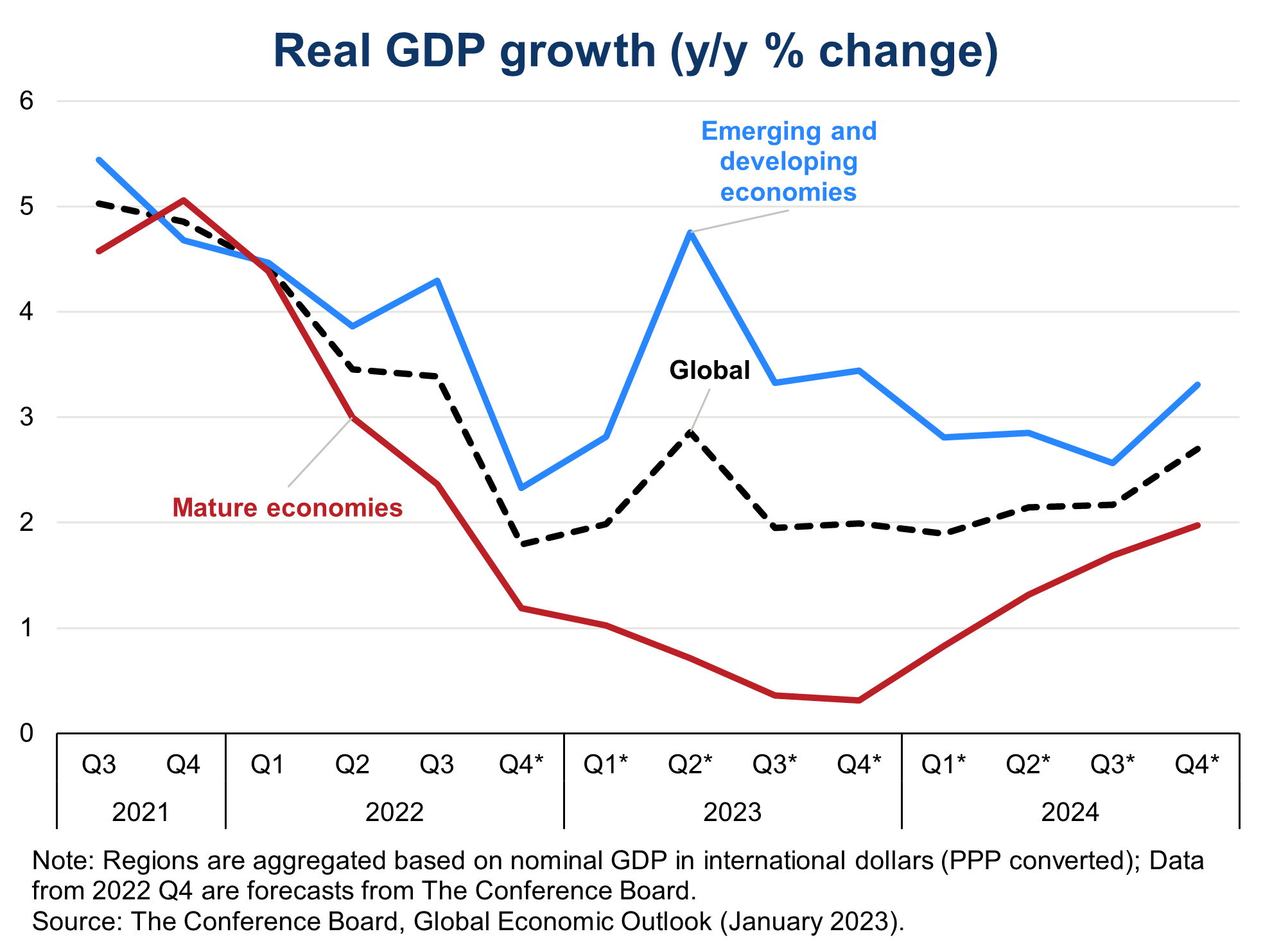

Global real GDP is forecasted to grow by 2.2 percent in 2023, down from 3.2 percent in 2022. Outsized contributions to growth in 2023 are expected from China – driven by a rebound in activity following the removal of its zero covid policy – and other economies in the region, most notably India. At the same time, the US and European economies are expected to stagnate in 2023 due to brief, yet shallow, recessions.

