May 11, 2021 | Chart

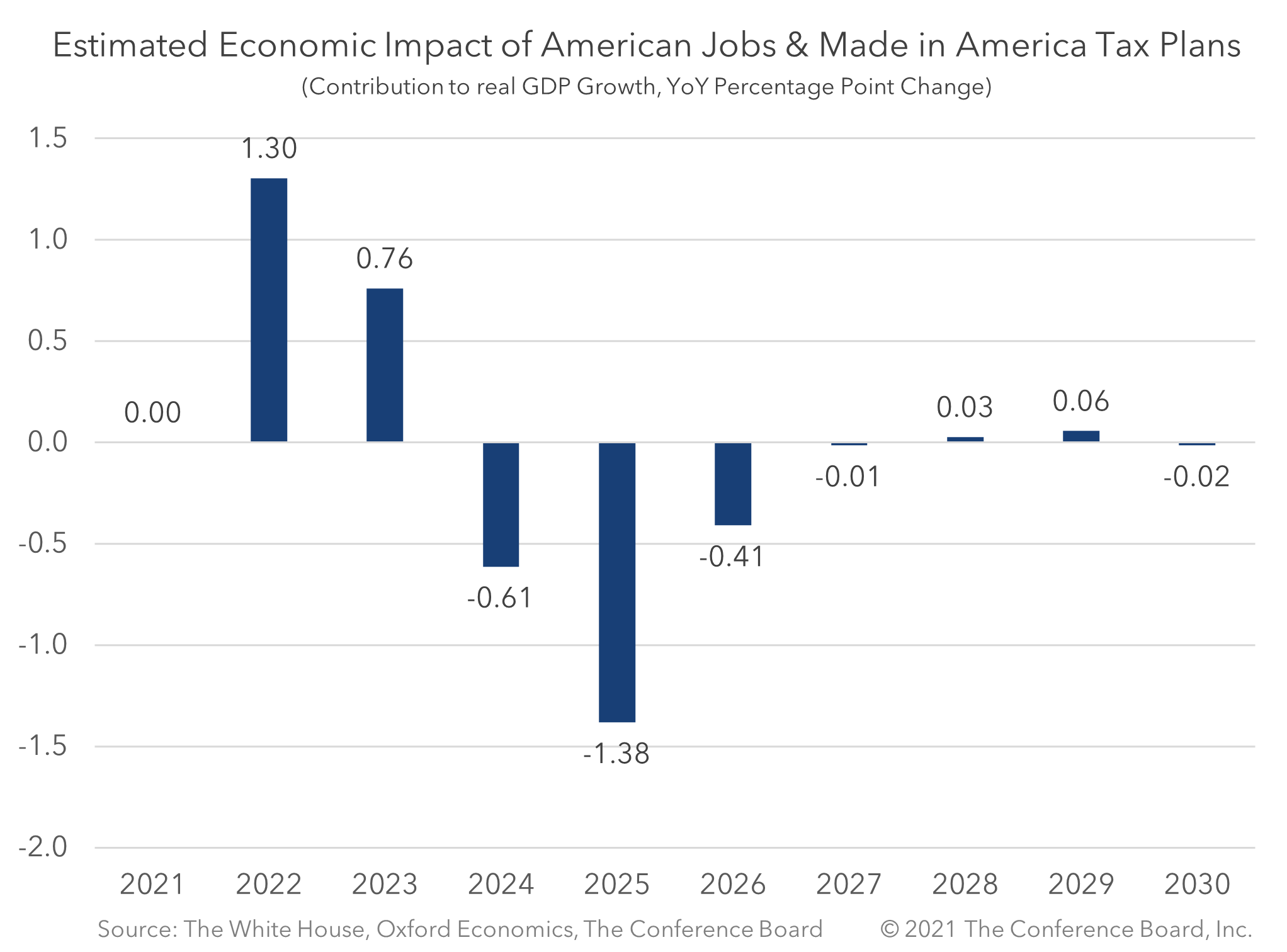

Over the next five years, the administration’s proposed American Jobs Plan and Made in America Tax Plan might provide an additional boost in economic activity at the start, but then weigh on activity for several years before becoming neutral.

The Conference Board’s estimate of the impact on US real GDP growth, using Oxford Economics Global Economic Outlook model simulations, suggests initial positive contributions of about 1.30 percentage points in the first year and then another 0.76 percentage point in the second year. However, fiscal drag kicks in the third year as the growth in federal spending begins to level off and the effects of the corporate tax hike potentially curb business investment. The slower rate of outlays might potentially weigh on the economy for three years before becoming neutral by the sixth year.

For additional insights on this important issue please see our new reports: Boom, Bust, Bang: Economic Implications of the American Jobs and Made in America Tax Plans (link) and A US Infrastructure Plan: Building for the Long Haul (link).

July 27, 2022 | Newsletters & Alerts