The Global Economic Fallout of the Ukraine Invasion

March 08, 2022 | Chart

A remote risk to the global economic outlook has now become reality: Russia has invaded its neighbor Ukraine. The response of countries and multi-national businesses to Russia’s aggression has been swift in the form of sanctions, divestment, and halting of business activities. While the tragic loss of life has been limited to within Ukraine, the broader economic fallout will have implications around the world.

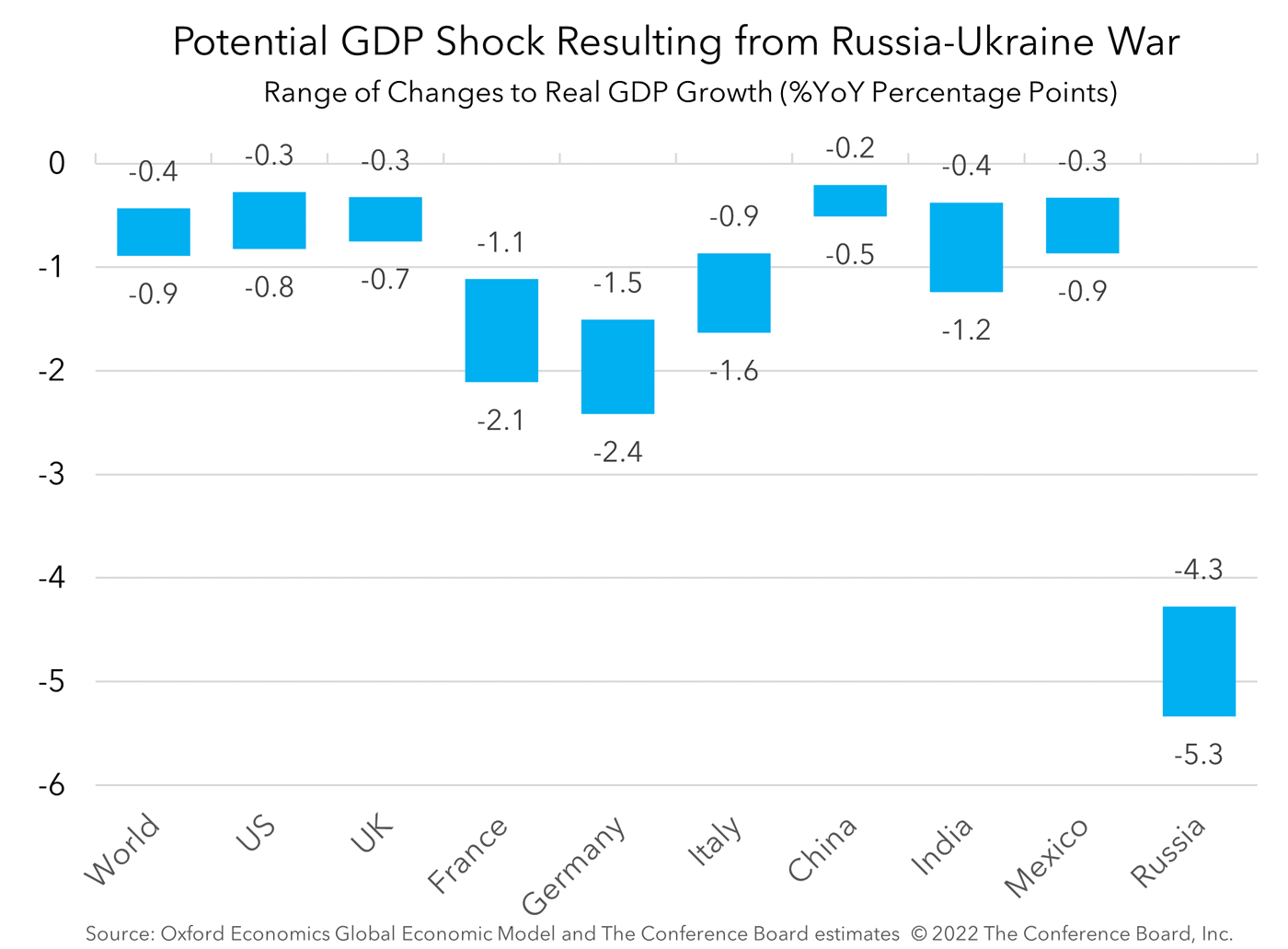

Five simultaneous shocks to the global economy from the Russia-Ukraine conflict could notably curb prospects for GDP growth. The shocks include sudden, and potentially sustained, spikes in 1) energy prices, 2) food commodity prices, and 3) metals prices; 4) recessions in both Russia and the Ukraine; and 5) intensification of existing bottlenecks in global supply chains for intermediate goods. While the severity of these shocks are presently unknowable, The Conference Board has generated three possible scenarios for what may lie ahead.

Scenario 1 includes oil prices averaging US$105 per barrel in Q2 2022 before gradually falling; Scenario 2 includes oil prices averaging US$125 per barrel in Q2 2022 before gradually falling; and Scenario 3 includes oil prices averaging US$150 per barrel in Q2 2022 before gradually falling. All three scenarios result in headwinds to global economic growth in 2022 that range from -0.4 percentage points to -0.9 percentage points. However, these potential drags on economic growth vary from country to country.

For more information about the business implications of Russia’s invasion of Ukraine, please visit our website.