Sustainability Reporting Across Asia: Trends and Challenges

01 Feb. 2019 | Comments (0)

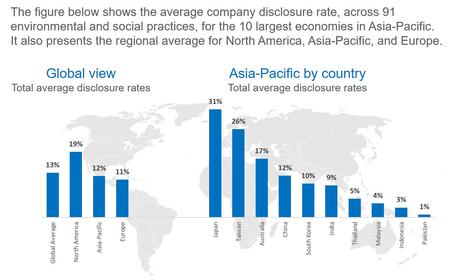

The Conference Board recently released its annual study on the state of corporate sustainability disclosure around the world. The research assesses environmental and social disclosure practices of the 250 largest publicly traded companies domiciled in each of the 10 largest economies (by GDP at purchasing power parity) in North America, Europe and Asia-Pacific. As we look to Asia, what are key trends in reporting practices across the region? Where do we see the biggest challenges ahead?

The degree of corporate sustainability disclosure varies dramatically across Asia-Pacific

Japanese and Taiwanese companies clearly lead in regional sustainability disclosure; in fact, Japanese companies have the highest overall disclosure rates across all countries analyzed in the study, and overall disclosure rates of Taiwanese companies are on par with companies based in the UK and the US. Sustainability disclosure is clearly still in its infancy for companies from other major regional economies like Thailand, Malaysia, Indonesia, and Pakistan, where disclosure is virtually nonexistent. Companies in China are somewhere in the middle field, roughly on par with companies in South Korea and India, but still significantly lagging the disclosure levels of Japanese and Taiwanese companies.

Overall, corporate sustainability disclosure is clearly improving over time

For the most part, disclosure rates across Asia-Pacific have improved notably over time. But many of these improvements are starting from a very low base. While major improvements are most noticeable for Taiwanese companies over the 2009-2018 period, disclosure practices by companies from South Korea, Thailand, and Indonesia have, in fact, improved at a similar pace, but from a significantly lower base, thus their improvements aren’t as readily apparent.

Significantly more focus is given to disclosing social rather than environmental practices

We continue to see significantly more focus on disclosing social rather than environmental practices; this is readily apparent in the gap in average disclosure rate of environmental practices compared to social practices. In most instances, this gap has widened over time, indicating that social practices are progressing faster than environmental practices. Across the region, the gap is most pronounced for Chinese companies. There are several potential reasons for this gap. A lot of the early stages of improving corporate sustainability practices in labor-intensive economies have focused on labor, health, and safety issues. As well, many of the social practices are also more straightforward to implement and measure, and don’t require the same amounts of capital investments needed to change the environmental footprint of a company.

Mandatory and voluntary sustainability reporting instruments are shaping reporting practices

Looking at stock exchange guidelines in the region, it is easy to see that there has been an evolution towards formulating non-financial reporting guidelines. Over the past few years, all major Asian stock exchanges have implemented ESG reporting as a listing requirement, and most of them offer some form of guidance for reporting. There is also a clear rise in the number of sustainability related indices. What is important to understand is that the requirements for reporting vary widely, and that has a huge impact on the effectiveness of the guidelines. In India for example, stock exchange guidelines are focused on very large companies, and those are the companies where our analysis shows big improvements in disclosure rates, while smaller Indian companies have made very little progress. Voluntary reporting frameworks, such as the GRI Standards, also play an important role in helping companies navigate nonfinancial disclosure. In countries with high overall disclosure rates, a large share of companies is using the GRI framework. In Japan and Taiwan, around 60 percent of the largest 250 publicly listed companies are referencing the GRI framework; in China it’s nearly a third of companies. There is a very clear relationship between the increase in disclosure and increasing references to the GRI framework (all countries with significant improvements in overall disclosure rates between 2009 and 2018 also show a multi-fold increase in references to the framework).

Looking for more analysis? Members of The Conference Board can download the Key Findings Report here. The report is complemented by a comprehensive database and online benchmarking tool, the Sustainability Practices Dashboard. The Dashboard allows users to generate customized charts by segmenting data by sector, revenue group, region, and country.

-

About the Author:Anke Schrader

The following is a bio of a former employee/consultant Anke Schrader leads the research of The Conference Board China Center for Economics and Business on corporate citizenship, sustainability, and h…

0 Comment Comment Policy