What if Oil Hits US$200 per Barrel?

March 25, 2022 | Report

Mapping the Potential Causes and Implications of a Rise to US$200 Oil Around the World

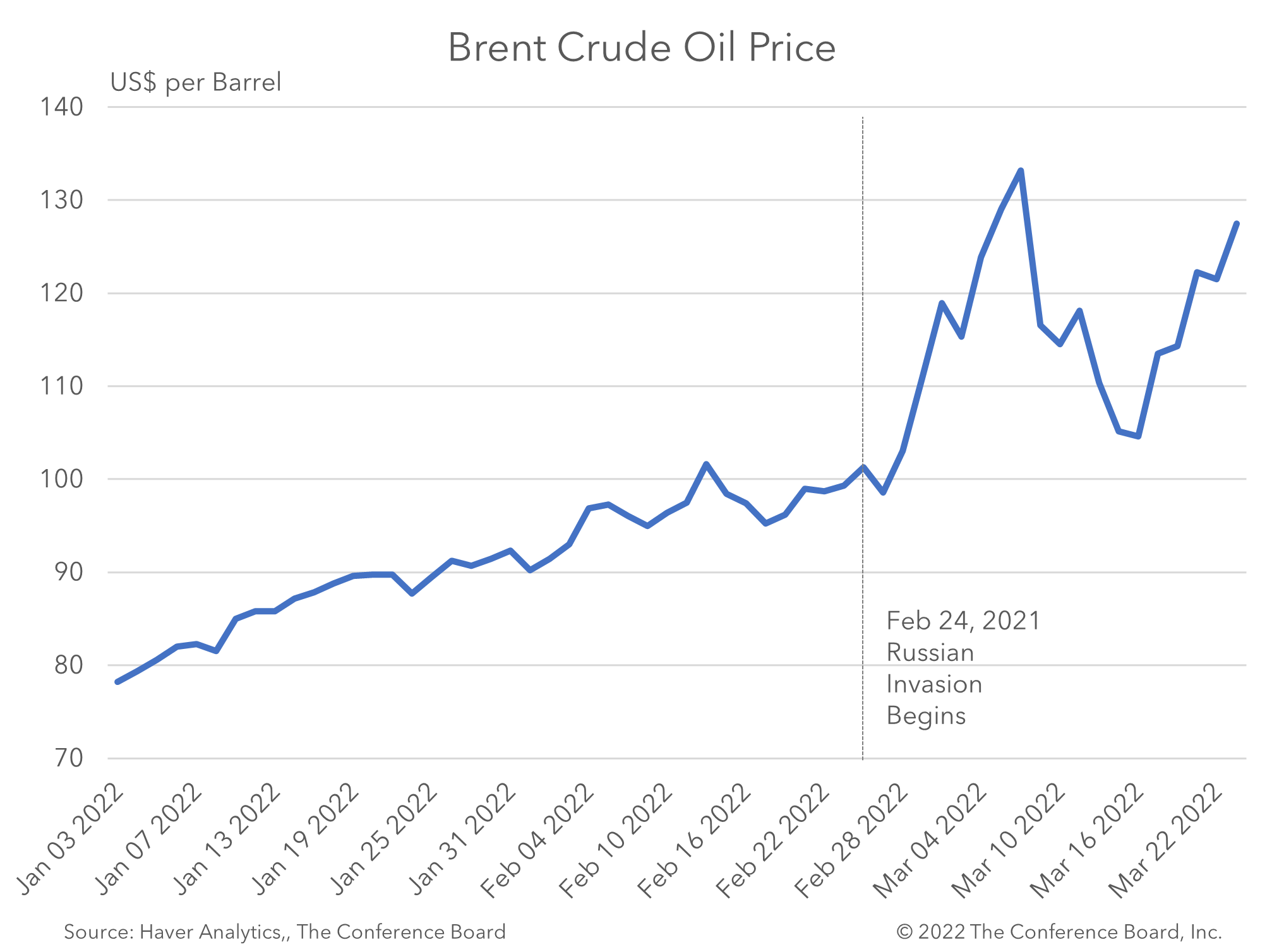

The prospect of Brent crude oil prices rising to US$200 per barrel may not be as remote as it sounds. What could cause such a spike and what are the implications? Major disruptions to Russia’s oil production and exports could result in prices at this height–even if other countries try to step in to offset the shortage. The economic implications of US$200 oil are severe and include widespread inflation and slower economic growth around the world.

According to a scenario developed and modeled by The Conference Board, the economic implications of US$200 oil are acute. Inflation would spike around the world and economic growth would slow. Already high inflation rates in places like the United States and the Eurozone would rise even higher. While no global recession would likely result, economic downturns would be more severe in some economies than others.

AUTHORS

-

Complimentary.