-

Email

Linkedin

Facebook

Twitter

Copy Link

Loading...

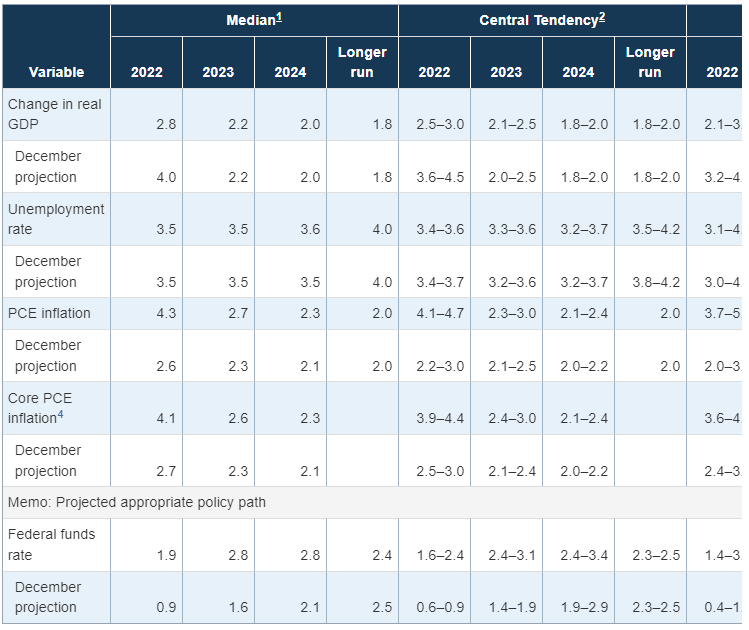

The Fed is going to hike rates quickly to lean against inflation. FOMC participants materially raised inflation projections and the number of interest rate hikes to seven in total this year, and three to four hikes next year. In other words, observers should likely expect six more 25 basis point hikes at the remaining 2022 meetings and three or four 25 basis point hike in 2023. Still, there is scope for the Fed to raise interest rates by 50 or more basis points at any meeting to accelerate the process. The Fed may start balance sheet reduction soon. The FOMC policy statement also signaled the FOMC expects to begin reducing its holdings of Treasury securities and agency debt and agency mortgage-backed securities at a coming meeting. In the past, the Fed shrunk the size of the balance sheet by letting assets mature (“roll-off the balance sheet”), and Chair Powell said that the process this time would be familiar. Still, we note that asset sales are a possibility depending upon the desired pace of reduction. There was no timing given for when the reduction would begin, but the Fed left optionality for doing so sooner rather than later. Indeed, Chair Powell suggested that by end of 2022, “significant” balance sheet runoff could be achieved. Moreover, the Chair said that the process will be faster and sooner than the prior experience. Posting of the framework could be done in May. Essentially, the balance sheet reduction might be equivalent to an additional 25 basis point rate hike in terms of macroeconomic impact, per Chair Powell’s estimation. The Fed anticipates higher inflation, but slower, yet healthy growth – roughly consistent with The Conference Board March projections. The Summary of Economic Projections (SEP) anticipates somewhat slower real GDP growth over the forecast horizon (Figure 1). The FOMC projects 4q/4q 2022 GDP growth of 2.8 percent now compared to 4 percent at the December meeting. The FOMC’s 4q/4q 2023 estimate was unchanged at 2.2 percent. This is compared to our projection of 1.7 percent real GDP growth in 4q/4q in 2022 and 2.4 percent in 2023. Our estimates were both downgraded in March relative to 2.5 percent and 2.5 percent respectively in February, ahead of the Russian invasion of Ukraine. Still, these growth rates are consistent with a healthy economy. Notably, Chair Powell confirmed that growth in the range of 2-2.5 percent, would be above potential (~1.75 percent) and potent enough to handle multiple interest rate hikes. We agree with this sentiment. Unsurprisingly, the FOMC materially raised its expectations for inflation ahead. The FOMC projects 4q/4q 2022 PCE inflation of 4.3 percent now compared to 2.6 percent at the December meeting. For 4q/4q 2023, it now forecasts 2.7 percent from 2.3 in December. The FOMC also increased its projections for Core PCE inflation to 4.1 percent from 2.7 percent in December. For 4q/4q 2023, it now forecasts 2.6 percent compared to 2.3 at the December meeting. We also posit that total and core PCE deflators will track higher now relative to several months ago. We estimate 4.2 and 4.4 percent for headline and core in 4Q 2022 and 2.9 and 3.0 for headline and core in 4Q 2023. The Fed must tighten monetary policy from its highly accommodative pandemic-emergency state to fight inflation amid a backdrop of relatively robust growth and a strong labor market. Importantly, the Fed is extremely concerned about the combination of continued pandemic-era pricing pressures and the new risks to higher inflation from the war in Ukraine. The Fed’s goal is to lower inflation back to the 2-percent target while keeping the labor market vigorous. This is possible by carefully calibrating rate hikes and balance sheet reduction without creating a recession. Indeed, doing nothing risks a wage-price spiral and/or causing elevated inflation expectations to become entrenched, which can induce recession. We caution that the hikes will arguably do little to combat supply-side inflation shocks from the pandemic and the war – namely supply chain bottlenecks and shortages of commodities, especially food if Russia’s and Ukraine’s grain becomes stranded. Stranded grain means higher costs for cereal, bread, meat, and ethanol used in gasoline. Meanwhile, if Russian oil is cut off from the global market, then gasoline prices may continue soaring until US consumers just stop driving. Additionally, higher metals prices, especially for nickel and gold, bode poorly for semiconductor production and portend spikes in prices for autos, phones, appliances, and other gadgets. Nonetheless, the Fed’s hikes will address demand-induced price pressures from high employment, rising wages, and past infusions of cash from pandemic-era fiscal stimulus. Lower inflation should help provide relief for cash-strapped Americans. Figure 1: FOMC Summary of Economic Projections Source: The Federal Reserve Board.Insights for What’s Ahead

