For Release 10:00 AM ET, March 14, 2025

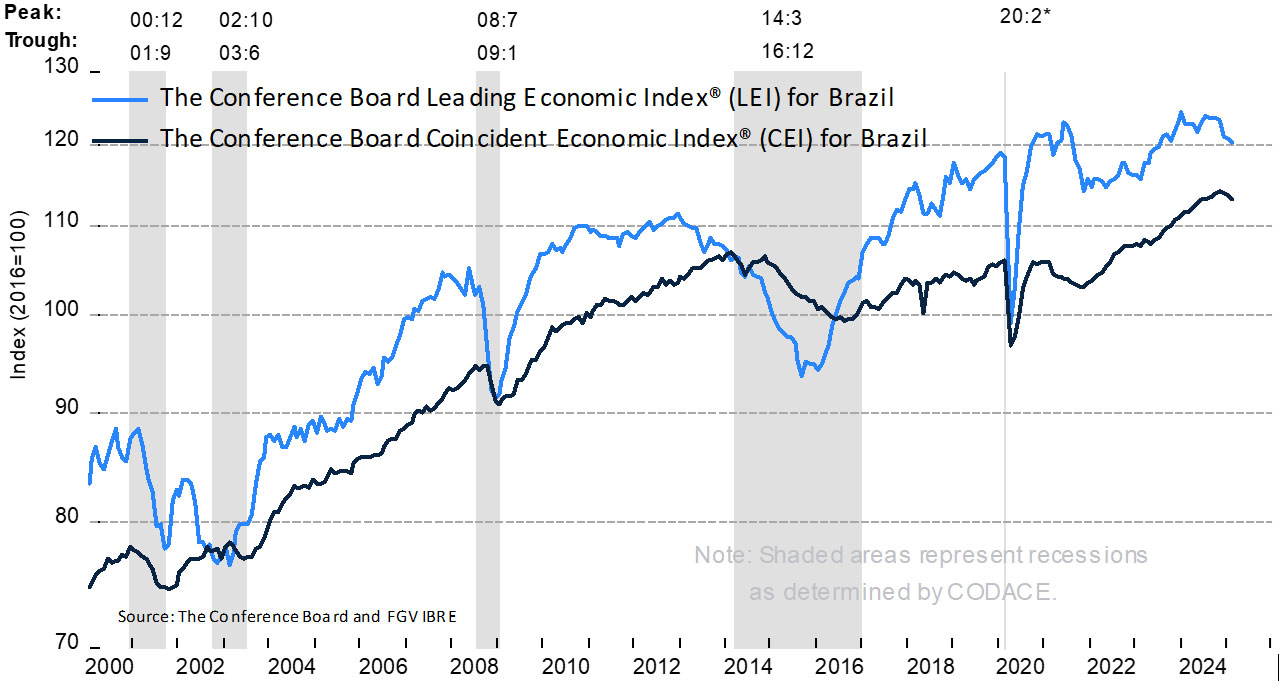

Using the Composite Indexes: The Leading Economic Index (LEI) provides an early indication of significant turning points in the business cycle and where the economy is heading in the near term. The Coincident Economic Index (CEI) provides an indication of the current state of the economy. Additional details are below.

