REPowerEU: Implications for Corporate Climate Commitments

Insights for What's Ahead

- The Ukraine war will keep energy prices high but will not affect European efforts to reduce emissions. While a few countries, including Germany and Austria, are reverting to coal to navigate the immediate energy crisis caused by Russia’s cutting gas supply, they have also reiterated that this is a temporary measure. Germany, for example, will still aim to close its coal power plants by 2030. European business leaders expect to move full steam ahead with their climate commitments and perceive this challenge as an opportunity to accelerate efforts toward reducing emissions and investing in greener solutions. Accelerating decarbonization in core operations and along the value chain can help companies mitigate climate risks and build resilience.

- REPowerEU—the European Commission plan to rapidly reduce dependence on Russian fossil fuels and fast forward the green transition—does not address short-term transition issues. Businesses, especially in the energy-intensive industries that account for 11 percent of Euro Area value added in manufacturing, face an urgent need for action. They need to act now to minimize the impact on operational expenditure as well as accelerate decarbonization plans to mitigate high energy costs in the mid to long term.

- REPowerEU has put energy conservation and behavioral interventions in the spotlight again. Businesses should consider energy efficiency as part of their climate plans. Energy efficiency measures can reduce business energy costs and can contribute toward future-proofing against volatile energy markets.

|

What is REPowerEU? REPowerEU is the plan charted by the European Commission to help countries navigate through the energy crisis brought about in Europe by Russia’s invasion of Ukraine and the subsequent sanctions. The plan focuses on both reducing European dependence on Russian fossil fuels and achieving climate change targets. Key aims of the plan include “energy savings, diversification of energy supplies, and accelerated rollout of renewable energy to replace fossil fuels in homes, industry, and power generation.” The commission will amend the Recovery and Resilience Facility regulation to add relevant provisions to member states’ existing recovery and resilience plans. |

War in Ukraine Will Keep Energy Prices High but Will Not Affect EU Efforts to Cut GHG Emissions

Energy price increases triggered by the war in Ukraine have already negatively affected European businesses and consumers. Euro Area inflation in May was the highest it has been since 2001, largely caused by soaring energy prices, and business leaders do not expect energy prices to come down anytime soon.

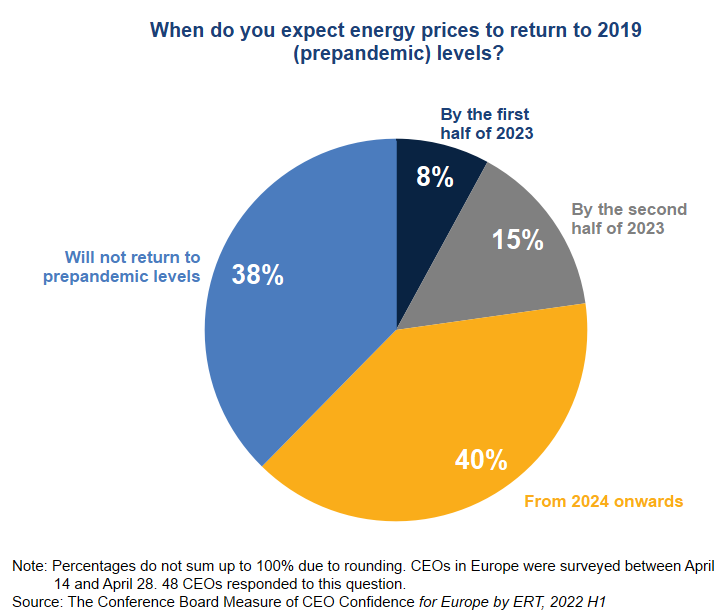

Forty percent of CEOs and chairs of leading European companies surveyed in the second half of April 2022 for The Conference Board Measure of CEO ConfidenceTM for Europe by ERT expect energy prices to return to prepandemic levels by 2024 or later. More than a third (38 percent) do not expect this to occur at all. Only 23 percent expect a return to prepandemic levels sometime in 2023. No respondents believe it will occur in the second half of 2022.

