-

Email

Linkedin

Facebook

Twitter

Copy Link

Loading...

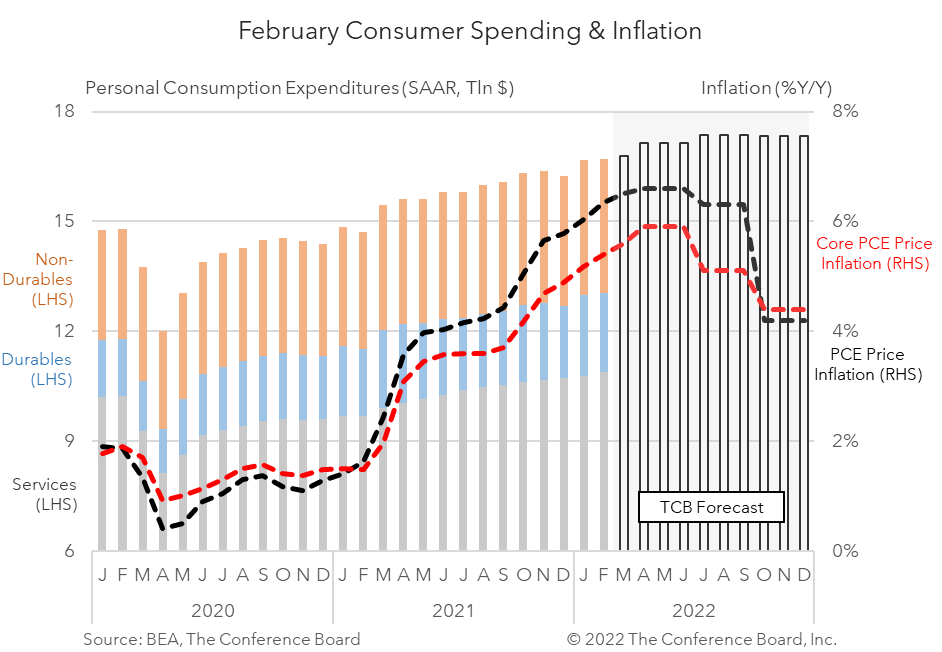

Consumer inflation continued to surge in February. Headline PCE price inflation increased by 6.4 percent year-over-year in February (the highest reading since 1982), vs. 6.0 percent in January. The BEA also reported that Core PCE Inflation, which excludes food and energy prices, rose to 5.4 percent year-over-year (the highest reading since 1983), vs. 5.2 percent in December. On a month-over-month basis, headline PCE price inflation was up at 0.6 percent in February, vs. 0.5 percent in January, while core PCE price inflation (total less food and energy) rose by 0.4 percent month-over month, following four months of 0.5 percentage point increases. The evolution of inflation in February is consistent with our anticipation that headline PCE inflation will remain well above 6 percent year-over-year for much of 2022, and that the core will linger above 5 percent for much of the balance of this year. Still, there are risks that our projections, which are amongst the highest relative to other forecasters in terms of the trajectory of inflation, could still be too low. The evolution of the war in Ukraine and COVID-19 lockdowns in China will play a key role in how high prices go. Inflation is eroding households’ purchasing power. Overall personal income rose by 0.2 percent in February, following a modest 0.1 percentage point rise in January. Both employee compensation (+0.7 percent) and proprietors’ income growth (+0.8 percent) were healthy in the month. Government transfer payments declined a second month (-0.3 percent). Despite the increase in nominal personal income, real personal income, both overall and after taxes, continued to decline on rising inflation. Real total personal income fell by -0.1 percent month-over-month in February marking the sixth consecutive contraction, while real disposable personal income fell by 0.2 percent month-over month, tacking on a seventh month of decline. Payback, the end of omicron, but also rising prices dampened consumption. Nominal personal consumption expenditures rose by just 0.2 percent month-over-month in February following a 2.7 percent jump in January. Again, some of the slowing in February likely reflected payback from January’s outsized increase, plus shifting demand away from durables (-2.5 percent) towards in-person services including healthcare (+0.6 percent), transportation (+3.0 percent), recreation (+2.7 percent), and hotels and restaurants (+3.0 percent) as omicron faded. However, after accounting for inflation, real personal consumption expenditures fell 0.4 percentage point in February, declining the third time in four months. Real goods spending was down 2.1 percent month-on-month. However, one bright spot is that real services increased by 0.6 percent in February, the fastest pace since July 2021 ahead of the delta COVID-19 variant.Insights for What’s Ahead

Report Details: Somber News for Consumption

Cutting Discretionary Spending to Offset Higher Prices

March 28, 2025

Auto Makers Hit a Tariff Speedbump

March 27, 2025

Administration acts with Congress to reverse methane fee

March 25, 2025

Fed Keeps Cutting Bias amid “Transitory” Tariff Inflation

March 19, 2025

Retail Sales Show Consumers Are More Frugal amid Uncertainty

March 17, 2025

The EU's Retaliatory Tariffs Will Hit Beef, Bourbon and More

March 14, 2025