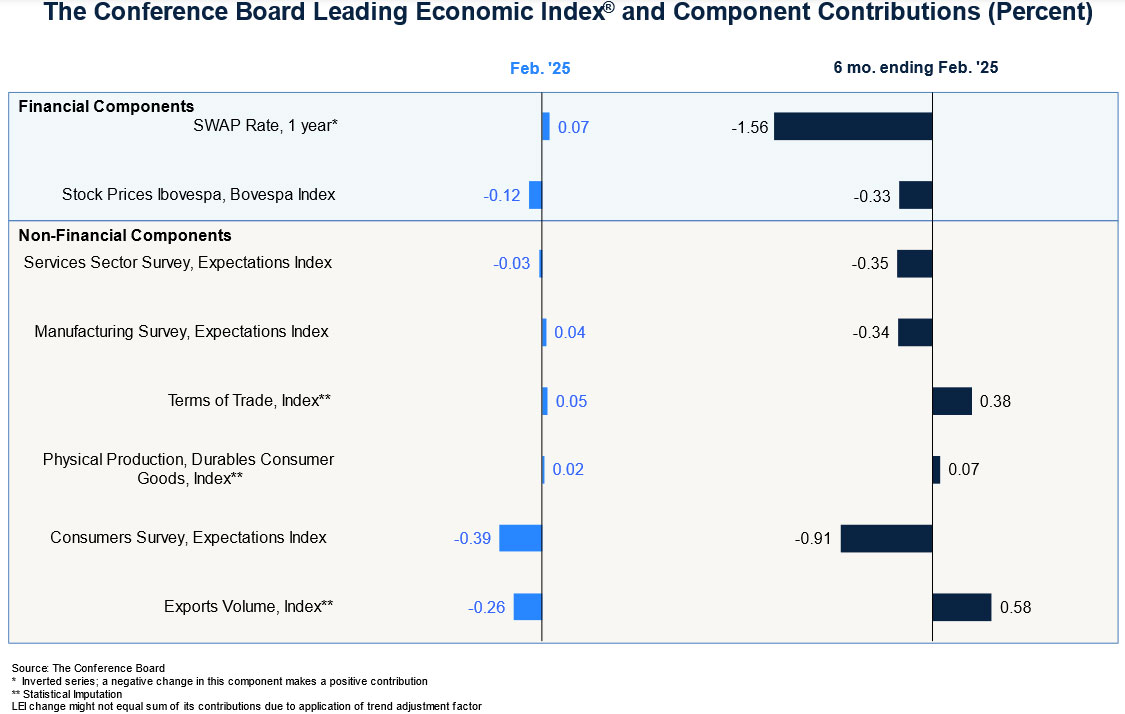

The Conference Board Leading Economic Index® (LEI) for Brazil, together with Fundação Getulio Vargas, decreased by 0.5% in February 2025 to 120.2 (2016=100), following a decline of 0.2% in January. As a result, the LEI contracted by 2.7% over the six-month period between August 2024 and February 2025, more than reversing the 0.7% expansion over the previous six-month period.

The Conference Board Coincident Economic Index® (CEI) for Brazil, together with Fundação Getulio Vargas, decreased by 0.4% in February 2024 to 113.1 (2016=100), after decreasing by 0.3% in January. Overall, the CEI contracted by 0.3% over the six-month period between August 2024 and February 2025, after expanding by 1.5% between February and August 2024.

“The Brazil LEI fell in February, marking the fourth consecutive monthly decline,” said Malala Lin, Economic Research Associate at The Conference Board. “The weakness was driven by negative contributions from consumer expectations, as in previous months, but also export volume and stock prices. As a result, the six-month and annual growth rates of the LEI remained negative and continued to point to recession risks. Moreover, the latest Central Bank of Brazil (BCB) Focus Survey indicated that financial markets’ inflation expectations are still rising, suggesting persistent concerns despite the BCB tighter monetary stance. Economic activity cooled in the last quarter of 2024 and expanded only by 0.7% (annualized rate). Overall, The Conference Board forecasts real GPD to slow down to 1.7% in 2025 after 2.9% in 2024.”

The next release is scheduled for Tuesday, April 15, 2025 at 10 A.M. ET.

About The Conference Board Leading Economic Index® (LEI) and Coincident Economic Index® (CEI) for Brazil

The composite economic indexes are key elements in an analytic system designed to signal peaks and troughs in the business cycle. Comprised of multiple independent indicators, the indexes are constructed to summarize and reveal common turning points in the economy in a clearer and more convincing manner than any individual component.

The CEI reflects current economic conditions and is highly correlated with real GDP. The LEI is a predictive tool that anticipates—or “leads”—turning points in the business cycle by around seven months.

The seven components of Leading Economic Index® for Brazil are:

The six components of the Coincident Economic Index® for Brazil are:

To access data, please visit: https://data-central.conference-board.org

About The Conference Board

The Conference Board is the member-driven think tank that delivers Trusted Insights for What’s Ahead®. Founded in 1916, we are a non-partisan, not-for-profit entity holding 501 (c) (3) tax-exempt status in the United States. ConferenceBoard.org

ABOUT FGV IBRE

Created in 1944, FGV is a Brazilian private higher education institution, think tank and producer of statistics, with a mission "to foster Brazil’s socioeconomic development." The Brazilian Institute of Economics (IBRE) is FGV’s arm with the mission to produce and disseminate high-quality economic statistics and studies that are relevant to improve policies and private action in Brazil. www.fgv.br/ibre

With graph and summary table

March 14, 2025

PRESS RELEASE

The LEI for Germany Increased in February

April 11, 2025

PRESS RELEASE

LEI for South Korea increased in February

April 10, 2025

PRESS RELEASE

LEI for Spain Rose in February

April 10, 2025

PRESS RELEASE

LEI for Japan Unchanged in February

April 09, 2025

PRESS RELEASE

LEI for the Global Economy Decreased in January and February

March 27, 2025

PRESS RELEASE

LEI for China Decreased in February

March 26, 2025

All release times displayed are Eastern Time

Charts

Recession and growth trackers are analytical tools to visualize where the economy is and where it is headed.

LEARN MORE

Business & Economics Portfolio

March 31, 2025 | Database

The Economy Stabilized in August but Outlook Remains Weak

September 27, 2023 | Report

China's Economic Recovery Continues to Stutter (Economy Watch: China View, June 2023)

June 30, 2023 | Report

Leading Economic Indicators and the Oncoming Recession

December 07, 2022 | Report

The Evolving Economic Outlook for Europe

July 10, 2024 11:00 AM ET (New York)

Is a Global Recession on the Horizon?

July 13, 2022 11:00 AM ET (New York)