December Retail Sales Plummet

14 Jan. 2022 | Comments (0)

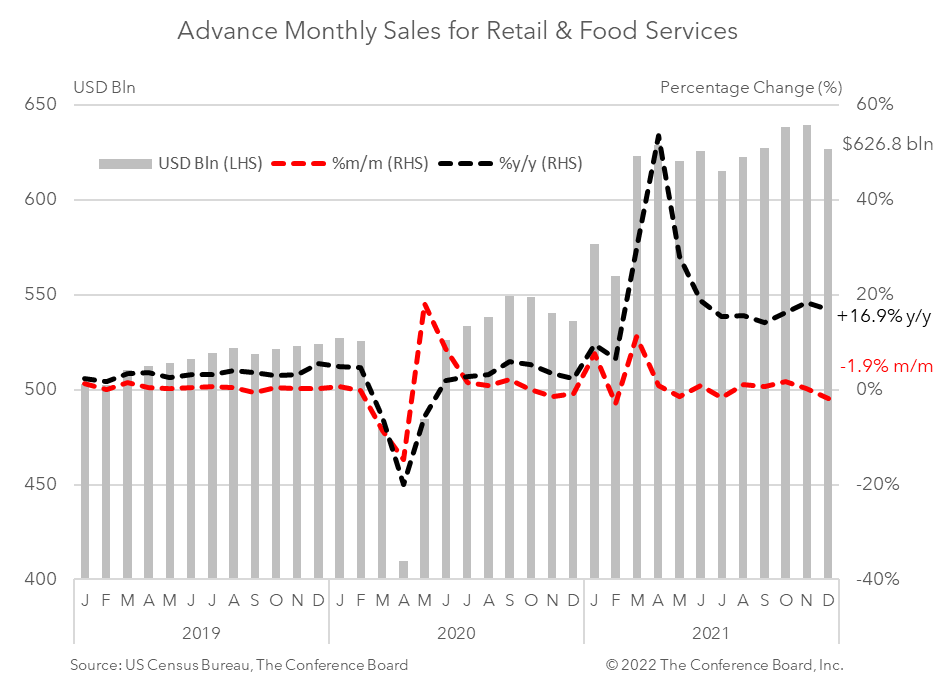

Retail spending in December dropped $12.2 billion to $626.8 billion for the month – down 1.9 percent from the previous month and up 16.9 percent from a year earlier. This drop in sales was associated with frontloaded holiday spending, low inventories, and the initial spread of Omicron. Adjusted for CPI inflation, which clocked in at a 40-year high in December, sales were down 2.4 percent month-over-month. The recent surge in new COVID-19 cases may further erode consumer spending in January, but strong household balance sheets and an eagerness to spend should buttress retail sales once the current wave of infections passes.

Spending on goods was the primary drag on consumer demand in December. While spending for motor vehicles and parts fell 0.4 percent from November, retail sales excluding this important category fell 2.3 percent month-over-month. Retail control, which excludes motor vehicles, gasoline, and building supplies was down 3.1 percent from the previous month. Spending at department stores dropped 7.0 percent month-over-month and spending at non-store retailers fell 8.7 percent. The fact that both of these categories fell suggests that front-loaded holiday spending and shortages may have been a major factor in December spending on goods.

Demand for in-person services also fell in December, but the weakness was less pronounced. Spending at food services and drinking places dropped 0.8 percent from a month earlier. The weakness here is most likely associated with early worries about the Omicron variant of COVID-19. Unfortunately, spending in this category is unlikely to rebound quickly as new infections continue to swell.

While these December data may yield some disappointment, overall spending this holiday season exceeded expectations. 2021 holiday sales, defined as total retail sales in November and December, grew by 17.6 percent from a year earlier. This growth rate was well above most forecasts.

While there is reason to be concerned about retail sales spending through the remainder of the winter, strong household balance sheets and a desire to spend (especially on in-person services) should help bolster demand as the spring approaches and the threat of Omicron subsides. However, high inflation rates are unlikely to dissipate quickly and will continue to erode consumer spending power. The net result will likely be modest growth in real retail sales over the course of 2022.

-

About the Author:Erik Lundh

Erik Lundh is Senior Global Economist for The Conference Board Economy, Strategy & Finance Center, where he focuses on monitoring global economic developments and overseeing the organization&rsquo…

0 Comment Comment Policy