-store retailers fell 0.8 percent in August. When adjusting goods spending for CPI inflation the real growth rate was up nearly a percentage point from the previous month.* This uptick reflects lower gasoline prices and is likely temporary.

Meanwhile, spending at food services and drinking places rose by 1.1 percent month-over-month, vs. -0.8 percent in July. The reading was the largest uptick since April 2022 and coincides with a recent spike in food and beverage prices. Upon adjusting spending on food services and drinking places for CPI inflation, the real growth rate was up about 0.4 percent from the previous month.*

US consumers were granted some reprieve from inflation in August at the gas pump, but saw prices continue to rise across the rest of the economy. These retail sales data, when adjusted for inflation, reveal a consumer that remains ready to spend despite these challenges. However, we expect inflation to continue to constrain consumer spending as interest rates continue to rise. The combined impact will likely result in a sustained contraction in consumer spending as the US economy slips into recession.

* Real growth rates are The Conference Board estimates based on Census Retail Sales data and BLS CPI data

-

About the Author:Erik Lundh

Erik Lundh is Senior Global Economist for The Conference Board Economy, Strategy & Finance Center, where he focuses on monitoring global economic developments and overseeing the organization&rsquo…

0 Comment Comment Policy