-

Email

Linkedin

Facebook

Twitter

Copy Link

Loading...

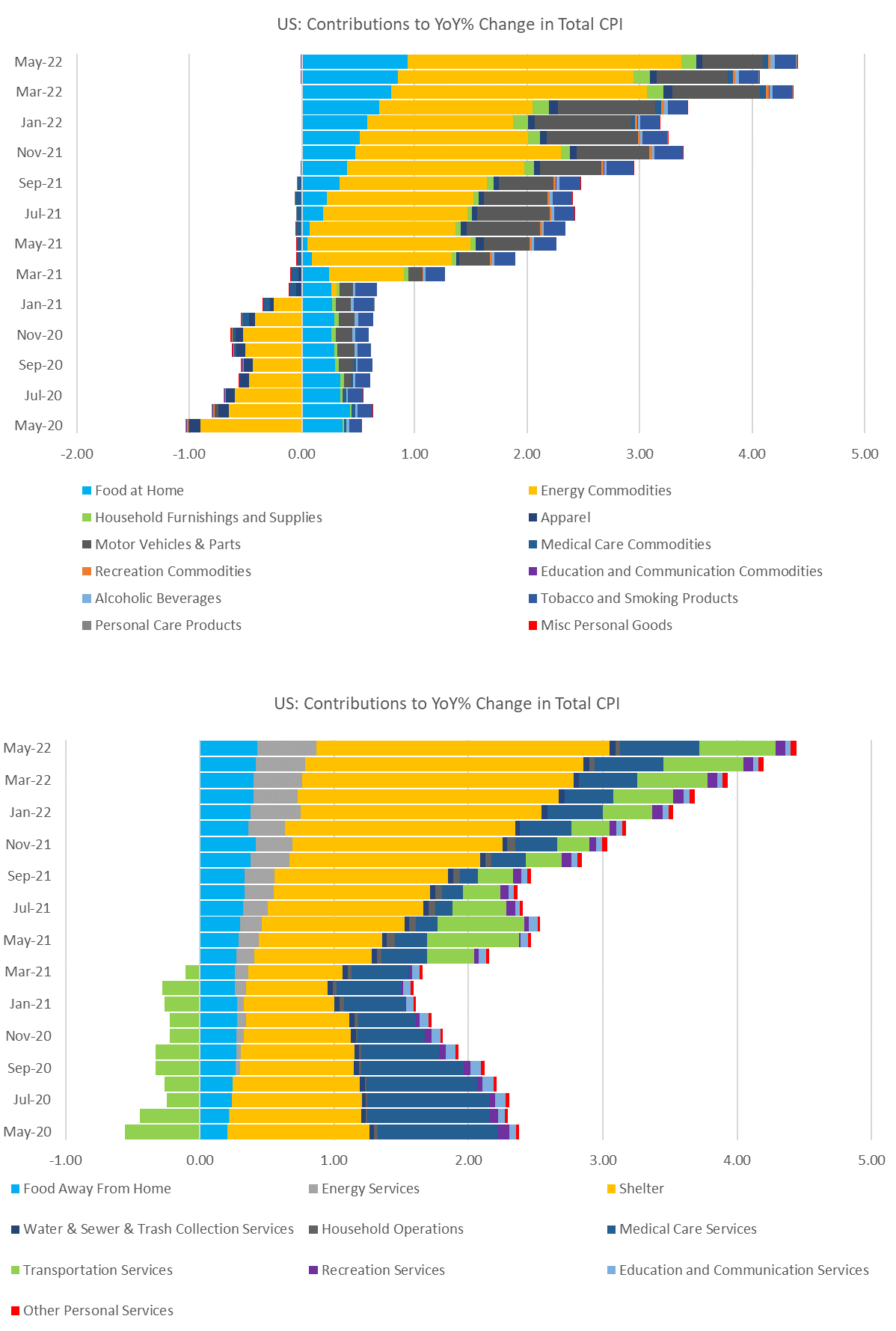

The total Consumer Price Index (CPI) rose to a 41-year high in May. Prices increased both month-over-month and relative to a year ago, providing further reason for the Fed to follow through with a 50bp rate hike next week. Core CPI inflation slowed year-over-year for a second consecutive month, but remains extremely elevated. Although prices for select durables are falling, the war in Ukraine continues to stoke nondurables prices, particularly for food and energy (i.e., gasoline and energy utilities). Additionally, services prices are picking up pace, reflecting increasing demand for in-person services now that many consumers have moved beyond the pandemic. Meanwhile, rising home price valuations are placing upward pressure on actual rents and owner’s equivalent rent (OER) within the services category. These shelter costs represent roughly one-third of consumers’ total basket of goods and services consumed. Total CPI continued to rise in May. The gauge rose by 1.0 percent month-over-month in May, following a 0.3 percent increase in April. On a year-on-year basis, headline inflation hastened to 8.6 percent – the fastest pace since December 1981 – from 8.3 percent. In the month, prices were 1.2 percent higher for food at home (i.e., groceries) and 0.7 percent for food away from home (i.e., restaurants). The cost of food overall was 10.1 percent higher compared to a year ago, the highest since 1981. The year-over-year rate of increase in energy prices was 34.6 percent, also a four-decade high. The price of gasoline increased by 4.1 percent month-over-month confirming what consumers have been seeing in terms of skyrocketing prices at the pump. Indeed, gasoline prices are up an astounding 48.7 percent from a year ago. The price of energy services, which include natural gas and electricity, rose by an outsized 3.0 percent month-over month. Indeed, prices for food and energy are among the fastest rising costs in the CPI (Figure 1), again reflecting surges in global commodity prices for grain, fertilizer, oil, and natural gas as bad weather events across the globe, and the war in Ukraine and resultant sanctions on Russia are disrupting production and shipments. There could be some relief in gasoline prices ahead as OPEC+ has agreed to increase oil production somewhat. However, the relief could also come from destruction of demand for gasoline