What Were the Fed’s Actions?

How Do the Fed’s Forecasts Compare to Ours?

Why Is Fed Tightening Needed Now?

Cutting Discretionary Spending to Offset Higher Prices

March 28, 2025

Auto Makers Hit a Tariff Speedbump

March 27, 2025

Administration acts with Congress to reverse methane fee

March 25, 2025

Fed Keeps Cutting Bias amid “Transitory” Tariff Inflation

March 19, 2025

Retail Sales Show Consumers Are More Frugal amid Uncertainty

March 17, 2025

The EU's Retaliatory Tariffs Will Hit Beef, Bourbon and More

March 14, 2025

Charts

Recession and growth trackers are analytical tools to visualize where the economy is and where it is headed.

LEARN MORECharts

Getting to net zero requires technologies that are not currently commercially available. Use the power of markets to help companies make further innovation.

LEARN MORECharts

Results of operational resilience survey of 147 resilience professionals

LEARN MORECharts

The Gray Swans Tool helps C-suite executives better navigate today’s quickly developing economic, political, and technological environments.

LEARN MORECharts

Infographic: US dependence on China remains high in some key sectors.

LEARN MORECharts

China’s Consumption Slump May Be Bottoming Out, But Downside Risks Remain

LEARN MORECharts

Since Russia’s invasion of Ukraine, global CEOs have confronted a new world of extraordinary volatility and uncertainty

LEARN MORECharts

Passing increases downstream, cutting costs, and absorbing price increases into profit margins are the chief ways to manage rising input costs. Few see changing

LEARN MORECharts

While fear of a chaotic collapse of the global oil market sparked by the war in Ukraine has waned, gross imbalances could still resurface

LEARN MOREPRESS RELEASE

CED Provides Plan to Reach Net Zero While Ensuring Economic Growth

May 16, 2024

PRESS RELEASE

US CEOs Rank National Debt as the Top Geopolitics Threat

January 11, 2024

IN THE NEWS

A critical-moment-to-evaluate-US-China-ties-Raimondo's Trip

August 29, 2023

PRESS RELEASE

CEOs Can View Operational Resilience as an Advantage

August 16, 2023

PRESS RELEASE

CED Maps Out 2023 Policy Priorities and Solutions

January 18, 2023

IN THE NEWS

Sustainability Is the Pathway to Supply Chain Resilience

May 17, 2022