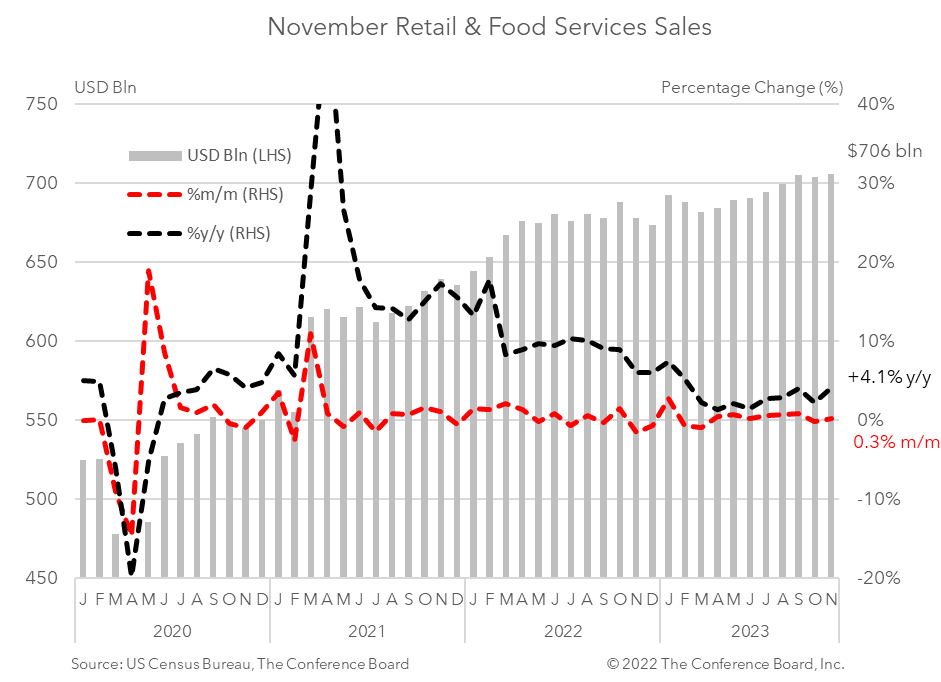

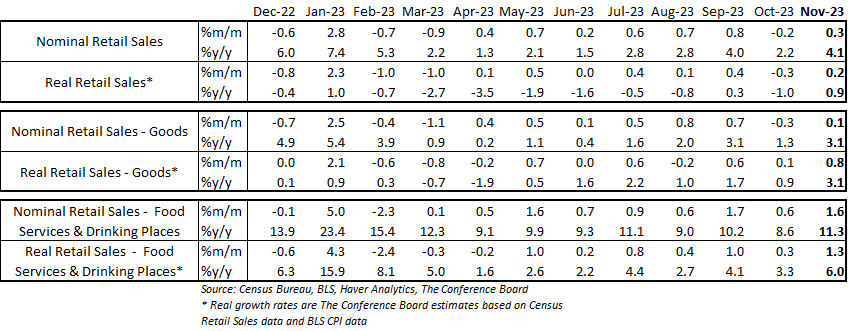

Following a weak October, retail sales surprised to the upside in November and expanded in both nominal and real terms. However, September and October sales data were revised downward somewhat. Consumer spending rose by 0.3% m/m in November, vs. an decrease of 0.2% m/m in October (formerly -0.1%) and an increase of 0.8% m/m in September (formerly 0.9%). After adjusting for inflation using CPI data, real November spending growth was up 0.2% from October*. These data show that US consumer spending is still expanding, though at a growth rate well below those seen over the summer period. While spending growth in Q4 should be positive given the data released thus far, the growth rate will likely be less than half that seen in Q3. Looking ahead, we expect spending growth to cool further as US consumers contend with high interest rates, elevated prices, rising debt and falling savings. These headwinds to consumption coupled with a pullback in business investment associated with decades-high interest rates are likely to tip the economy into contractionary territory in H1 2024. We expect that the NBER will classify this period as a recession. Regarding the drivers of retail sales this month: Consumer demand for goods rose 0.1% from the month prior in nominal terms. Spending on motor vehicles and parts rose by 0.5% in November from October, while retail sales excluding motor vehicles fell by 0.1%. Spending at gasoline stations fell 2.9% from the month prior due to further declines in oil prices. Retail sales less motor vehicles, gasoline, and building supplies (known as “Retail Control”) rose by 0.4% from the previous month. Nonstore retail sales rose 1.0% from the month prior. When adjusting goods spending for CPI inflation, the real growth rate was about 0.8%.* Meanwhile, spending at food services and drinking places rose by 1.6% month-over-month in November. After adjusting for CPI inflation the real growth rate was about 1.3%.* * Real growth rates are The Conference Board estimates based on Census Retail Sales data and BLS CPI data.

Retail Sales Show Consumers Stock Up ahead of Tariffs

April 16, 2025

US Seeks Shipbuilding Revival, Muting of China Dominance

April 14, 2025

March CPI May Hint at Consumer Pullback as Tariffs Rise

April 10, 2025

The US-China Trade War Escalates

April 09, 2025