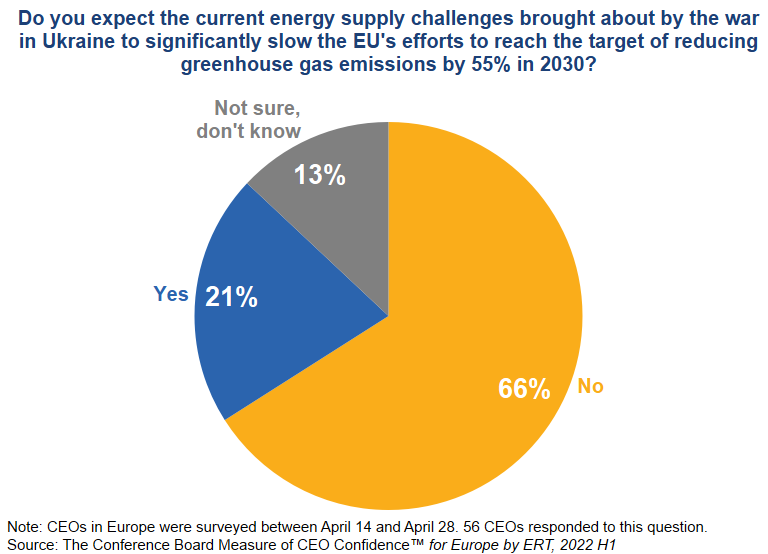

While energy prices may remain inflated for some time to come, this does not seem to affect Europe’s climate ambitions. Most business leaders see the current energy supply challenges as an opportunity to accelerate efforts toward reducing or even eliminating dependence on Russian fossil fuels and to invest in greener solutions. These actions may help achieve the EU’s objective of reducing greenhouse gas emissions (GHG) by 55 percent by 2030. In fact, two-thirds (66 percent) of respondents say that the current energy crisis will not significantly slow Europe’s efforts toward this objective.

Ramping Up Renewables

In the early days after the Russian invasion of Ukraine, it was not clear what impact the war might have on corporate climate action. As weeks went by, a certain alignment between government and corporate ambitions emerged.

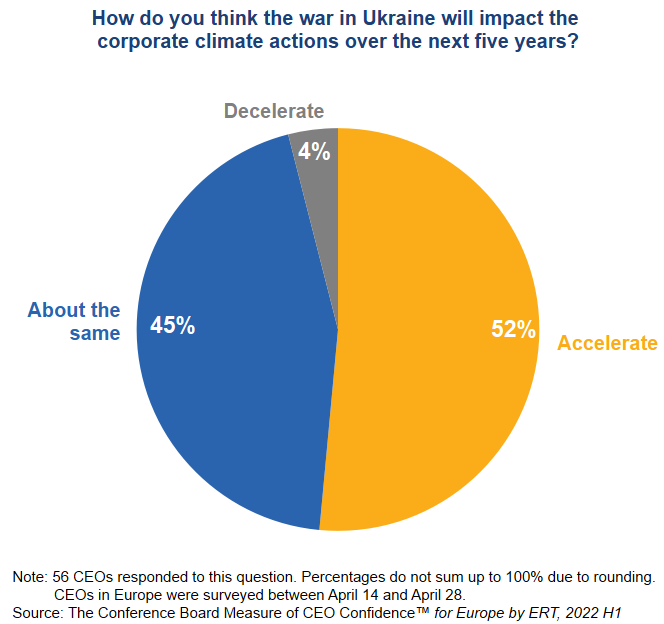

Despite challenges associated with the current energy crisis, 52 percent of European CEOs say corporate climate actions are likely to accelerate in the next five years as a result of the war in Ukraine. Forty-five percent expect to proceed at the same pace, and only 4 percent expect a deceleration.

While net zero remains the ultimate goal, there might be uncertainty around specific climate policies, action plan, and targets. Scenario-planning exercises can help companies understand and analyze their risk exposure. The insights gained can help inform strategies to mitigate risks and find opportunities.

REPowerEU: affordable, secure, and sustainable energy

On June 3, 2022, the European Council agreed on an embargo of oil from Russia by the end of 2023. The decision, part of the sixth package of EU sanctions, came shortly after the release of REPowerEU, a plan by the European Commission to rapidly reduce dependence on Russian fossil fuels and fast forward the green transition.

The plan focuses on five elements: 1) energy savings, 2) diversification of energy supplies, 3) accelerated rollout of renewables, 4) reduced fossil fuel consumption in industry and transport, and 5) smart investment. Most elements of REPowerEU have a mid- to long-term horizon; the plan will affect businesses across all sectors, and new legislation can be expected.

While the commission acknowledges the potential role of nuclear power during the transition, its emphasis is on energy from renewable sources (e.g., wind, solar). The commission has proposed increasing the existing target of 40 percent of EU energy from renewable sources by 2030 to 45 percent. The Declaration of Energy Ministers on the North Sea as a Green Power Plant in Europe is an example of how various EU member states are coming together to contribute to both EU climate neutrality and energy security.

In addition to promoting wind sources and doubling the use of hydrogen,1 the commission also outlined plans to more than double solar power capacity to 320 gigawatts (GW) by 2025 and 600GW of capacity by 2030. Specific initiatives include introducing a legally binding obligation for new public, commercial, and residential buildings to install rooftop solar photovoltaics. A detailed implementation plan remains to be seen, however, as increasing the share of renewables in power generation entails various technical challenges that have not yet been adequately addressed.

REPowerEU also includes plans to curb emissions in transport, primarily through supporting and incentivizing electric and alternative fuel vehicles. Further regulation is expected in this area to target freight transport. While the role of energy storage is quite widely acknowledged in the energy transition, there is little mention of it in the REPowerEU plan.

Pain of Abandoning Fossil Fuels Is Not Equally Distributed Across Industries in the Short Term

REPowerEU sets goals and initiatives for the longer term without specifically addressing the short-term pain of accelerating the transition.

Academic research indicates that, both in the power sector and in nonenergy industries, energy coming from fossil fuels can be substituted with electricity coming from renewables if prices for renewables drop far enough to make this transition feasible. However, the pain of accelerating the transition away from fossil fuels is not equally distributed across sectors.

