- The key social issues that are top of mind for investors and companies;

- What investors expect companies to do—and the tools they may use;

- How companies are approaching these key social issues—and what else they can do;

- The implications of the 2020 upheaval for executive compensation; and

- How shareholders and companies can constructively engage on social issues in the long run.

The report provides a snapshot in time and is not intended to be exhaustive or comprehensive. It doesn’t reflect the views of all categories of investors (for example, we have not consulted hedge fund activists).

But the report’s findings and insights should help investors and corporations navigate their evolving roles in society in a time of significant uncertainty. Unlike prior crises from Enron to the global financial crisis of 2008, which pitted investors and corporations against each other and resulted in significant new government regulation, the upheaval of 2020 provides an opportunity for a different narrative: one in which investors and corporations work collaboratively to address key social challenges. The private sector cannot solve these issues on its own, but as this report outlines, this is an opportunity for constructive engagement and meaningful progress.

Insights for what’s ahead

The key social issues

- There is a broad consensus among investors and companies on the key issues facing the business community in light of the health, economic, and racial upheaval of 2020. As we head into 2021, expect an acute focus by investors on human capital (i.e., workforce) issues–which is set at the nexus of these health, economic, and racial crises.

Investors’ views and tools for change

- Major institutional investors are looking for boards and management to be in the driver’s seat when it comes to developing, implementing, and communicating their plans to address social issues—and will afford companies latitude in doing so.

- But there are some baseline expectations: Investors expect companies to disclose more on racial diversity in the board room and throughout the entire organization; they expect boards to be engaged on these topics; and they will evaluate company actions through a lens of stakeholders, so boards should be particularly alert to decisions that may appear to advantage or disadvantage one stakeholder group over another.

- If dissatisfied, major institutional shareholders are likely to make their views known in ways that go beyond votes on shareholder proposals and play out in director elections and, for active funds, capital allocation.

Corporate responses

- While many companies issued statements on COVID-19 and racial inequality in the “heat of the moment” earlier this year, companies should prepare for more comprehensive and detailed disclosures that address the full scope of their actions in their year-end reports.

- Companies should lean toward transparency: If companies don’t identify their own shortcomings, someone else will. Investors don’t expect perfection. But they do want companies to identify gaps and disclose plans for closing them.

Implications for executive compensation

- Investors are not expecting a major reset on executive compensation, and they understand the pressures that companies are under to continue to appropriately motivate and reward performance by executives.

- But to avoid negative say-on-pay votes, votes against compensation committee members, and an erosion of confidence among investors, compensation committees should: 1) make decisions with broader stakeholders in mind; 2) avoid making adjustments to 2020 bonus targets that increase payouts beyond the formula; and 3) ensure that any adjustments to “in flight” long-term compensation programs, or future long-term programs, keep compensation “at risk” and reward relative outperformance.

- Companies should give careful consideration to incorporating ESG goals into long-term incentive plans, not just annual bonus plans. In doing so, they should be mindful of the potential accounting and disclosure issues. Importantly, to address investors’ concerns that incorporating ESG metrics may provide compensation committees with too much discretion, companies should have significant engagement before deciding whether and how to incorporate such metrics.

Shareholder engagement on social issues

- Investors and boards will be asking the same questions of management on social issues, so management should be prepared to have in-depth, candid discussions with each.

- Companies should be prepared to break new ground in discussing issues of economic fairness. Many companies have an untold story to tell about how their business–and philanthropy–helps to broaden the circle of economic opportunity. Companies should marshal the data to tell their story of how they are making a measurable difference.

Key social issues

Consensus that social issues have shifted during 2020

Coming into 2020, the social issues that were receiving significant attention from investors and companies included board gender diversity; workforce gender pay equity; human rights; supply chain issues; and political contributions.[1]

Investors and corporations agree that the events of 2020 have shifted the focus, however, to emphasize:

- Health and safety of workers, customers, communities

- Economic security and inequality

- Racial equality and justice

- Intersection of social and environmental issues

Broad consensus on key current issues–with particular emphasis on human capital, racial equality

