CPI Supports September Fed Cut Narrative

14 Aug. 2024 | Comments (0)

Total and core Consumer Price Index (CPI) inflation continued to cool in July, supporting the narrative of a first Fed rate cut in September. While the Fed focuses on the Personal Consumption Expenditure (PCE) deflator, the CPI often portends the direction of the PCE inflation gauges, which will be released later this month.

Trusted Insights for What’s Ahead®

- Inflation data continue to slow consistent with the Fed’s desire to stabilize inflation at its 2-percent target.

- The CPI data bode well for the PCE inflation data, which will be released on August 30th.

- Tomorrow’s retail sales data will provide early insights into how real GDP faired at the start of Q3, but Q2 growth was robust.

- Again, we believe that the labor market is healthy and is engaging in a natural slowdown from the breakneck pace of additions in the wake of the pandemic.

- We do expect the US economy to slow notably in H2 2024, but not fall into recession.

- Given this anticipation, we believe the Fed will cut by 75 basis points by end-2024, likely 25 basis points at each the September, November, and December meetings.

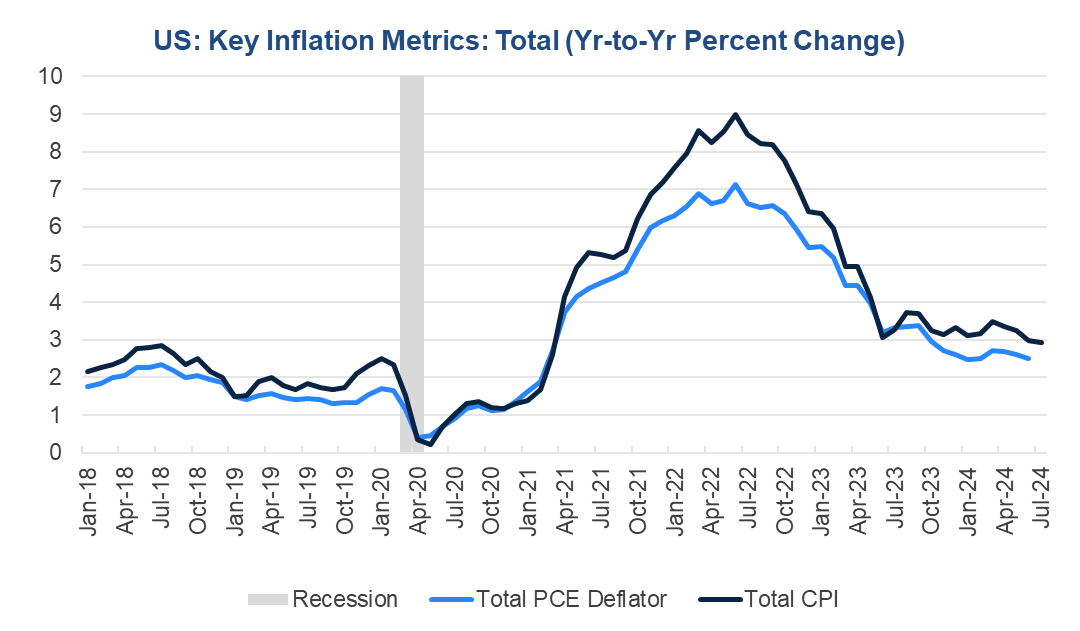

Figure 1. CPI portends slower PCE inflation in July

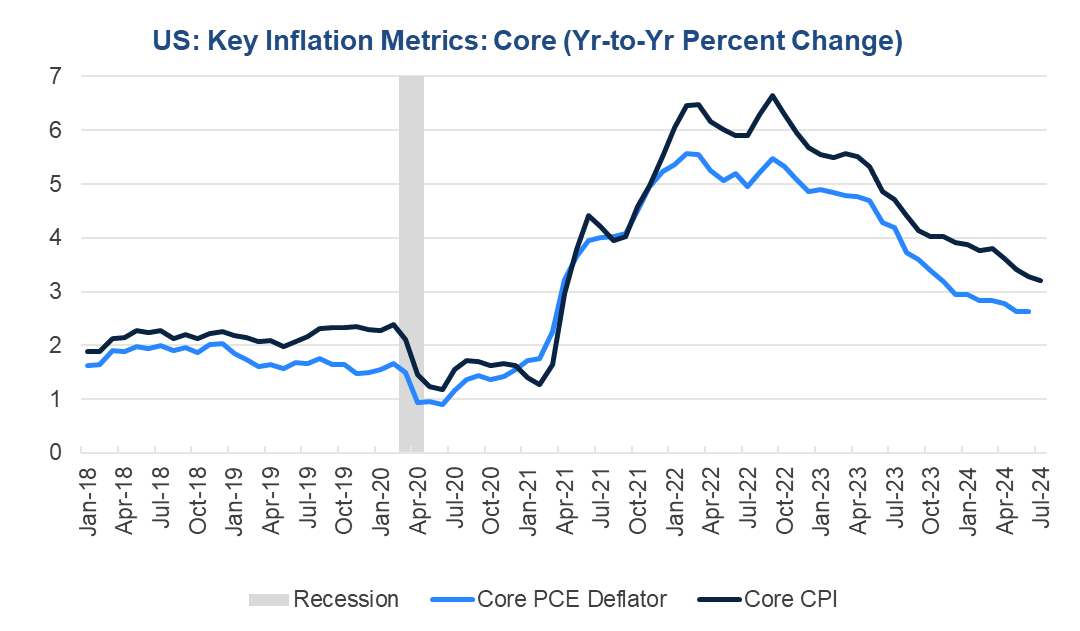

Total CPI rose by 0.2 percent month-over-month in July but slowed from 3.0 percent year-over-year to 2.9 percent. This is significantly lower than the peak of 9 percent year-over-year reached in June 2022. Meanwhile, core inflation, which is total less food and energy, also rose by 0.2 percent in the month, but slowed year-over-year from 3.3 percent to 3.2 percent.

Figure 2. Core CPI inflation cooled as well, portending slower core PCE inflation

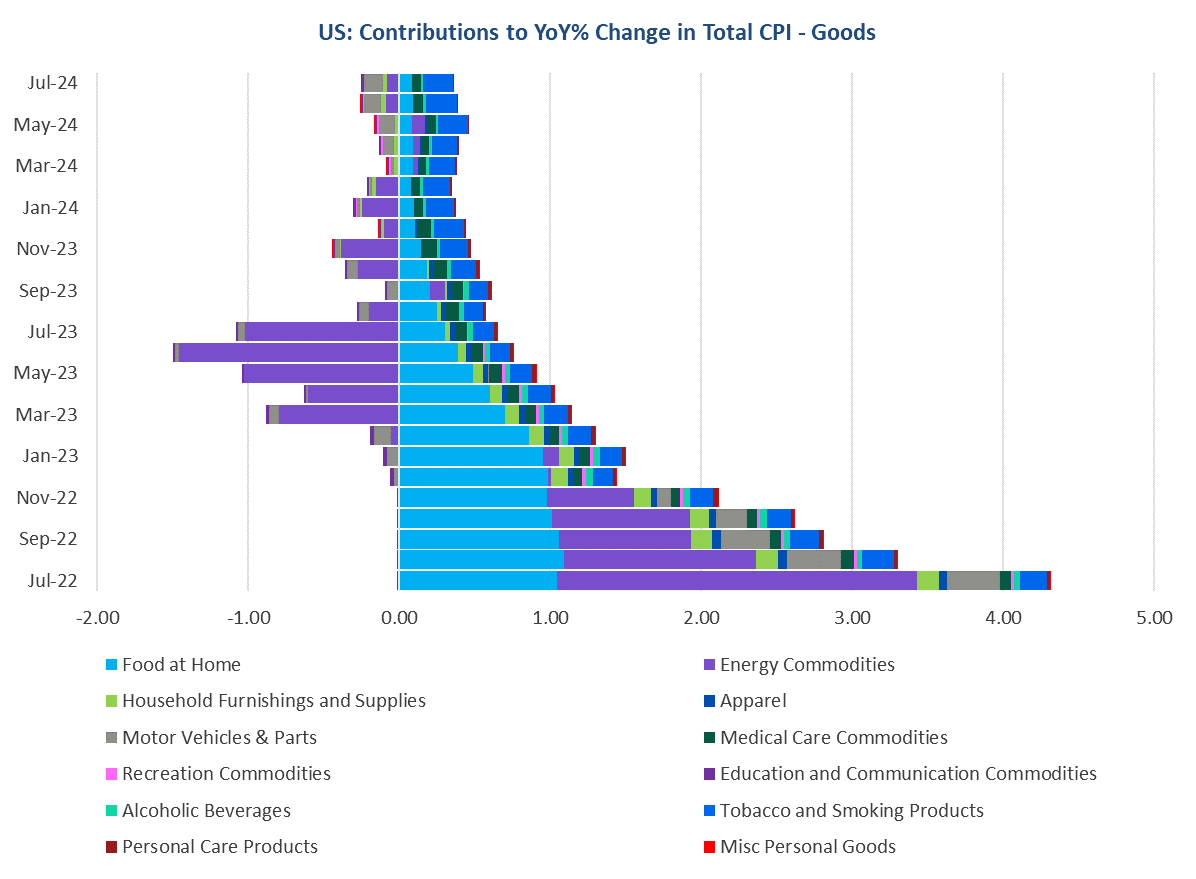

On a year-over-year basis, food and tobacco are mainly driving CPI good prices higher, but this is largely being offset by declines in prices for autos and energy commodities.

