February 11, 2022 | Chart

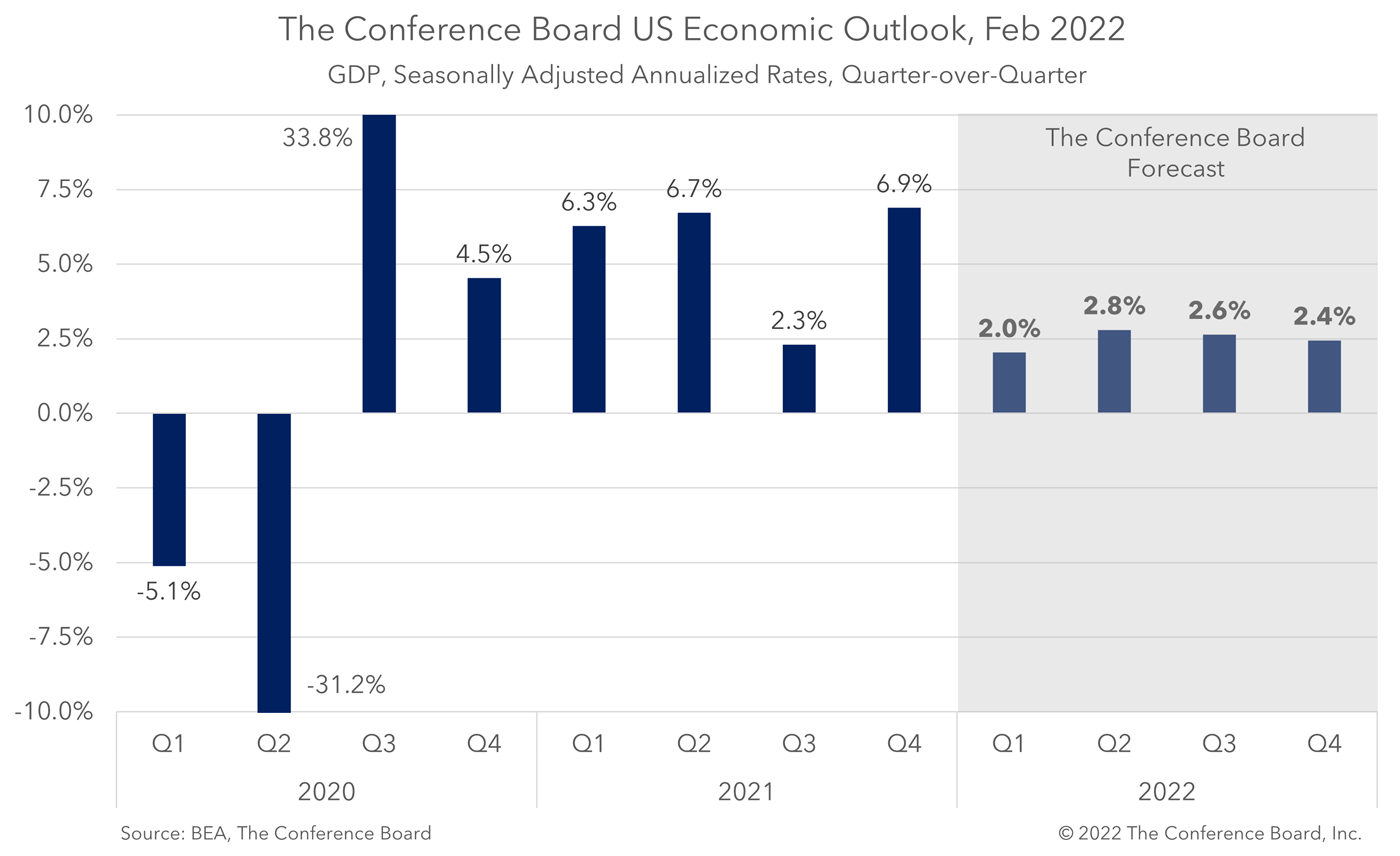

The Conference Board now forecasts that US Real GDP growth will slow to 2.0 percent (quarter-over-quarter, annualized rate) in Q1 2022. Economic growth through the remainder of the year will be lower than previously projected, but the economy will still grow at healthy rates above 2 percent under current assumptions.

Our prior forecasts had assumed that a “winter wave” of COVID-19 would dampen economic growth in Q1 2022, but the scale of infections was much larger than anticipated. We are therefore lowering of first quarter projection by 0.2 percentage points. Beyond that, expectations of persistent inflation and a more restrictive monetary policy environment have resulted in downgrades to our growth forecast for Q2, Q3 and Q4 2022.

Sizeable downside risks still weigh on this forecast. While the number of new cases of COVID-19 are down significantly, there is still a risk that new, more dangerous variants may emerge. Additionally, tight labor markets helped drive inflation higher over the course of 2021 – as wages rose rapidly and companies increased prices to offset these higher costs. If this trend worsens a wage/price spiral may ensue that exacerbates the inflation problem. Finally, geopolitical tensions in Europe and Asia present additional economic risks.

For more information on our latest US economic forecast please visit our website.

July 27, 2022 | Newsletters & Alerts