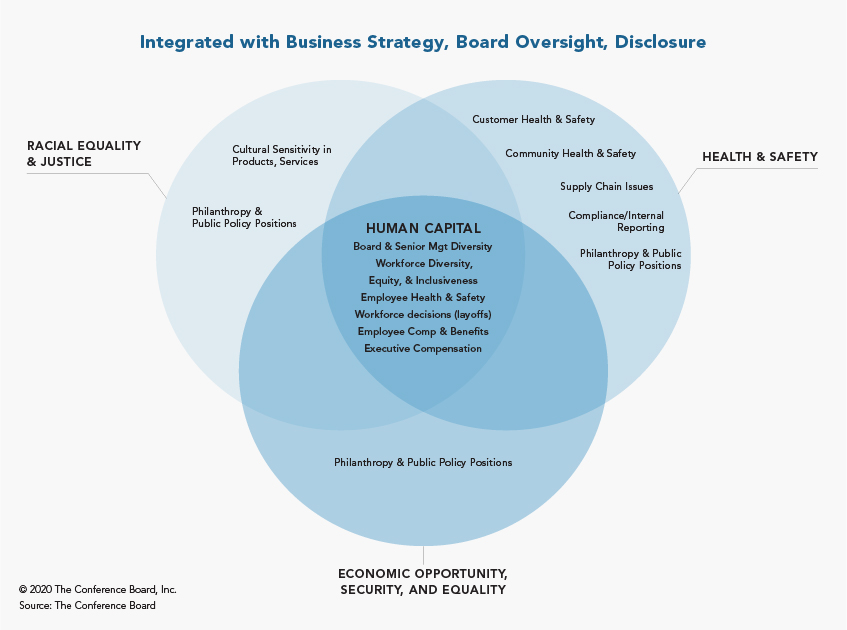

Based on their public statements, as well as direct input, there seems to be a consensus among investors and companies as to the key current social issues presented below:

Two areas of particular emphasis for investors:

- As shown above, several of these issues fall under the heading of “human capital management,” which is a lens through which investors assess companies’ efforts.

- Institutional investors are hearing from their clients about the need to address racial inequality.

Investors’ approach to key social issues

Investor expectations of companies (and themselves) are increasing, but most are taking a measured approach

As in most areas, investors are not monolithic in their approaches to 2020 social issues: Some currently appear to rely on existing policies, while others have issued policies and statements tailored to 2020 social issues.[2] There are, however, some common themes:

- Investors want companies to articulate: their strategies for addressing social issues (including drawing connections to their business), the board’s role; key goals; and progress toward those goals.

- Investors are looking for both qualitative and quantitative disclosure that allows them to have appropriate discussions and make baseline assessments.

- Investors, however, are not looking for perfection at this point.

- They want companies to disclose their strategy and goals, even if the data are not yet robust.

- They also realize that this is a journey–there will be gaps.

- Investors have set forth their expectations in varying degrees of detail:

- Racial and ethnic diversity–investors tend to have the most detailed policies.

- Health–investors are approaching these issues through HCM and external impacts on public health.

- Economic opportunity, security and equality–investors have the least detailed policies and expectations.

- With respect to racial equality, investors are looking for:

- More specific disclosure on the ethnic diversity of the board (in addition to gender diversity). For some investors, aggregate disclosure may be sufficient, but others will be looking for disclosure at the individual director level so that they can assess diversity in leadership positions and key committees.

- Investors recognize that disclosure can be challenging as some directors do not prefer to self-identify in terms of their ethnicity and that the EEO-1 data do not reflect the full range of diversity.

- With respect to economic fairness, and the COVID-19 pandemic, investors are not prescriptive:

- Understand that the pandemic is requiring many companies and even industries to focus on survival right now but do not want companies to lose track of their long-term goals.

- View topics such as employee layoffs, customer price increases, and executive compensation through the lens of stakeholder governance – and whether companies are disproportionally disadvantaging one group of their stakeholders (e.g., employees or customers) in a way that undermines the long-term prospects of the company.

- The frameworks that investors have issued with respect to racial equality (e.g., State Street’s guidance on racial and ethnic diversity[3]) can be applied to other social issues as well.

Investor tools to drive change

Generally speaking, investors are not looking to be in the driver’s seat when it comes to addressing social issues; they want boards to be. Having said that, investors will use a variety of tools to understand what companies are doing and to drive change where they believe it is needed in the long-term interests of the company.

