-

Email

Linkedin

Facebook

Twitter

Copy Link

Loading...

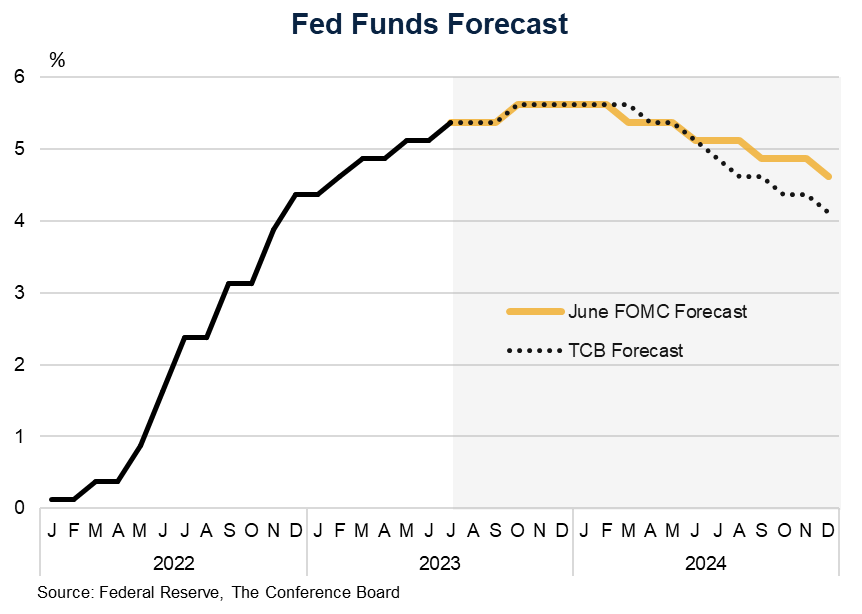

The Fed hiked interest rates by 25 basis points today, as expected. Chair Powell said that in the future, decisions on additional rate hikes will be made on a meeting-by-meeting basis and will be data dependent. Our forecast includes a final 25 basis point hike before the end of the year, but the evolution of inflation, credit, and labor market data over the coming months may result in a pause instead. Chair Powell said that while progress continues to be made on inflation it remains far too high. He noted that the June CPI report came in better than the Fed had expected, but that more work remains to be done. He characterized the current economic growth as “moderate” and noted that it is consistent with his view that a ‘soft landing’ for the US economy is possible. However, he said that he does expect the economy to slow in the future. Notably, Powell said that the Federal Reserve’s staff economists no longer forecast a recession, which they had previously. Looking further in the future, Chair Powell said that monetary policy has not been restrictive enough for long enough to have the desired impact on the economy. The June Summary of Economic Projections does not have rates falling until next year. The Conference Board projects that the Fed will begin lowering rates in Q2 2024. The Conference Board continues to forecast that the US economy will slip into recession later this year, but agrees that the probability of a soft landing is rising. The Fed hiked by another 25 basis points in July and pushed the federal funds rate window to 5.25 – 5.50 percent (a 22-year high). This was the Fed’s 11th hike this cycle. Rates are now deep in ‘restrictive’ territory (anything above 3 percent). The Fed also said that there will be no change to its ongoing plan to reduce the size of its balance sheet, which was first unveiled in May 2022. Today’s actions were unanimously approved by the members of the Federal Open Market Committee. The Federal Reserve’s actions today were widely anticipated, but its tone about the economy shifted. In its policy statement, the FOMC said “Recent indicators suggest that economic activity has been expanding at a moderate pace.” In previous statements it said, “Recent indicators suggest that economic activity has continued to expand at a modest pace” which suggests that the Fed’s assessment of the economic climate has improved. Powell said that if economic growth was too strong inflation could begin to rise again, but characterized a “modest” or “moderate” environment as largely acceptable from the Fed’s perspective. Since tightening started in March 2022, the Fed Funds rate has risen by a total of 525 basis points. As a function of this, interest rates throughout the economy have risen rapidly. Tighter monetary policy is cooling the overall economy but with a variable lags. While the labor market remains tight, other parts of the economy have been moderating or contracting, including housing and capex. As the full impact of the Fed’s monetary policy tightening continues to weigh on businesses and consumers, inflation should continue to cool and economic activity will slow further. While a soft-landing is becoming increasingly possible, we continue to believe a short and mild recession starting later this year is the more probable outcome.What were the Fed’s actions?

What does this mean for the US economy?

Retail Sales Show Consumers Stock Up ahead of Tariffs

April 16, 2025

US Seeks Shipbuilding Revival, Muting of China Dominance

April 14, 2025

March CPI May Hint at Consumer Pullback as Tariffs Rise

April 10, 2025

The US-China Trade War Escalates

April 09, 2025

Reciprocal Tariffs Will Weaken US and Global Economies

April 03, 2025