Feb CPI shows stubborn inflationary pressures

12 Mar. 2024 | Comments (0)

The February Consumer Price Index (CPI) showed that inflation rose 3.2% from a year earlier, vs. 3.1% in January and 6.4% at the beginning of 2023. Meanwhile, core CPI, which excludes volatile food and energy prices, rose by 3.8% in February from a year earlier, vs. 3.9% y/y in January and 5.6% y/y at the beginning of 2023.

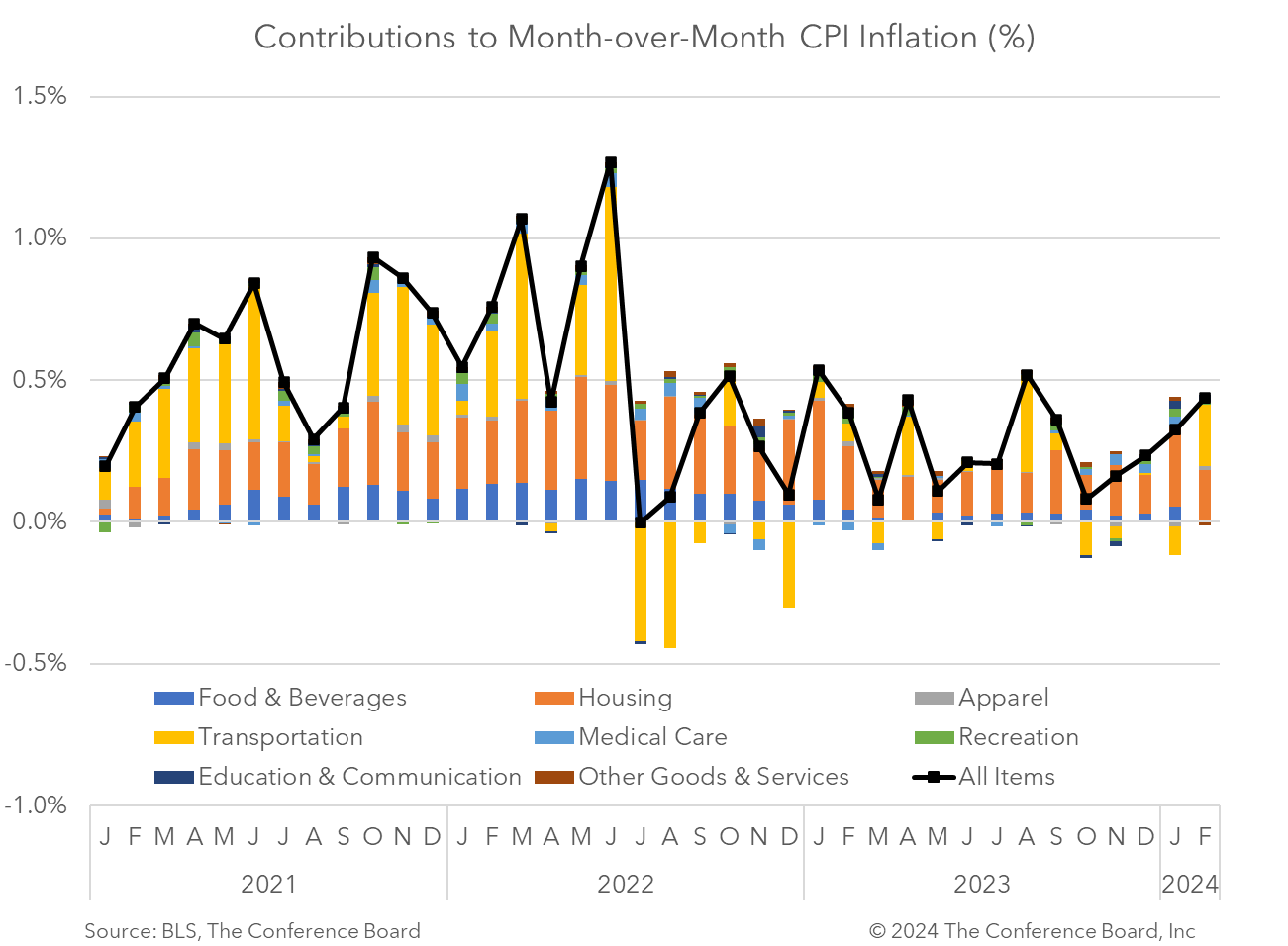

Following hotter than expected January CPI data, these February numbers continued to show pockets of stubborn inflation. Goods inflation has come down significantly from the high rates seen in 2022, but services inflation has been more problematic. While shelter prices play a large role in this story, prices for services ex-shelter are also a factor. Shelter prices, including both rent and Owners Equivalent Rent (OER) are continuing to cool in year-on-year terms, but month-on-month increases have yet to converge toward their pre-pandemic norms. Prices for services excluding shelter have been going in the wrong direction in recent months. This is likely due to labor market tightness is this sector and persistent post-pandemic demand.

Today’s data provide a preview of the PCE deflator – the Fed’s preferred measure for guiding policy – later this month. Given what the CPI signals for the PCE deflator and Fed Chair Powell’s previous statements, the Federal Reserve will likely hold rates steady at the conclusion of the March FOMC meeting. However, as inflation rates continue to slow over the next several quarters we expect the Fed to begin cutting rates starting in June.

DATA DETAILS

Headline CPI rose by 0.4% m/m and 3.2% y/y, vs. January’s 0.3% m/m and 3.1% y/y. Month-on-month shelter and energy price increases accounted for more than 60% of the all items increases, according to the Bureau of Labor Statistics (BLS). Gasoline prices rose 3.8% from the month prior. Within the shelter category, rent prices rose to 0.5% m/m, vs. 0.4% in January, but Owner Equivalent Rent (OER) price increases cooled to 0.4% m/m, vs. 0.6%. However, in year-on-year terms inflation for both of these shelter types continued to cool. Food prices were flat from January.

Core CPI rose by 0.4% m/m and 3.8% y/y, vs. January’s 0.4% m/m and 3.9% y/y. According to the BLS, the core CPI was driven by shelter, but airline fares, motor vehicle insurance, apparel, and recreation also played a role.

-

About the Author:Erik Lundh

Erik Lundh is Senior Global Economist for The Conference Board Economy, Strategy & Finance Center, where he focuses on monitoring global economic developments and overseeing the organization&rsquo…

0 Comment Comment Policy