In light of the SEC’s amendments to the rules governing shareholder proposals, such proposals may become less important for large institutional investors to express their views. Institutional investors may therefore be quicker to use their role in director elections, as they did with gender diversity on boards. (See, e.g., Russell Reynolds Associates’ memo regarding investors’ push for more gender-diverse boards.[4])

In the meantime, institutional investors will be focusing on:

- Requests for disclosure

- Engagement with companies

- Their own internal policies regarding proxy voting and capital allocation

Investors may well use frameworks developed in other contexts to inform their analysis of other social issues. Two examples are the “human rights risk assessment” framework used in prior shareholder proposals and State Street’s recently announced framework for addressing racial equality.[5]

How corporations are addressing key social issues

Corporate approaches to key social issues of 2020

Companies have several tools to address social issues:

- Workforce and workplace policies and practices

- How they conduct their core business activities in the marketplace

- Their positions on public policy issues and engagement with public officials, including law enforcement

- Their public statements

- Their corporate philanthropic efforts

To date, corporate public statements have focused largely on what they are doing within their companies (e.g., workforce health, diversity and inclusion) and their philanthropic efforts with communities. The statements relating to racial equality and health have tended to be the most specific, those relating to economic issues less detailed. (See Appendix for an illustrative list).

Look for this to change:

- Expect more comprehensive and detailed information as companies prepare their year-end reports and SEC filings. In addition, companies have continued to implement more detailed efforts to address racial equality than those originally outlined–so they have more to say.

- Over time, look for more disclosures tied to the company’s business strategy, especially as it relates to economic opportunity, security, and fairness. This is an area where companies have not traditionally emphasized their role–providing jobs has often been taken as a given. But it is the area where companies can have the greatest impact.

There is also an opportunity for a deeper dialogue between investors and companies when it comes to corporate philanthropy. On the one hand, mainstream institutional investors generally support corporate efforts to address social issues in a way that is in the long-term interests of the corporation and society (thereby reducing risks for all). On the other hand, investors generally do not have the information needed to assess the effectiveness of corporate philanthropy and are therefore often more concerned about reputational risk associated with corporate citizenship efforts that backfire. As companies invest more funds in addressing social issues, they would be well served to increase their use of benchmarking data to evaluate (and report on) the effectiveness and efficiency of their efforts.[6]

Implications for executive compensation

The events of 2020 also have implications for executive compensation—not only because the COVID-19 pandemic has upended many businesses and rendered some compensation plans irrelevant to varying degrees, but also because executive compensation itself is a topic being viewed through the lens of the events of 2020.

Despite the upheavals of 2020, investors are not expecting a major overhaul of executive compensation. It looked as if that was possible when the economy went into recession and stocks dropped earlier this year. However, the stock market rebounded and not all companies are being hurt.

But compensation committees should be aware that the events of 2020 are having an impact on how investors are viewing executive compensation. Here are some key takeaways:

2020 annual bonuses:

- Investors are not looking for major adjustments to results when determining bonuses; unlike the 2017 tax cut, the impact of the pandemic is harder to back out from financial results.

- Outperformers are not likely to be punished for recognizing performance, as long as it’s not out of alignment with what happened with other stakeholders (e.g., employees).

- However, investors do expect that those companies that were hit hard by the crises will see that reflected in bonuses, especially if the workforce has suffered (in terms of layoffs, furloughs, salary cuts).

Long-term incentive compensation plans currently in place:

- Both investors and companies are in the process of grappling with making adjustments to in flight long-term incentive plans—those that cover 2018-20, 2019-21, and 2020-22.

- Mainstream investors understand why companies might want to make adjustments to those plans. But it is critical for companies to ensure that compensation is still “at risk,” relative, and performance based. If a company modifies the goals for in-flight programs—in a way that makes it likely that the award (which was unlikely to be earned) is now likely to be earned, or earned at a higher level—the company will incur additional accounting expense and be required to make additional disclosure.[7]

2021 equity grants:

- If companies based their equity grants in early 2020 on delivering an estimated dollar value, they may have provided “outsized” equity grants to executives when stock prices were depressed. Investors don’t want to see a repeat of the windfall equity grants made in early 2009, so compensation committees should consider looking at 2021 equity grants in the context of what they granted in 2020.

Future long-term incentive compensation plans:

- Investors also understand how difficult it may be to set targets for the 2021-23 long-term incentive compensation programs when companies don’t know what operating or financial metrics to aim at.

- Investors will object, however, if companies simply shift to using time-vested restricted stock units. While investors acknowledge the problems with performance-share units, they will want companies to find some operating, financial, or stock performance metrics that continue to reward relative out-performance—total shareholder return relative to a peer group remains an option.

Say-on-pay votes in 2021:

- Companies don’t necessarily have to fear worse outcomes in their say-on-pay votes in 2021, but there are clearly more places where companies might run afoul of investors, so it’s key for companies to engage with their shareholders.

- Compensation committees needed to make decisions regarding executive compensation at the outset of 2020 regardless of the impact on 2020 say-on-pay votes, but going forward they would be well advised to take say-on-pay vote prospects (and results) into account, because it could otherwise result in increases in opposition to the reelection of compensation committee members and undermine their relationship with investors.

