-

Email

Linkedin

Facebook

Twitter

Copy Link

Loading...

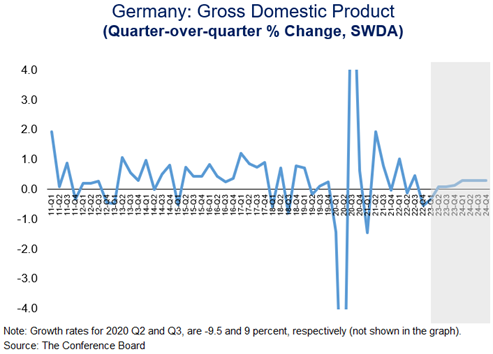

According to the latest revised GDP growth figures, Europe’s largest economy contracted in Q1 2023, as consumption keeps feeling the pressure from higher prices and public spending simultaneously. Following a decline of 0.5 percent in the final quarter of 2022, the second estimate of German GDP showed that the economy, instead of having stagnated, declined by another 0.3 percent in the first quarter of 2023. Given the two consecutive quarters of falling real activity, the German economy entered into a so-called technical recession in early 2023. Other large economies in the region have fared better recently, in particular, Italy and Spain, which were able to post growth rates around 0.5 percent in Q1. Potential reasons for this divergence could be Germany’s greater dependence on Russian energy, greater exposure to the global industry downturn and finally a strong tourism rebound fueling growth in Southern Europe. With regards to the subcomponents, private consumption contracted in Q1 2023 by 0.6 percent compared to a quarter ago, potentially owing to higher prices amid annual inflation higher than 7 percent. Meanwhile, government expenditure also declined, by as much as 1.1 percent. This raises the question whether Germany might be adopting a pro-cyclical fiscal stance, although the authorities took extraordinary measures last year to support households and businesses in the energy crisis. These were seen with concern by other governments regarding competitiveness within the bloc. At this point, weakening demand in Germany, if it were to last, could also weigh negatively on other European economies. On the other hand, investments and net exports had a positive impact on GDP growth. Interestingly, a closer look into other major economic indicators strengthen our view that Germany’s output contraction in Q1 was most likely a negative surprise rather than an indication of a full-fledged economic recession. Employment for example maintained its positive outlook, growing further in Q1 by another 0.3 percent quarter-on-quarter, while unemployment rate figures also remained at the historically low 2.8 percent. And despite uncertainty and geopolitical instability due to war in Ukraine still weighing negatively on business decisions, investment growth turned positive in Q1, partly offsetting consumption’s negative impact on economic activity. Looking forward, growth is expected to remain sluggish for the remainder of 2023. Adverse financial conditions and inflationary pressures will remain key challenges to the country’s economic recovery, as they exert downward pressure on domestic demand and investments. However, on the positive side, as energy prices continue to decline and natural gas prices are now closer to their historical average, input price pressures will continue to weaken further, helping industrial activity to pick up in coming quarters. Easing supply bottlenecks and the high backlog of orders will also continue to support the recovery of the German manufacturing sector. Headline annual inflation is expected to moderate further, currently at 7.6 percent in April from the record highs of 11.5 percent in October last year. Falling inflationary pressures, combined with wage growth that has also picked up significant steam recently should support private consumption in the second half of 2023. All things considered, assuming that inflation cools down further, wage growth maintains pace, and the labor market maintains a resilient outlook, the German economy is likely to exit recession and achieve tepid growth in coming quarters. As a result, we slightly downgrade our GDP growth forecasts for the German economy for Q2, from 0.2 percent to now 0.1 percent quarter-on-quarter, with growth remaining positive and closer to zero for the remainder of 2023 (Graph 1). Overall, growth for the full year is expected to come in at -0.4 percent versus our previous estimate of -0.1 percent. As a result of this downgrade, annual GDP growth projections for the Euro Area aggregate are also slightly downgraded, from 0.8 to 0.7 percent for 2023.

Retail Sales Show Consumers Stock Up ahead of Tariffs

April 16, 2025

US Seeks Shipbuilding Revival, Muting of China Dominance

April 14, 2025

March CPI May Hint at Consumer Pullback as Tariffs Rise

April 10, 2025

The US-China Trade War Escalates

April 09, 2025