-

Email

Linkedin

Facebook

Twitter

Copy Link

Loading...

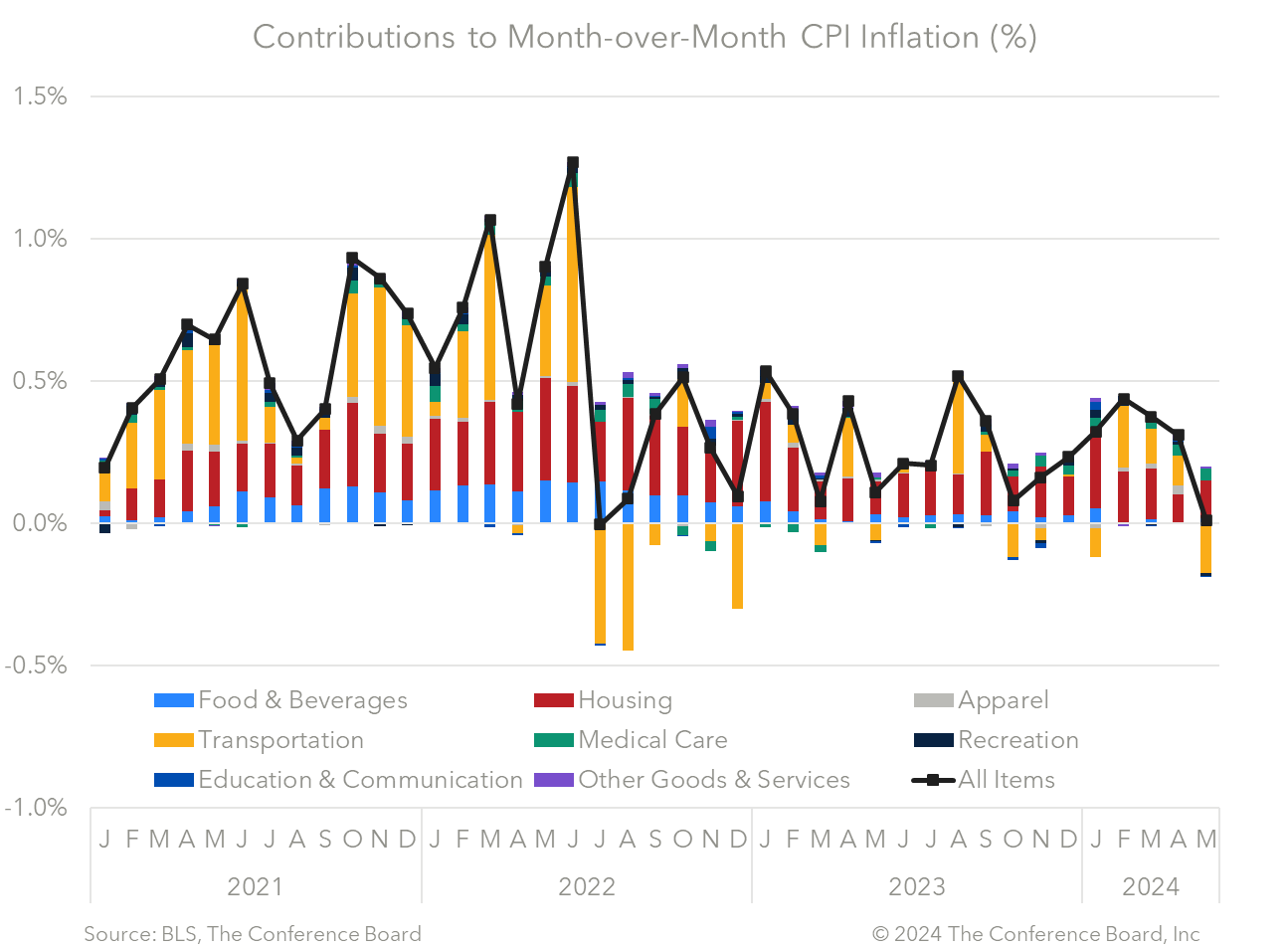

The May Consumer Price Index (CPI) showed that inflation rose by 3.3% from a year earlier, vs. 3.4% in April and 6.4% at the beginning of 2023. Meanwhile, core CPI, which excludes volatile food and energy prices, rose by 3.4% from a year earlier, vs. 3.6% y/y in April and 5.6% y/y at the beginning of 2023. Following hotter-than-expected inflation data in Q1 2024, these May numbers showed welcome relief. Declines in energy prices, and gasoline specifically, helped to offset price increases elsewhere, resulting in a flat m/m headline reading. Goods inflation fell by 0.4% from the month prior, and stubborn services inflation cooled to 0.2%. However, there was no progress on monthly shelter prices, which have risen by 0.4% m/m for four consecutive months. According to the BLS, shelter prices account for over two-thirds of the total 12-month increase in the Core CPI. It is notable that core CPI excluding shelter prices has slowed to 1.9% y/y, while core prices stand at 3.4% y/y. Today’s data will be welcomed by the Fed, which is currently meeting to discuss monetary policy. However, the progress in today’s CPI data isn’t enough to negate the spike in inflation seen at the onset of this year. Optimism about imminent Fed cuts has given way to an expectation that a “higher for longer” interest rate environment is more likely. While we do expect inflation to gradually ebb further we do not think the Fed’s 2% PCE inflation target will be achieved until Q2 2025. However, we forecast that enough progress will be made by the end of 2024 that the Fed will begin to cut interest rates in November. Core CPI rose by 0.2% m/m and 3.4% y/y, vs. April’s 0.3% m/m and 3.6% y/y readings. While shelter price increases have been cooling gradually in %y/y terms, according to the Bureau of Labor Statistics (BLS) it accounted for two-thirds of the 12-month core CPI increase. It is notable that Core CPI excluding shelter prices now stands at just 1.9% year-on-year.

DATA DETAILS

Headline CPI rose by 0.0% m/m and 3.3% y/y, vs. April’s 0.3% m/m and 3.4% y/y readings. Gasoline prices fell by 3.6% from the month prior, but were offset by a rise in shelter prices. According to the BLS, indexes that increased m/m included: shelter (0.4%), medical care (0.3%), used cars and trucks (0.6%), and education (0.4%). Meanwhile, indexes that declined m/m included airline fares (-3.6%), new vehicles (-0.5%), communication (-0.3%), recreation (-0.2%), and apparel (-0.3%). Food prices rose by 0.1% in the month, with food at home remaining flat and food away from home rising slightly.

Members of The Conference Board get exclusive access to Trusted Insights for What’s Ahead® through publications, Conferences and events, webcasts, podcasts, data & analysis, and Member Communities.

Retail Sales Show Consumers Stock Up ahead of Tariffs

April 16, 2025

US Seeks Shipbuilding Revival, Muting of China Dominance

April 14, 2025

March CPI May Hint at Consumer Pullback as Tariffs Rise

April 10, 2025

The US-China Trade War Escalates

April 09, 2025

Reciprocal Tariffs Will Weaken US and Global Economies

April 03, 2025