After rising sharply over 2021 and much of 2022, inflation in most of the world is slowing, mostly driven by falling energy and food prices. This is paving the way for a reduction in the pace and intensity of interest rate hikes by the world’s major central banks, suggested at their recent meetings. However, given continued underlying inflationary pressures, monetary policy is likely to remain restrictive throughout most of 2023. This will act as a break on economic activity and will likely lead to increases in unemployment rates in various economies, particularly in Europe and the US.

Global real GDP growth should pick up steam in 2024 to 2.6 percent and be more evenly distributed among regions. Tailwinds to growth in 2024 will largely come from fading shocks related to the pandemic, elevated inflation, and monetary tightening. However, growth rates in 2024 and beyond are likely to be below the prepandemic trend, given ongoing supply-side weakness.

For more resources on the global economy, please see our monthly updated Global Economic Outlook page, quarterly StraightTalk publication and annual long-term outlook (October 2022).

United States

The US economy, and the US consumer, have been defying expectations. US consumer spending continued to support real GDP growth despite the dual headwinds of rising interest rates and high inflation. However, we still expect the US economy will fall into recession soon. We currently anticipate three quarters of negative real GDP growth starting in Q1 2023. However, this downturn will be relatively mild and brief, and growth should rebound in 2024 as inflation ebbs further and the Fed begins to loosen monetary policy.

We forecast that real GDP growth will be 2.0 percent year-over-year in 2022, slow to 0.2 percent in 2023, and then rebound to 1.7 percent in 2024.

For more resources on the US economy, please see our monthly updated forecast, monthly Economy Watch webcast, monthly report and annual long-term outlook (November 2022).

Europe

Large parts of Europe have likely entered into recession as of Q4 2022 and probably will remain so in the first quarter of 2023, after which a relatively modest recovery should set in. CEO confidence fell to an all-time low in H2 2022, reflecting the challenging outlook ahead. Still, a variety of factors including fading supply chain woes, a robust labor market, and fiscal stimulus portend a short and shallow recession. Furthermore, the region seems to be weathering the energy crisis shock better than expected due to increased efficiencies, favorable weather conditions and increased LNG inflows.

After growing by an estimated 3.5 percent in 2022, real GDP is forecast to slow to 0.2 percent growth for the full year of 2023 and pick up again in 2024 with 1.1 percent growth.

For more resources on the European economy, please see our monthly Economy Watch report and annual long-term outlook (October 2022).

China

Businesses and consumers chafed at mobility restrictions and lockdowns, and the government has responded by abandoning its dynamic zero-COVID-19 policies at the end of 2022. While this will eventually lead to a recovery in economic activity, the near-term situation looks extremely challenging. Furthermore, the anticipated recovery, anticipated to start around the second quarter of 2023, is expected to be relatively subdued given a weaker external environment and ongoing domestic challenges, for example regarding housing.

After growing by an estimated 2.7 percent in 2022, real GDP is forecast to pick up to 5.1 percent growth for the full year of 2023 and 4.8 percent for 2024.

For more resources on the Chinese economy, please see our monthly Economy Watch report and annual long-term outlook (November 2022).

Emerging Markets

Economic conditions for economies outside China, Europe, and the US are expected to be mixed. While Asian economies apart from China have fared well from reopening postpandemic, slowing external demand as the US and Europe head toward recession is beginning to cloud growth prospects. The same is true for Latin American economies dependent upon trade with the US and in commodities, whose prices have retreated from early-year peaks. Tighter monetary policy and political instability threatening fiscal outlooks are also troubling select Latin American economies. Elsewhere, Turkey will experience materially slower growth in 2023, but it will avoid recession. Russia and Ukraine will remain in recession due to the ongoing conflict, sanctions (Russia), and widespread destruction (Ukraine).

For more resources on the emerging market economies, please see our monthly Economy Watch report.

April 23, 2025 | Brief