heading into the US summer driving season. Indeed, our Consumer Confidence survey reveals that after purchasing cheaper goods, consumers are driving less to manage higher inflation. Core CPI may be starting to cool, but remains elevated. The core index, which is total CPI less volatile food and energy prices, rose by 0.6 percent month-over-month in May, matching April’s rate of increase. However, the rate of inflation was 6.0 percent higher compared to a year ago in May compared to 6.2 percent in April. This marks the second consecutive month of slower annual inflation gains. The relative improvement reflects smaller increases in good prices compared to a year ago, especially for apparel, furniture, appliances, recreation goods, and new and used vehicles. Slower price increases for many goods is consistent with reports from retailers implementing heavy discounting as consumer preferences are changing with the end of the pandemic emergency. Nonetheless, services prices even away from energy continue to levitate. This reflects rising home price valuations and increasing demand for services as consumers rebalance their mix of goods and services consumption post-pandemic. Housing costs are rising because the prices of new and existing homes have risen on strong millennial demand and two years of rock-bottom mortgage rates. Rents and OER, which reflects the price a homeowner might receive if she rented her home, mirror home price valuations, but with a lag. As home prices have yet to peak there is still scope for increases in shelter costs going forward. Meanwhile, services costs are also rising quickly – fueled by higher prices for hotels, motor vehicle maintenance and insurance, plane tickets, and out-of-home entertainment. Additionally, costs for healthcare, personal services, and popular streaming services are also rising rapidly. Figure 1. Food, Energy, and Shelter are Driving Consumer Prices Higher Sources: Bureau of Labor Statistics and The Conference Board.Insights for What’s Ahead

May Inflation Highlights

Cutting Discretionary Spending to Offset Higher Prices

March 28, 2025

Auto Makers Hit a Tariff Speedbump

March 27, 2025

Administration acts with Congress to reverse methane fee

March 25, 2025

Fed Keeps Cutting Bias amid “Transitory” Tariff Inflation

March 19, 2025

Retail Sales Show Consumers Are More Frugal amid Uncertainty

March 17, 2025

The EU's Retaliatory Tariffs Will Hit Beef, Bourbon and More

March 14, 2025