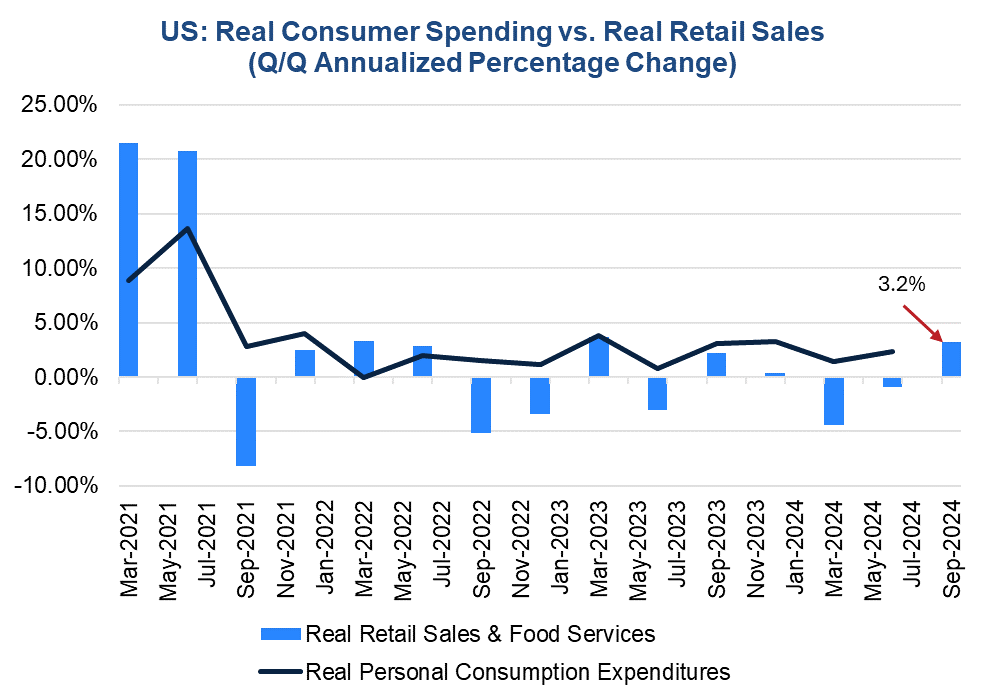

Nominal retail sales jumped by 0.97 month-over-month in July and real retail sales grew by 0.81 percent, starting third quarter consumption off on a strong note. Real Retail Sales grew by 3.2 percent annualized in July compared to Q2 2024. Trusted Insights for What’s Ahead® Figure 1. Real Retail Sales suggest a healthy start to 3Q consumer spending Sources: Census Bureau, Bureau of Labor Statistics, Haver Analytics, and The Conference Board. Strong Q3 Consumption Start Nominal retail sales rose by 1 percent month-over-month in July after declining by 0.2 percent in June. Sales were strong across most categories, especially for motor vehicle and parts dealers (+3.6 percent), furniture (+0.5 percent), electronics and appliances (+1.6 percent), building supplies (+1.0 percent), groceries (+1.0 percent), healthcare (+0.8 percent), and general merchandise (+0.5 percent) stores, which were led by spending at warehouse clubs and superstores. Sales were also positive for nonstore retailers (+0.2 percent), bars and restaurants (+0.3 percent), and gasoline stations (+0.1 percent). Nominal sales were down for clothing stores (-0.1 percent), sporting goods (-0.7 percent), and department stores (-0.2 percent). Retail control – defined as retail sales and food services excluding auto, building supplies and gasoline stations – rose by 0.3 percent in the month. Importantly, real retail sales were up by 0.8 percent month-over-month, and a sizable 3.2 percent annualized over Q2. While only one month in the quarter, these data suggest that at the start of Q3, consumers were still content to spend on goods and food and beverage services.

Retail Sales Show Consumers Stock Up ahead of Tariffs

April 16, 2025

US Seeks Shipbuilding Revival, Muting of China Dominance

April 14, 2025

March CPI May Hint at Consumer Pullback as Tariffs Rise

April 10, 2025

The US-China Trade War Escalates

April 09, 2025