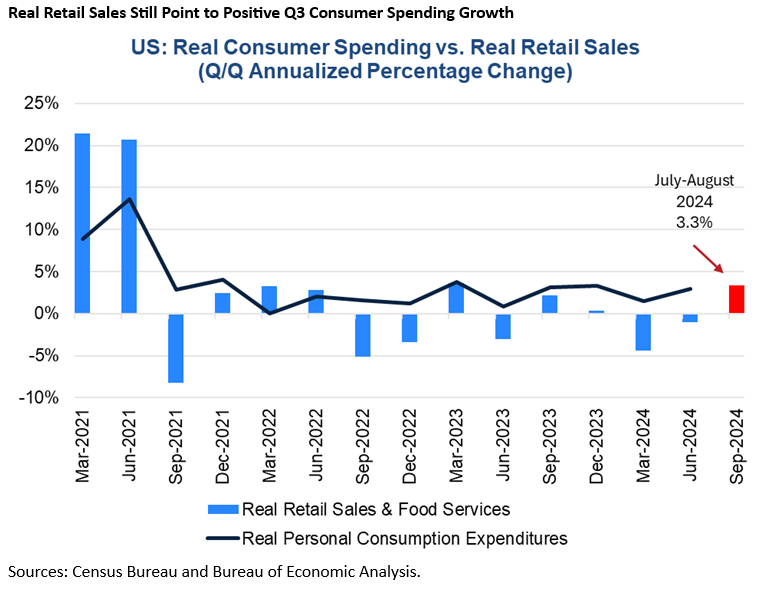

Nominal retail sales ticked up by just 0.1 percent in August and sales edged down by 0.1 percent in real terms. Despite the August setback, real retail sales over the July-August span were still 3.3 percent annualized above Q2, suggesting that Q3 consumer spending growth will still be positive even if consumption momentum slowed over the course of the quarter. We project real GDP will grow by 0.8 percent annualized in Q3.

Trusted Insights for What’s Ahead®™

Members of The Conference Board get exclusive access to Trusted Insights for What’s Ahead® through publications, Conferences and events, webcasts, podcasts, data & analysis, and Member Communities.

Retail Sales Show Consumers Stock Up ahead of Tariffs

April 16, 2025

US Seeks Shipbuilding Revival, Muting of China Dominance

April 14, 2025

March CPI May Hint at Consumer Pullback as Tariffs Rise

April 10, 2025

The US-China Trade War Escalates

April 09, 2025