Figure 3. Goods price inflation components are largely offsetting

Source: Bureau of Labor Statistics and The Conference Board.

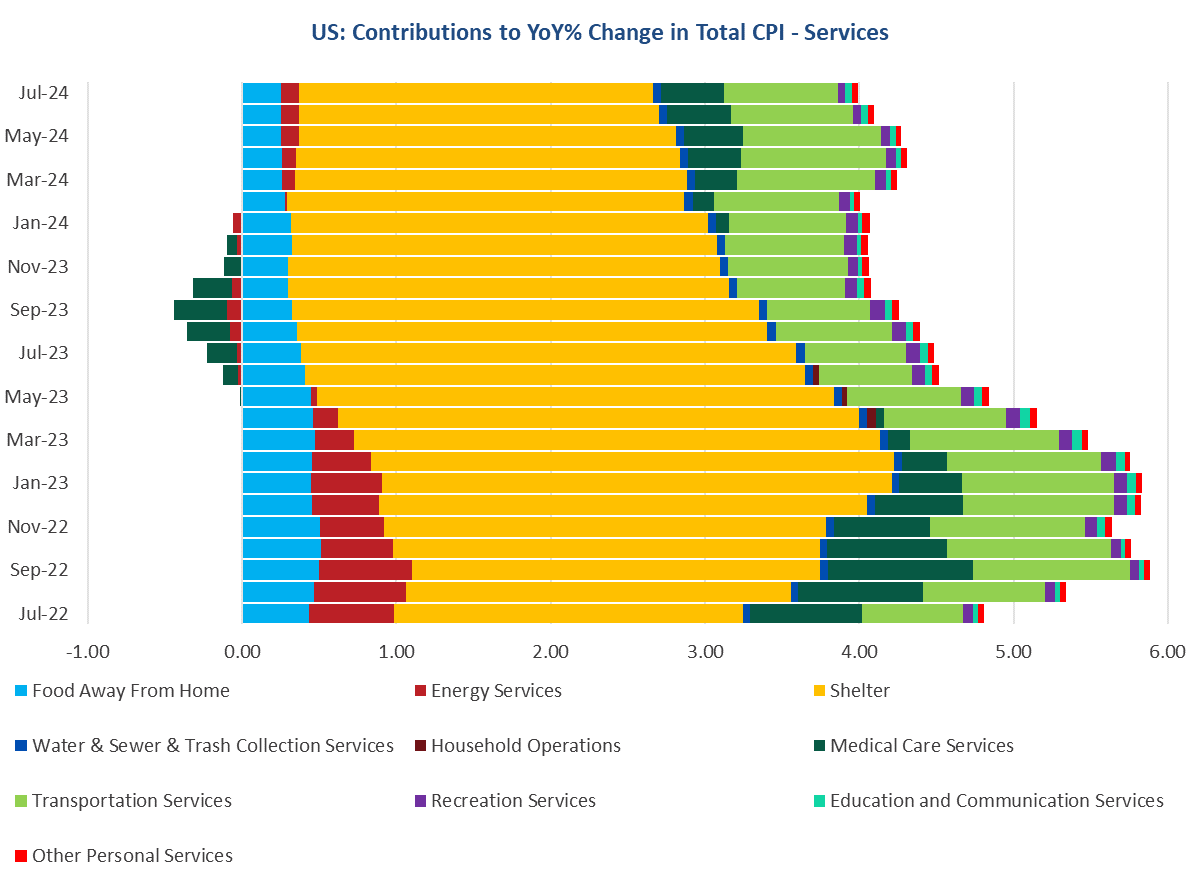

Hence, it is still the case that services are driving most CPI inflation on a year-over-year basis. The largest contributor is housing costs, but those are slowly shrinking consistent with past cooling in home prices. Nonetheless, medical services and transportation services price increases are still notable drivers of services inflation.

Figure 4. Services price inflation cooling as shelter costs ease

Source: Bureau of Labor Statistics and The Conference Board.

-

About the Author:Dana M. Peterson

Dana M. Peterson is the Chief Economist and Leader of the Economy, Strategy & Finance Center at The Conference Board. Prior to this, she served as a North America Economist and later as a Global …

0 Comment Comment Policy