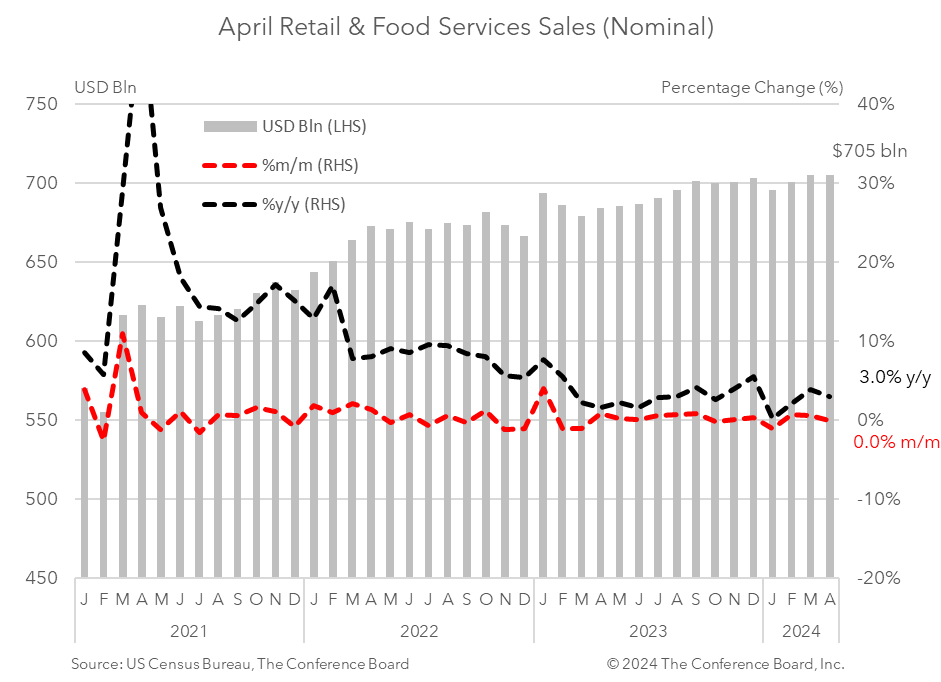

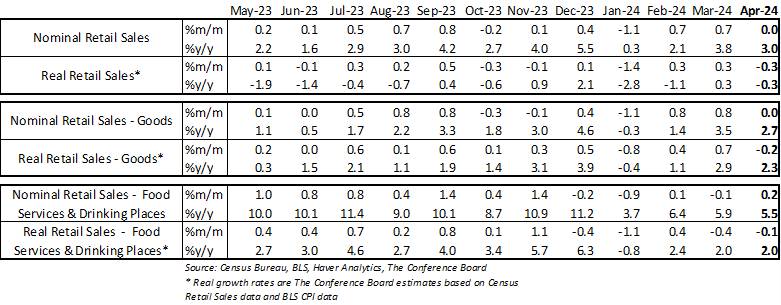

Retail sales stagnated in April and growth figures for February and March were revised lower. Nominal retail spending grew by 0.0% m/m in April, following a 0.7% m/m (revised) gain in March and a 0.7% (revised) gain in February. However, after adjusting for inflation using CPI data real April spending growth was -0.3% from the month prior.* This lackluster report saw weakness in a number of important categories. Notably, spending on motor vehicles and parts contracted by 0.8% from the month prior. Spending at non-store retailers and on sporting goods also fell for the month, but rising oil prices helped to boost sales at gasoline stations. These data demonstrate that the Federal Reserve’s tight monetary policy is weighing on consumer spending on goods – especially interest rate sensitive categories. Coupled with slowing wage gains, falling savings, and rising debt we are concerned about consumer spending over the next several quarters. However, a more subdued spending environment should help to quell inflation and position the Fed to start lowering interest rates toward the end of the year. Consumer demand for goods was flat from the month prior in nominal terms. Spending on motor vehicles and parts fell by 0.8% in April from March (both motor vehicle sales, parts sales declined), while retail sales excluding these categories rose by 0.2%. Spending at gasoline stations rose by 3.1% from the month prior due to an uptick in gasoline prices. Retail sales, less motor vehicles, gasoline, and building supplies (known as “Retail Control”) fell by 0.3% from the previous month. Categories that saw strength included electronics & appliances, and clothing & accessories. Spending on sporting goods, health & personal care, furniture, and at non-store retailers all fell in the month. When adjusting goods spending for CPI inflation, the real growth rate was about -0.3%.* Meanwhile, spending at food services and drinking places rose by 0.2% month-over-month in April. After adjusting for CPI inflation the real growth rate was about -0.1%.* * Real growth rates are The Conference Board estimates based on Census Retail Sales data and BLS CPI data.

Key drivers of retail sales in April:

Members of The Conference Board get exclusive access to Trusted Insights for What’s Ahead® through publications, Conferences and events, webcasts, podcasts, data & analysis, and Member Communities.

Retail Sales Show Consumers Stock Up ahead of Tariffs

April 16, 2025

US Seeks Shipbuilding Revival, Muting of China Dominance

April 14, 2025

March CPI May Hint at Consumer Pullback as Tariffs Rise

April 10, 2025

The US-China Trade War Escalates

April 09, 2025