-

Email

Linkedin

Facebook

Twitter

Copy Link

Loading...

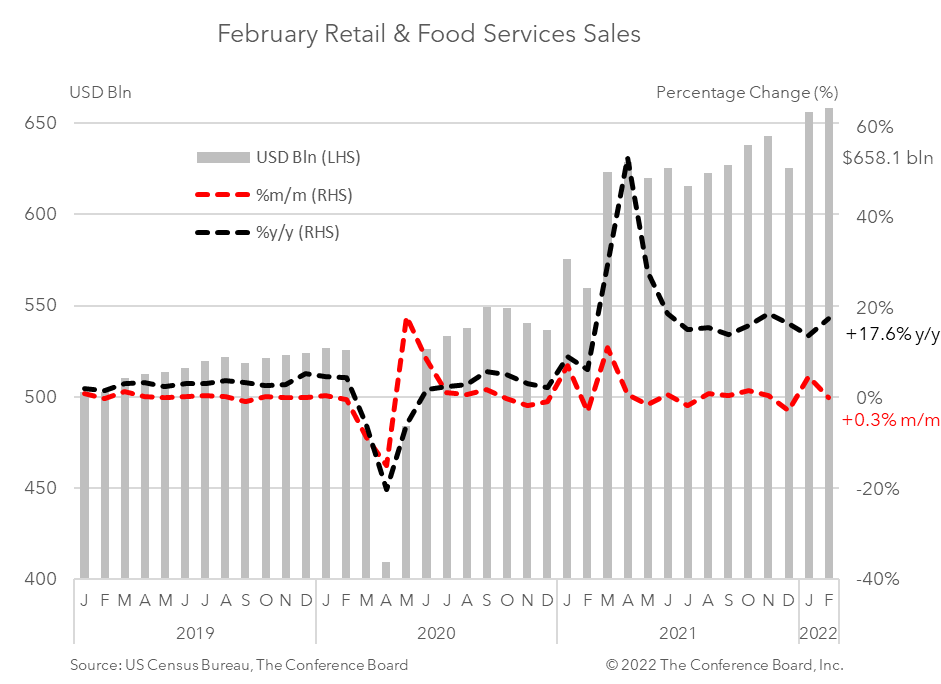

Retail spending in February rose $2.0 billion to $658.1 billion for the month – up 0.3 percent from the previous month and up 17.6 percent from a year earlier. Adjusted for CPI inflation, which clocked in at another 40-year high in February, sales were down 0.5 percent month-over-month. This contraction in real retail sales underscores the degree to which high inflation is eroding US consumer purchasing power. Spending at food services and drinking places was the primary driver of growth in February – rising 2.5 percent from the previous month. The rapid decline in new cases of Omicron, which spiked in January, underpinned this rebound. Looking forward, we expect spending at food service and drinking places to continue to rise in the coming months as the threat of the pandemic abates and the weather improves. Meanwhile demand for goods was flat in February – rising just 0.04 percent from the previous month. Spending on motor vehicles and parts rose 0.8 percent from January, while retail sales excluding this important category declined 0.2 percent month-over-month. Retail sales less motor vehicles, gasoline, and building supplies (known as “Retail Control”) was down 1.2 percent from the previous month. Spending at non-store retailers dropped 3.7 percent from the previous month after jumping by 20.1 percent in January – due to consumer angst about in person shopping in the midst of the Omicron wave. We expect consumer spending growth to continue to pivot toward in-person services as worries about COVID-19 abate. However, we anticipate that high inflation – driven by rising energy and food prices related to the Ukraine Crisis – to erode some of these gains in real terms. This will limit overall economic growth in 2022.

Retail Sales Show Consumers Stock Up ahead of Tariffs

April 16, 2025

US Seeks Shipbuilding Revival, Muting of China Dominance

April 14, 2025

March CPI May Hint at Consumer Pullback as Tariffs Rise

April 10, 2025

The US-China Trade War Escalates

April 09, 2025

Reciprocal Tariffs Will Weaken US and Global Economies

April 03, 2025