-

Email

Linkedin

Facebook

Twitter

Copy Link

Loading...

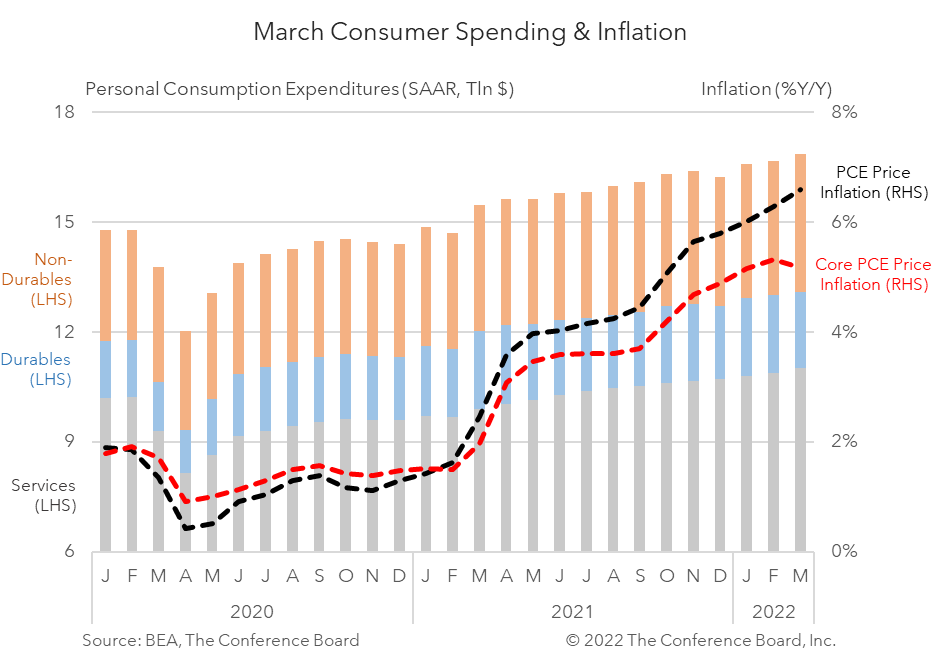

March Personal Income & Outlays data, released this morning, show an economy exiting the pandemic shock but entering a new one associated with the war in Ukraine. According to the Bureau of Economic Analysis (BEA), US incomes rose in March and consumer spending continued to expand. Meanwhile, inflation continued to climb, but the primary drivers shifted to energy and food price increases resulting from the war in Ukraine. Unfortunately, high inflation rates continue to undermine income in consumption growth in real terms. Headline PCE price inflation came in at 6.6 percent year-over-year (y/y) in March (a fresh 4-decade high), vs. 6.3 percent y/y in February. The BEA also reported that Core PCE Inflation, which excludes food and energy prices, came in at 5.2 percent y/y, vs. 5.3 percent y/y in February. On a month-over-month (m/m) basis, headline PCE price inflation increased to 0.9 percent m/m, vs. three consecutive months at 0.5 percent m/m. Meanwhile, core PCE price inflation remained at 0.3 percent m/m for a second consecutive month, vs. 0.5 percent m/m over each of the four months prior to that. These trends show that core inflation appears to be cooling somewhat, but that food and energy prices are offsetting any progress to tame overall inflation. This shift in inflation drivers is tied to the shock seen in oil and grain prices associated with Russia’s invasion of Ukraine. Overall personal income growth rose 0.5 percent m/m (in nominal terms), vs. up 0.7 percent m/m in February. Employee compensation grew by 0.5 percent m/m, proprietors’ income grew by 0.8 percent m/m, and rental income grew by 0.7 percent m/m. However, recent increases in personal income have been more than offset by increases in prices. In inflation adjusted terms, personal income fell by -0.4 percent m/m in March. Indeed, nine of the last twelve months have seen negative real income growth. Thus, while Americans have recently seen their incomes rise in nominal terms, they are seeing their purchasing power eroded even more quickly. Personal consumption expenditures rose by 1.1 percent m/m (in nominal terms) in March following a 0.6 percent m/m increase in February. Spending on services rose by 1.0 percent m/m while spending on goods rose by 1.2 percent m/m. Spending on durable goods fell by a -1.0 percent m/m, while spending on non-durables rose 2.5 percent m/m. After accounting for inflation, consumer spending rose by 0.2 percent m/m in March with spending on goods falling -0.5 percent m/m and spending of services rising 0.6 percent m/m. We expect this shift in spending patterns from goods to services to continue as the severity of the pandemic continues to wane. Personal income, consumer spending, and inflation will face continued challenges in the months ahead. As the impact of COVID-19 on the US economy gradually wanes the conflict in Eastern Europe is taking its place as the economic disruptor. Prior to Russia’s invasion of Ukraine we expected inflation to moderate in Q2 2022. That has changed. Russia and Ukraine are large energy and grain producers and are key global suppliers. With conflict and sanctions curbing this supply, energy and food prices around the world will continue their recent climb, adding to inflationary pressures and creating further drag on households’ wallets. If the inflation problem is to be resolved, either new suppliers of these goods need to be identified or the conflict in Eastern Europe needs to end.

Retail Sales Show Consumers Stock Up ahead of Tariffs

April 16, 2025

US Seeks Shipbuilding Revival, Muting of China Dominance

April 14, 2025

March CPI May Hint at Consumer Pullback as Tariffs Rise

April 10, 2025

The US-China Trade War Escalates

April 09, 2025

Reciprocal Tariffs Will Weaken US and Global Economies

April 03, 2025