The Conference Board Measure of CEO Confidence™ in collaboration with The Business Council increased by 9 points in the first quarter of 2025 to 60, the highest level in three years. For the first time since early 2022, the Measure was well above 50 in Q1 2025, indicating that CEOs have shifted from the cautious optimism that prevailed in 2024 to a more confident optimism. (A reading above 50 reflects more positive than negative responses.) A total of 134 CEOs participated in the Q1 survey, which was fielded from January 27 to February 10.

“The improvement in CEO Confidence in the first quarter of 2025 was significant and broad-based,” said Stephanie Guichard, Senior Economist, Global Indicators, The Conference Board. “All components of the Measure improved, as CEOs were substantially more optimistic about current economic conditions as well as about future economic conditions—both overall and in their own industries. CEOs’ assessments of current conditions in their own industries also improved. (This measure is not included in calculating the topline Confidence measure). Consistent with an improved expected outlook, there was a notable increase in the share of CEOs expecting to increase investment plans and a decline in the share expecting to downsize investment plans. Still, a majority of CEOs indicated no revisions to their capital spending plans over the next 12 months.”

“Accompanying Q1’s surge in confidence, CEOs also reported an easing of concerns regarding a range of business risks,” said Roger W. Ferguson, Jr., Vice Chairman of The Business Council and Chair Emeritus of The Conference Board. “Compared to Q4 2024, fewer CEOs ranked cyber threats, regulatory uncertainty, financial and economic risks, and supply chain disruptions as high-impact risks. The one exception was geopolitical instability, which 55% of CEOs in Q1 saw as a high-impact risk to their industry—up from 52% last quarter.”

Overall, 73% of CEOs planned to grow or maintain the size of their workforce over the next 12 months, virtually unchanged from last quarter. However, the share expecting to expand their workforce fell to 32%—down from 40% in Q4—while the share planning no change in employment rose to 41%, up from 34%. Notably, the share planning to reduce their workforce ticked up again, rising 1 ppt to 27%. Fewer CEOs reported difficulty finding qualified workers in Q1.

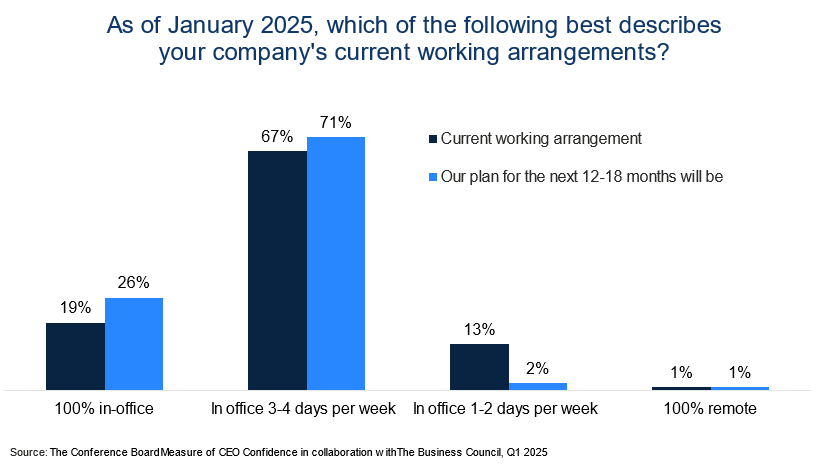

The share of CEOs planning to raise wages by 3% or more over the year climbed to 71%, up from 63% in Q4. A majority of CEOs—60%—plan wage increases in the 3.0–3.9% range, up from 48%. Regarding work arrangements, a schedule with 3-4 days a week in the office remained the most popular option. However, the share of CEOs planning to shift away from remote work—toward 3-4 days or 100% in-office—over the next 12-18 months continued to climb.

Current Conditions

CEOs’ assessment of general economic conditions became positive in Q1 2025:

CEOs’ assessments of conditions in their own industries also flipped to positive in Q1:

Future Conditions

CEOs’ expectations about the short-term economic outlook surged in Q1 2025:

CEOs’ expectations for short-term prospects in their own industries also became far more optimistic:

Employment, Recruiting, Wages, and Capital Spending

Work Arrangements and Return to Office:

Most companies have a hybrid work arrangement, but more CEOs plan on shifting toward a 100% in-office workforce:

Industry Risks:

Compared to last quarter, the impact and intensity of most risks have declined among CEOs:

About The Conference Board

The Conference Board is the member-driven think tank that delivers Trusted Insights for What’s Ahead®. Founded in 1916, we are a non-partisan, not-for-profit entity holding 501 (c) (3) tax-exempt status in the United States. ConferenceBoard.org

About The Business Council

The Business Council is a forum for the CEOs of the world’s largest multinational corporations across all industry sectors. Members gather several times each year to share best practices, network and engage in intellectually provocative, enlightening discussions with peers and thought-leaders in business, government, academia, science, technology and other disciplines. Through the medium of discussion, the Council seeks to foster greater understanding of the major opportunities and challenges facing business, and to create consensus for solutions. The Business Council is a non-partisan, not-for-profit entity holding 501 (c) (6) tax-exempt status. The Business Council does not lobby. Visit The Business Council’s website at www.thebusinesscouncil.org

For further information contact:

Joseph DiBlasi

781.308.7935

jdiBlasi@tcb.org

Jonathan Liu

jliu@tcb.org

PRESS RELEASE

CEO Confidence Increased Sharply in Q1 2025

February 20, 2025

IN THE NEWS

Dana Peterson Discusses CEO Confidence

October 24, 2024

IN THE NEWS

Topindustriëlen zien wereld splitsen in competitieve handels

May 24, 2022

IN THE NEWS

Roger Ferguson: CEO confidence dip, inflation, and more

October 06, 2021

IN THE NEWS

Steve Odland on CEO Confidence and Returning to the Office

September 22, 2021

IN THE NEWS

CEO Confidence Soars in Q2

May 20, 2021

All release times displayed are Eastern Time

The Cost of Soaring Uncertainty: What Uncertainty Means for the US Outlook

April 22, 2025 | Essay

CEO Confidence Survey Quarterly Report

February 20, 2025 | Article

The Conference Board Measure of CEO Confidence™ for China: 2023 H1 Results

May 24, 2023 | Report

The Conference Board Measure of CEO Confidence™ for China: 2022 H2 Results…

November 25, 2022 | Report

The Conference Board Measure of CEO Confidence™ for Europe by ERT: 2022 H1 Results…

May 24, 2022 | Report

The Conference Board Measure of CEO Confidence™ for China: 2022 H1 Results

May 24, 2022 | Report

What’s Behind Conflicting US CEO & Consumer Confidence Readings?

March 12, 2025 11:00 AM ET (New York)

C-Suite Perspectives

Headed for Recession? Only 30% of CEOs Think So

August 08, 2024

The Evolving Economic Outlook for Europe

July 10, 2024 11:00 AM ET (New York)

Trends in CEO Confidence in 2024

June 12, 2024 11:00 AM ET (New York)

Trends in Consumer and CEO Confidence in 2024

May 08, 2024 11:00 AM ET (New York)

C-Suite Perspectives

October 13, 2022