Retail Sales Improved, But Not Enough to Counter Inflation

15 Jul. 2022 | Comments (0)

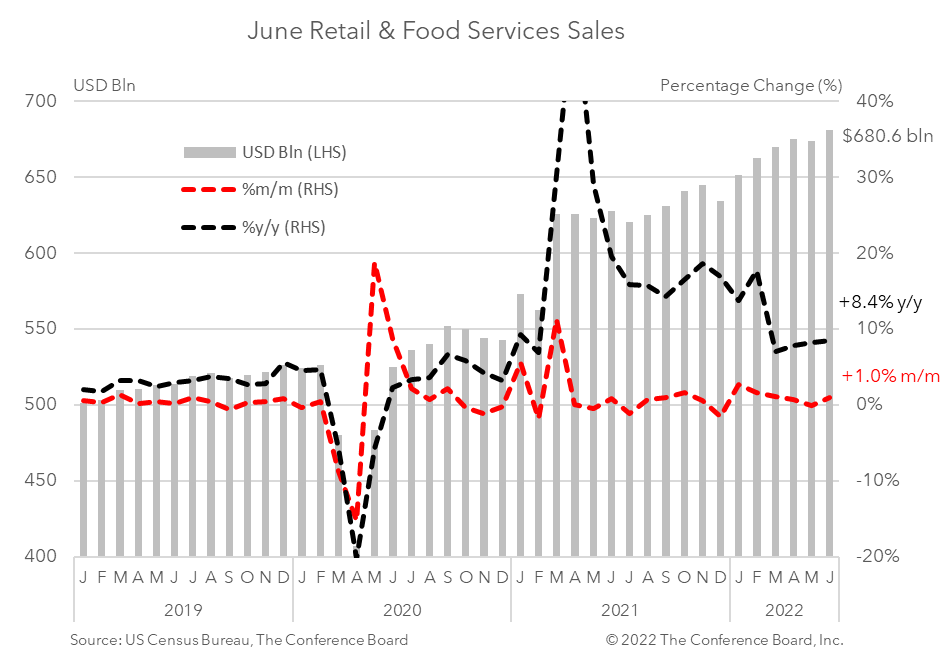

The latest retail sales data show an economy that may be losing some momentum as headwinds from high inflation and rising interest rates intensify. Retail spending rose by $6.7 billion to $680.6 billion in June — up 1.0 percent from the previous month and up 8.4 percent from a year earlier. While these may seem like positive data on the surface, when adjusted for CPI inflation (which hit a 41 year high in June) sales were down 0.3 percent month-over-month. Indeed, for the full quarter, real retail sales growth fell to -0.9% quarter-over-quarter (SAAR) compared to +4.3% in 1Q – suggesting that spending on goods will be a drag on GDP in Q2 2022.

Demand for goods rebounded in June — rising 1.0 percent from the previous month in nominal terms. This positive reading follows a contraction of 0.1 percent in May. Spending on motor vehicles and parts rose 0.8 percent in June from May, while retail sales excluding motor vehicles and parts rose by 1.0 percent month-over-month. Spending at gasoline stations jumped 3.6 percent for the month as crude oil prices spiked. Retail sales less motor vehicles, gasoline, and building supplies (known as “Retail Control”) were up 0.8 percent from the previous month. Spending at non-store retailers rose 2.2 percent in June. However, upon adjusting goods spending for CPI inflation the real growth rate drops to about -1.1 percent from the previous month. This large divergence in real and nominal growth rates underscores the degree to which inflation is impacting spending trends.

Meanwhile, spending at food services and drinking places rose 1.0 percent from the previous month. The fading impact of the pandemic coupled with pent up demand for in-person services is behind the bump as are rising prices. Looking forward, we expect spending at food service and drinking places to remain robust over the summer period. However, upon adjusting food and beverage spending for CPI inflation, the real growth rate was only up about 0.1 percent from the previous month.

Persistently high inflation has eroded consumer spending power. More money is needed to purchase the same basket of goods and services, and while incomes are rising they are not keeping pace. As the Federal Reserve aggressively tightens monetary policy to counter these rising prices, US consumers will face an additional obstacle as well – higher interest rates. These two forces will likely curb consumer spending and we expect them to push the economy into recession toward the end of 2022.

-

About the Author:Erik Lundh

Erik Lundh is Senior Global Economist for The Conference Board Economy, Strategy & Finance Center, where he focuses on monitoring global economic developments and overseeing the organization&rsquo…

0 Comment Comment Policy