-

Email

Linkedin

Facebook

Twitter

Copy Link

Loading...

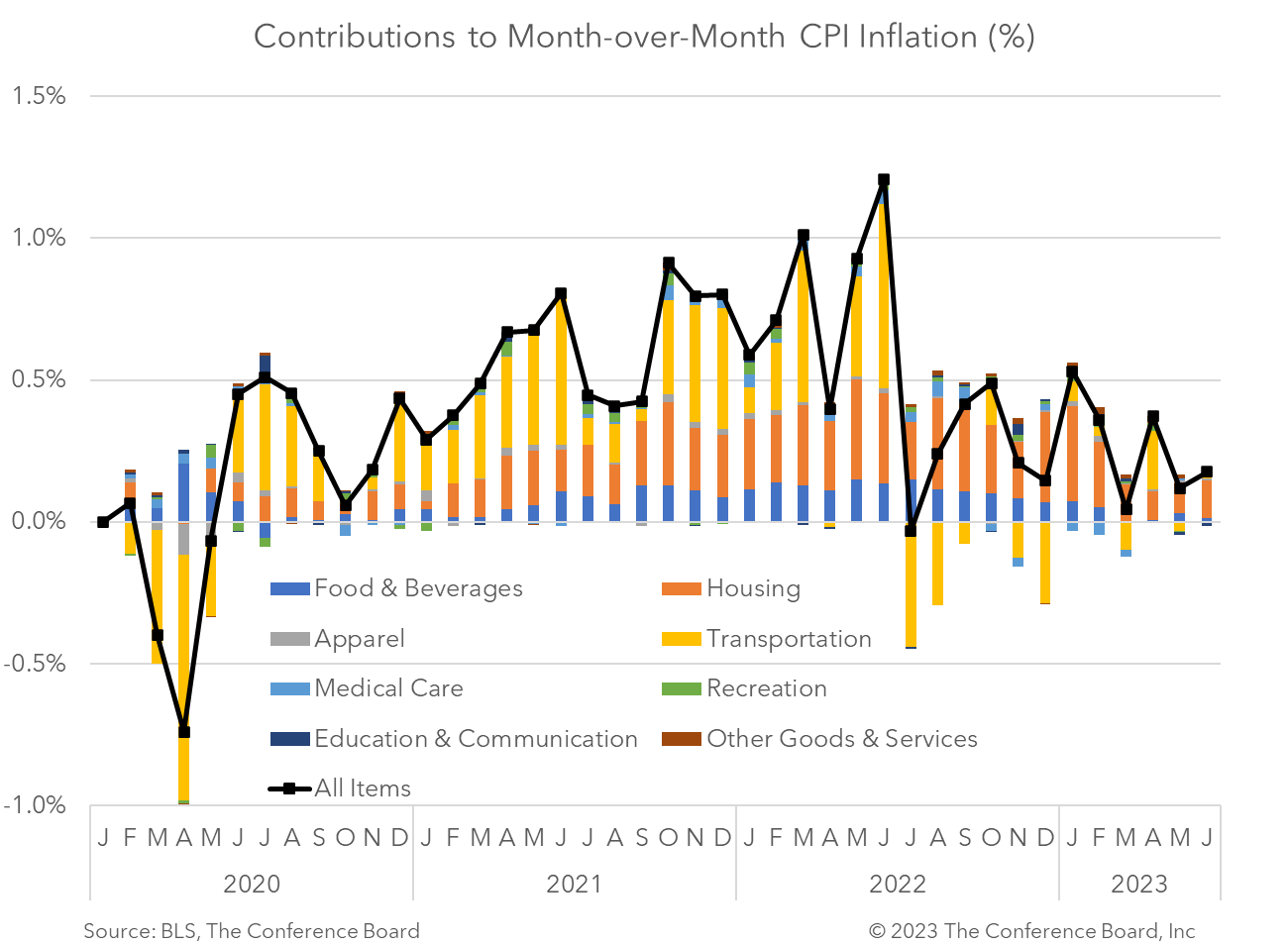

The June Consumer Price Index (CPI) showed inflation rose 3.0 percent from a year earlier, sharply lower than the recent peak of 9.1 percent and down from 4.0 percent in May. Meanwhile, core CPI, which excludes volatile food and energy prices, rose 4.8 percent in June from a year earlier, the slowest pace since October 2021 and down from 5.3 percent in May. Progress in food and energy prices is helping to bring down topline CPI in year-over-year terms. Trends in restaurant and medical prices are also helping. While rent prices remain a big contributor to overall inflation, this driver should begin to dissipate over the next few months. Prices for used cars and airline fare fell sharply, while prices for car insurance and recreation rose. In month-over-month terms, topline CPI accelerated to 0.2 percent, vs. 0.1 percent the month prior. According to the BLS, the index for shelter accounted for 70 percent of this increase, followed by increases in the index for motor vehicle insurance. The food index rose by just 0.1 percent for the month and the energy index rose 0.6 percent. Core CPI rose 0.2 percent month-over-month in June, vs. 0.4 percent in May. While CPI came in below expectations in June, inflation remains elevated and we expect the Fed to hike rates by 25 basis points in July and perhaps another 25 basis points at some point in Q3.

Retail Sales Show Consumers Stock Up ahead of Tariffs

April 16, 2025

US Seeks Shipbuilding Revival, Muting of China Dominance

April 14, 2025

March CPI May Hint at Consumer Pullback as Tariffs Rise

April 10, 2025

The US-China Trade War Escalates

April 09, 2025

Reciprocal Tariffs Will Weaken US and Global Economies

April 03, 2025