-

Email

Linkedin

Facebook

Twitter

Copy Link

Loading...

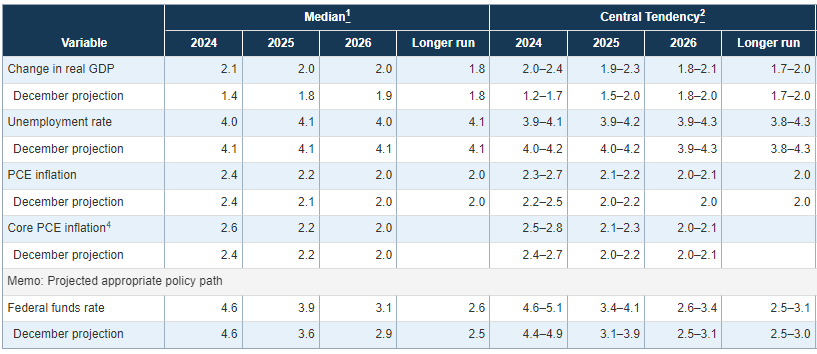

While inflation remains too high, Powell said that much progress toward achieving the 2% target was seen in 2023. He reiterated that the FOMC is waiting for more encouraging inflation data to come in before it starts to cut rates. Regarding the hotter-than-expected January and February inflation numbers, Powell said that it remains unclear if the data were distorted by seasonal effects. Regardless, he said that he did not see these data as changing the Fed’s view on inflation and he reiterated that the path to the Fed’s 2% inflation target would be bumpy. He did admit that the numbers did not inspire additional confidence, but noted that they justified the Fed’s cautious stance on implementing rate cuts. At the press conference, Chair Powell began laying the groundwork for future changes to the Fed’s balance sheet reduction program. He said that the program reduced the Fed’s balance sheet by $1.5 trillion since its inception and that the pace of the runoff would be lowered “fairly soon.” We believe this means at the next Fed meeting in early May. He noted that by slowing the pace of balance sheet runoff, the Fed would be able to run the program for longer by reducing the chance of any liquidity problems arising. He did not say when the program would end, but said the Fed wanted to maintain “ample reserves.” Otherwise, Chair Powell said that he didn’t know where interest rates would ultimately land but that he did not suspect they would return to the ultra-low rates seen before the pandemic. This is consistent with our view. Finally, he noted that the FOMC has thus far been unanimous in its decisions, but that this isn’t guaranteed to continue in the future. The FOMC does not require unanimity to enact policy. Importantly, the SEP projects that the Federal Funds rate will fall to 4.6% in 2024, 3.9% in 2025, and 3.1% in 2026. This implies three 25 basis point rate cuts in 2024. We are therefore lowering our Fed Funds forecast to four 25 bps cuts this year and another four 25 bps cuts in 2025. We previously anticipated five cuts in each year. Thereafter, the Fed sees additional cuts with the Fed Funds rate gradually converging to 2.6%.

Highlights

At this month’s meeting the Fed left rates unchanged and continued to portend three interest rates cuts in 2024. On the economy, Chair Powell said that the Fed expects GDP growth to slow from last year’s elevated pace as tight monetary policy and financial conditions continue to weigh on the economic activity. However, the Summary of Economic Projections (SEP) showed that FOMC members generally upgraded their growth outlook for 2024. Additionally, FOMC participants slightly raised the profile for the Fed Funds rate for 2025 and beyond. Otherwise, there were minimal changes made to the SEP’s projections for inflation and unemployment.What were the Fed’s actions?

After implementing 525 basis points of interest rate hikes since early 2022, the FOMC elected to hold the federal funds rate window at 5.25 – 5.50% again in March. Rates remain deep in ‘restrictive’ territory (anything above 3 percent). The Fed also said that there were no changes to its ongoing plan to reduce the size of its balance sheet, which has shrunken by $1.5 trillion since the program was first unveiled in May 2022. However, Chair Powell said that the Fed will slow the rate of runoff “fairly soon.” Today’s actions were unanimously approved by the members of the Federal Open Market Committee.What are the Fed’s expectations for the future?

The Federal Reserve’s March Summary of Economic Projections (see figure) anticipates a better economic environment this year than the December SEP did. The FOMC projects 4q/4q 2024 GDP growth of 2.1% (vs. December SEP of 1.4%), 4q/4q 2025 GDP growth of 2.0% (vs. December SEP of 1.8%), and 4q/4q 2026 GDP growth of 2.0% (vs. December SEP of 1.9%). We are more pessimistic than the Fed about 4q/4q 2024 GDP growth as we expect a mid-year slowdown, but we have a similar view of 2025. The FOMC forecast for inflation was largely unchanged, with 4q/4q 2024 PCE inflation of 2.4%, 4q/4q 2025 of 2.2%, and 4q/4q 2026 of 2.0%. We forecast PCE inflation to slow to 2.0% y/y before the end of this year —much earlier than the Fed’s estimate.

Members of The Conference Board get exclusive access to Trusted Insights for What’s Ahead® through publications, Conferences and events, webcasts, podcasts, data & analysis, and Member Communities.

Retail Sales Show Consumers Stock Up ahead of Tariffs

April 16, 2025

US Seeks Shipbuilding Revival, Muting of China Dominance

April 14, 2025

March CPI May Hint at Consumer Pullback as Tariffs Rise

April 10, 2025

The US-China Trade War Escalates

April 09, 2025

Reciprocal Tariffs Will Weaken US and Global Economies

April 03, 2025