Use of ESG factors:

- We may see increased use of ESG factors in compensation plans in the future, not just in annual incentive plans, but also in long-term incentive programs. From investors’ standpoint, these ESG factors still need to be tied to something that’s measurable. Further, companies that are considering building ESG factors into their future long-term incentive plans should carefully consider potential accounting and disclosure issues associated with doing so, and engage in dialogue with their investors who may be skeptical of making changes that afford compensation committees more discretion.

Shareholder engagement on social issues

There is a consensus on the ten key questions both boards and investors alike should be asking with respect to social issues:

- How does the company’s business relate to the underlying social issue?

- What can the company do that has an impact on the long-term interests of its stakeholders and society?

- Does the company have a special role to play?

- What is the company’s overall strategy for addressing the social issue (and how are key social issues incorporated into the company’s long-term business strategy)?

- What are the company’s goals with respect to the social issue?

- How does the company intend to track and report progress?

- What is the board’s role?

- What, if anything, has changed in the company’s approach?

- What has the company learned?

- How does the company intend to continue learning and responding?

Conclusion

Unlike prior crises of the past few decades, there is no group of “corporate bad actors” who can be held responsible for the multiple crises of 2020. This provides the opportunity for a different playbook. Investors and corporations have an opportunity—perhaps even an obligation—to find common ground in addressing key social issues under the broad framework of serving the long-term interests of stakeholders and society.

Appendix

Examples of corporate initiatives to address racial equality and justice based on public statements

- Board and Senior Management Diversity

- Committing to adding people of color to executive ranks

- Workforce Diversity and Equity

- Developing global inclusion strategy for employees

- Enhancing hiring and talent development practices to create opportunities at all levels for people of color

- Mentoring, sponsorship, development, and advancement of diverse employees

- Expanding recruitment efforts at and increasing scholarships for historically black colleges and universities

- Creating task forces on race, including bringing in outside experts

- Workplace Inclusiveness

- Implementing mandatory and companywide bias training and corporate culture programs, with a focus on promoting inclusion

- Related Philanthropy & Public Policy Positions

- Partnering with and donating to civil rights and social justice organizations that promote inclusion and racial justice

- Supporting communities of color through donations and inclusive investments

- Supporting employee community engagement through paid volunteer days and matching employee donations to organizations that promote racial justice

- Promoting Diversity in Supply Chain

- Expanding programs for diverse suppliers

Examples of corporate initiatives to address health & safety in COVID-19 area

- Related Philanthropy & Public Policy Positions

- Increasing investments and philanthropic support to bring vital resources to most affected communities (donation of medical gear; food insecurity investments; education and awareness campaign aimed at closing the gap on misinformation and lack of information in minority communities; support for health care workers; virus testing)

- Employee/Workplace Health & Safety

- Improving workplace safety during the COVID-19 pandemic (temperature scanning, contact tracing, and touchless printing)

- Practicing social distancing at facilities and taking additional precautions (providing hand sanitizer in facilities, separating workstations, and providing masks for frontline employees)

- Supply Chain Safety

- Taking precautions across supply chain, ensuring the continued safety of products and manufacturing locations

Examples of corporate initiatives to address economic opportunity, security, equality

- Advocating for public policy that addresses the root causes of systemic inequalities and barriers, including efforts to address socioeconomic status, education, and access to health care

- Investing to strengthen minority-owned small businesses

- Providing operating support and investment for affordable housing/neighborhood revitalization

- Giving underserved populations greater access to employment

Additional Resources

CEO Forum: Building a More Civil & Just Society

- Our CEO Forum features candid interviews with CEOs offering a combination of inspiring personal stories and concrete suggestions on how we can, individually and collectively, address inequities in our society.

Research

[1] Matteo Tonello, Proxy Voting Analytics (2016-2019), The Conference Board, December 2019; Governance Watch webcast: “Highlights from the 2020 Proxy Season,” aired July 23, 2020.

[2] “Comptroller Stringer and Three New York City Retirement Systems Call on 67 S&P 100 Companies Who Issued Supportive Statements on Racial Equality to Publicly Disclose the Composition of their Workforce by Race, Ethnicity and Gender,“ July 1, 2020; State Street Global Advisors, “Diversity Strategy, Goals & Disclosure: Our Expectations for Public Companies,” August 27, 2020.

[6] Alexander Parkinson, Data-Driven Corporate Philanthropy: The Revolutionary Potential to Change Lives, The Conference Board, forthcoming.