Currently, technology processes that require very high temperatures (>1000oC)—such as melting glass in a furnace and calcination of limestone for cement production—cannot benefit from renewable energy (through electrification) and need fossil fuels to continue producing. For processes that require low- to high-temperature heat (<1000oC), there are already commercially available technologies to be electrified, but while efficiency varies by sector, fossil fuel–based technologies are more cost effective. Moreover, even if all technically feasible industrial processes were electrified today, the EU would still be highly dependent on natural gas imports. Power and heat is the sector most dependent by far on natural gas, 90 percent of which is imported from outside the EU; petrochemicals, chemicals, paper, minerals, and metals are also highly dependent on foreign natural gas. The electrification of industrial processes would increase demand in the power and heat sector; this demand would have to be covered by increases in natural gas or oil consumption.

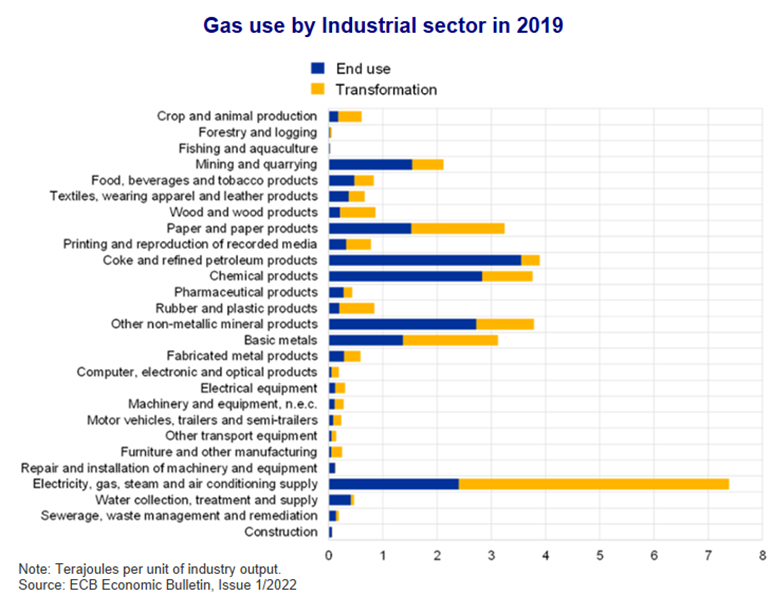

Data on gas use by sector show different energy intensity—measured as terajoules per unit of industry output—in different sectors. Energy can be used for transformation (yellow bars in Figure 4) or consumption (blue bars). Besides the energy sector itself, the most important users of gas in the Euro Area are producers of chemicals, basic metals, nonmetallic minerals (glass, cement, ceramics), paper products, and the mining sector. These five sectors account for more than 11 percent of total value added in manufacturing in the Euro Area.2 The ban on oil and a potential future ban on natural gas imports from Russia is expected to hit these sectors hard as they are too reliant on oil and/or natural gas. This has prompted several EU member countries (e.g., the Czech Republic, Bulgaria, Romania, Italy, and Germany) to proclaim that they might burn more coal in the short term.

For now, European countries are undeniably facing a supply issue with the Russian embargo. Companies should not shift focus from their ultimate goals; however, they may relax their short-term climate goals while acceleration of technology development continues. The key to achieving energy targets along with tackling the immediate crisis is a well-planned and executed transition.

Businesses Should Address Energy Efficiency

While most elements of REPowerEU have a mid- to long-term horizon, energy efficiency and savings can have an immediate impact. Since the start of the Russian invasion of Ukraine on February 24, political leaders have been reluctant to refer to the need to adjust consumption as a meaningful tool to reduce dependence on imports.

Companies should use this opportunity to:

- Sensitize the board and shareholders that energy efficiency is the need of the hour and must be urgently addressed;

- Develop ambitious policies and campaigns and take active steps to implement them to lead by example;

- Without further delay, revisit their energy management strategies and invest in energy-efficient equipment; and

- Encourage and enable their employees and other relevant stakeholders to contribute toward saving energy in the workplace and their homes.

The effort is worth it not only for energy security purposes, but also to alleviate the financial impact of high energy prices. The potential savings in gas and oil demand coming from behavioral changes is in the range of 5 percent for each fuel. At current fuel prices (USD 121 per barrel of crude oil on June 14 and 84.6 euros per megawatt hour for natural gas), a shift in behavior can lead to 25 billion euros in savings.

Companies have a vital role to play in building a low-carbon and climate-resilient economy. Those that proactively take concerted climate action will be better prepared to navigate the changing environment and build a competitive advantage for their organizations.

[1] The EU, as part of REPowerEU, has proposed a strategy to double the previous green hydrogen target to 10 million tons. This would require an install electrolyser capacity of 90–100 GW (measured in terms of hydrogen output). The current capacity of electrolyser manufacturers in Europe is estimated at 1.75 GW.

[2] Data refer to 2019. Due to data availability, Malta, Luxembourg, and Ireland are excluded from the calculation.