-

Email

Linkedin

Facebook

Twitter

Copy Link

Loading...

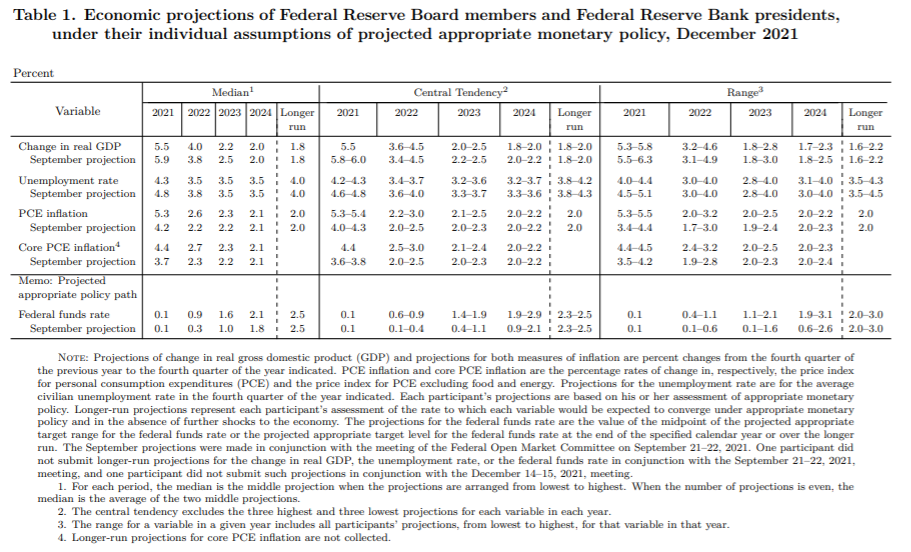

The Fed’s policy pivot in the face of elevated inflation, tremendous improvement in labor markets, and anticipation of well-above-trend GDP growth in 2022, is a powerful signal that financial markets, businesses, and consumers should anticipate higher interest rates in 2022. At the December monetary policy meeting, the Fed announced that it will reduce purchases of Treasury securities by $40 billion a month going forward, instead of by $20 billion at the start of the taper in November. Agency mortgage-backed securities purchases will be reduced by $20 billion a month instead of by $10 billion. This would effectively end the Fed’s quantitative easing program in March 2022. The Fed’s “dot” plot now shows most FOMC participants anticipating three 25 basis point interest rate hikes in 2022, from just a few expecting one 2022 hike before. FOMC members also expect three hikes in 2023 and two in 2024. While the timing of expected hikes has shifted forward, FOMC participants continue to see eight interest rate increases over the 2022-2024 span. The three hikes in the federal funds rate in 2022 are not a forecast, but an expectation by FOMC participants. Still, the “dots” plot reflect what financial markets and The Conference Board priced in ahead of the December meeting. A variety of factors underpinned the Fed’s more hawkish stance. Drivers include i) continued progress in vaccinations; ii) strong, presumably fiscal, policy support; iii) inflation well above the 2-percent target; iv) GDP growth well above potential; v) material improvements in the labor market; and vi) easy financial conditions that support businesses and households. The December meeting suggests that the Fed believes it is close to full employment, a key metric that prompted the Fed to remain accommodative as long as it has. The Fed did not declare victory on achieving the full employment mandate, but noted that job gains have been “solid” and the unemployment rate has “declined substantially.” The Fed views labor shortages as a function of quits and lower labor force participation linked to more retirements, fear of COVID-19 infection, and child and adult care challenges. Additionally, labor market conditions have improved for a variety of demographics including ethnic minority groups in the US, which was an important focus throughout the pandemic. Indeed, the Fed expects the unemployment rate to reach 3.5 percent by the end of 2022. The Fed anticipates strong US economic growth ahead. FOMC participants continue to expect above-trend real GDP growth in 2021 and 2022, and growth roughly mirroring the 2011-2019 average in 2023 and 2024, even with the Omicron variant casting a shadow over the outlook. The Fed dialed down the 2021 4q/4q GDP estimate from 5.9 percent to 5.5 percent, but this is more than double the 2.2 average pace of growth experienced in the decade preceding the global pandemic. The Fed also expects well above-trend GDP growth in 2022 at 4 percent, and for growth to average 2.1 percent over 2023 and 2024. These expectations include eight interest rate hikes over this period. The Fed foresees above target inflation for longer. FOMC participants also materially raised expectations for total and core (total less food and energy) Personal Consumption Expenditure (PCE) inflation. The expectations for PCE inflation gauges were both raised by 0.4 percentage point for 2022. The Summary of Economic Projections (SEP) anticipates both total and core inflation to linger above the 2-percent target at the end of 2022 (2.6 and 2.7 percent year-on-year, respectively) and even through the end of 2023 (2.3 and 2.3 percent, respectively). Hence, even with interest rate hikes, prices could remain somewhat elevated above target, including the risk of a wage-price spiral if labor shortages do not improve. However, the Fed believes that, for now, wages are still a small contributor to higher inflation. The Fed’s December policy statement and actions were consistent with the expectations of the Conference Board. We also believe that three interest rate hikes in 2022 is appropriate to help calm inflation without disrupting the economic expansion. Although there were some slight differences in the FOMC’s outlook for key economic indicators relative to ours, The Conference Board feels fairly confident that its outlook for the US economy still makes sense. Our GDP growth rates are in-line with FOMC participant’s expectations: above trend growth in 2021 and 2022, but slowing to a more sustainable pace just above 2 percent thereafter. We align in that we expect elevated inflation for longer, although our projections are somewhat higher than the FOMC’s given anticipation that some elements of inflation may become more permanent, including upward pressures from labor shortage-induced wage inflation, and strong demand for tech and the computer chips powering them. We do anticipate that the unemployment rate has further to fall next year as the Fed does, but that the US could even touch 3 percent as demographics weigh more heavily upon labor force participation ahead. Source: Federal Reserve Board. Insights for What’s Ahead

Fed Steps Up Pace of Easy Policy Reduction

What Drove The Hawkish Shift?

Concluding Thoughts

FOMC Participants Expect More Inflation, 3 Rate Hikes Next Year

Cutting Discretionary Spending to Offset Higher Prices

March 28, 2025

Auto Makers Hit a Tariff Speedbump

March 27, 2025

Administration acts with Congress to reverse methane fee

March 25, 2025

Fed Keeps Cutting Bias amid “Transitory” Tariff Inflation

March 19, 2025

Retail Sales Show Consumers Are More Frugal amid Uncertainty

March 17, 2025

The EU's Retaliatory Tariffs Will Hit Beef, Bourbon and More

March 14, 2025