-

Email

Linkedin

Facebook

Twitter

Copy Link

Loading...

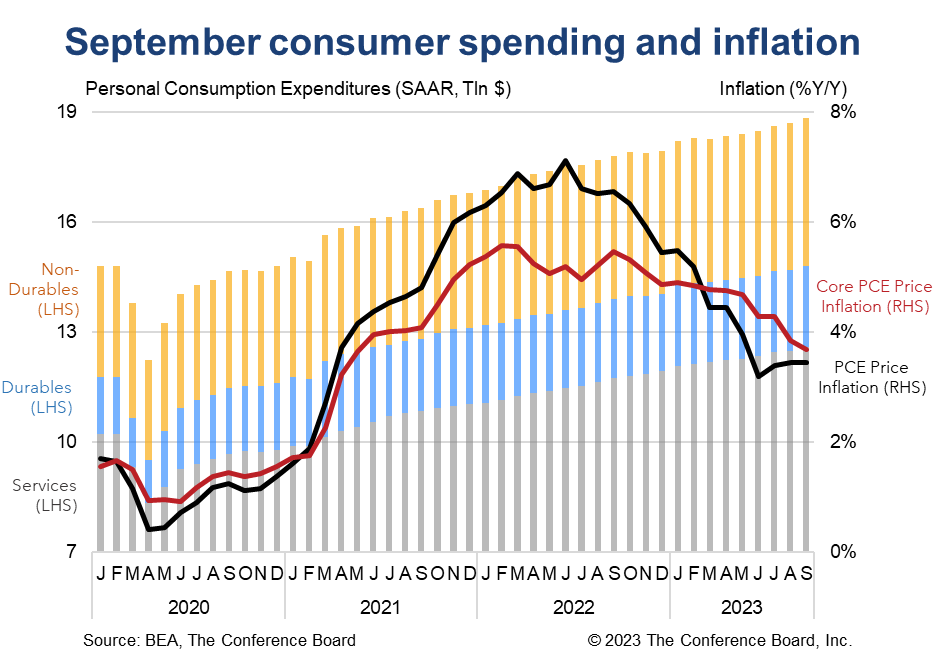

Real consumer spending rebounded to 0.4 percent month-on-month in September even as real income gains were zero once again. Meanwhile, headline inflation remained stuck at 3.4 percent year-on-year for the third consecutive month and core inflation worsened month-on-month. The Fed will likely be discouraged by this print along with yesterday’s GDP report. We continue to expect one final 25 basis point rate hike before yearend, but it may not come until the Fed’s December meeting given the recent jump in treasury yields. We do not expect rate cuts until mid-2024. Our forecast for a short and shallow recession in early 2024 holds. Inflation worsened in September. On a year-on-year basis the headline PCE deflator rose by 3.4 percent for a third consecutive month and the core deflator ticked down just 0.1 percentage point to 3.7 percent. Month-over-month changes were even less encouraging, with the headline PCE deflator rising 0.4 percent for the second consecutive month and the core PCE deflator jumping to 0.3 percent from 0.1 percent the prior month. As we’ve said before, the path to 2 percent will be a bumpy one.

Highlights

Collectively, these data show that consumption remains on an unsustainable path. Real disposable personal incomes have been either flat or negative for four consecutive months while real personal consumption expenditures continued to expand. Meanwhile, the personal savings rate fell to 3.4 percent—the lowest rate since late 2022—and debt levels are quickly rising. In the background sits a rapidly diminishing pile of pandemic excess savings and the recent launch of mandatory student loan repayments. In our view, these trends will increasingly come to a loggerhead and an indebted and cash-strapped consumer will have to pull back. This is consistent with our expectation that a short recession is on the horizon.Inflation

Headline PCE price inflation remained at 3.4 percent year-over-year (y/y) in September and core PCE price inflation (which excludes food and energy) came in at 3.7 percent y/y. On a month-over-month basis (m/m), headline PCE inflation rose 0.4 percent (again) and core PCE inflation rose 0.3 percent (vs. 0.1 percent in August). Prices for goods rose 0.2 percent m/m and services rose 0.5 percent m/m.Incomes

Overall personal incomes rose by 0.3 percent m/m (in nominal terms) in September, vs. 0.4 percent m/m in August. However, when factoring in inflation, the real month-over-month growth rate was 0.0 percent m/m. In year-over-year terms, real personal income rose 1.2 percent in September, vs. 1.3 percent in August. Meanwhile, real disposable personal income (which is personal income less taxes) contracted by 0.1% m/m, vs. -0.1 percent in August, -0.2 percent in July, and 0.0 percent in June. Finally, the savings rate fell from 4.0 percent to 3.4 percent of disposable personal income.Spending

Personal consumption expenditures rose by 0.7 percent m/m (in nominal terms) in September, vs. 0.4 percent m/m percent in August. Spending on services rose by 0.8 percent m/m while spending on goods rose to 0.7 percent m/m. After accounting for inflation, real consumer spending was up 0.4 percent m/m in September with spending on services rising 0.3 percent m/m and spending of goods falling 0.5 percent m/m.

Members of The Conference Board get exclusive access to Trusted Insights for What’s Ahead® through publications, Conferences and events, webcasts, podcasts, data & analysis, and Member Communities.

Cutting Discretionary Spending to Offset Higher Prices

March 28, 2025

Auto Makers Hit a Tariff Speedbump

March 27, 2025

Administration acts with Congress to reverse methane fee

March 25, 2025

Fed Keeps Cutting Bias amid “Transitory” Tariff Inflation

March 19, 2025

Retail Sales Show Consumers Are More Frugal amid Uncertainty

March 17, 2025

The EU's Retaliatory Tariffs Will Hit Beef, Bourbon and More

March 14, 2025