FOMC Meeting Reaction – Fed Begins Taper, Disagrees Over Inflation

03 Nov. 2021 | Comments (0)

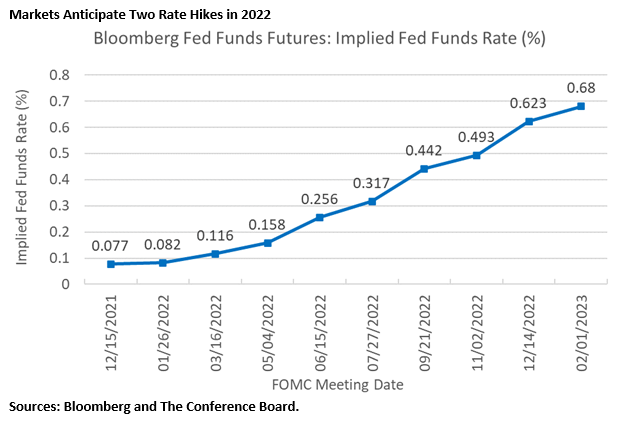

As expected, the Fed announced the start of tapering of its large-scale asset purchases program (LSAP), and exhibited a more hawkish tone on inflation at its November meeting. Still an apparent doubling down on the view that mounting inflationary pressures are largely transitory in nature suggests continued internal disagreement among FOMC participants on the timing and pace of future interest rate hikes. The internal debate notwithstanding, markets are pricing in the first 25 basis point rate hike as soon as June 2022, with the possibility of a second hike later that year.

Insights for What’s Ahead

- The Fed’s QE announcement begins removal of extraordinarily accommodative monetary policy – a sign of greater confidence in the evolution of the US economy amid the pandemic. Still, the Fed remains cautious, stating that it stands ready to adjust the pace of QE purchases should there be a negative turn of events.

- There was no change in policy rates today, but markets and interest rate sensitive businesses should expect higher interest rates over the next few years. The Summary of Economic Projections (SEP), last released in September, pointed to seven or eight interest rate hikes over the 2022-2024 span. The November statement hints that there has been no retreat in those expectations.

- Although interest rates will rise from the current zero-lower-bound, the SEP still anticipated a healthy economic backdrop over the medium term. Even with upwards of 200 basis points of tightening, the SEP projected above-pre-pandemic-trend rates of GDP growth and continued decline in the unemployment rate.

- The key risks to the monetary policy path relate to the evolution of the pandemic, progress on vaccinations, jobs, inflation, and also fiscal policy. A more rapid return to in-person services consumption, and continued improvement in labor markets, but also faster inflation might prompt the Fed to raise interest rates sooner and more often in 2022 than currently priced in. Also, the passage of additional fiscal stimulus that materially boosts growth and feeds prices next year could also hasten the tapering and rate hike timeline.

5 Key Takeaways

- The Fed is pleased with the economy despite the Delta Variant disruption. The Fed left interest rates unchanged in November, but began its highly anticipated start to QE taper. The reduction in US Treasury and mortgage backed securities (MBS) purchases was well telegraphed, and reflected confidence that the US continues its expansion in the wake of the 2020 pandemic-induced recession. Starting later this month, the Fed will buy $10 billion fewer of US Treasures and $5 billion less of MBS. This would result in $70 billion of Treasuries and $35 billion of MBS purchases in November. The Fed would again reduce purchases amounts in December to $60 billion and $30 billion, respectively. Although tapering is not on a preset course, monthly reductions of this nature would end the LSAP program by June of 2022.

- The Fed still sees slack in the labor market, but potentially not as much as before. Fed Chair Powell in a post-statement press conference indicated that the economy could potentially achieve full employment next year. This would meet one aspect of the Fed’s dual mandate, which stipulates maximum employment and inflation at the rate of 2 percent over the longer run. When asked about low participation rates, the Chair indicated confidence that they would pick up and that payrolls could return to the half-million per month pace that predated the Delta variant. Chair Powell also pointed to the aging population as a reason for low participation rates. So, as many persons have retired participation rates might still remain below pre-pandemic levels, a signal that the FOMC views that there is not as much slack still left in the labor market as the data suggest.

- The Fed thinks rising inflation is still mostly transitory in nature. The Fed acknowledged that inflationary pressures are mounting, but appeared to double down on its view that inflationary pressures are largely linked to the pandemic, and thereby temporary in nature. The Fed cited in the statement that “Supply and demand imbalances related to the pandemic and the reopening of the economy have contributed to sizable price increases in some sectors, but that “an easing of supply constraints are expected to support continued gains in economic activity and employment as well as a reduction in inflation.” Notably, Chair Powel acknowledged that supply chain issues were lasting longer than expected and could persist well into next year. Still he stated at the press conference that “transitory” means not permanently high prices, and noted that inflation pressures could start to ease by 2Q or 3Q of 2022. However, the September SEP saw a shift upwards in timing of the first rate hike from 2023 to 2022 among a number of FOMC participants. This could hint at continued internal disagreement among FOMC participants over the duration of above-target inflation, and importantly the timing and pace of future interest rate hikes. The Conference Board continues to maintain that while some factors are temporary, there are also some elements of inflation that may prove to be more enduring even once the pandemic is behind us.

- The Fed doesn’t fear a wage-price spiral. Chair Powell stated that there was no evidence of a wage-price spiral afoot and rejected the notion that inflationary (i.e., consumer price inflation) pressures to date are a function of a tight labor market. This is despite acknowledgement that wages are rising very strongly. Instead, Chair Powell pointed to very strong demand and supply-chain bottlenecks as the cause of inflation, not wages. Moreover, that the strength in wages was a sign of the tightness in the labor market. In other words, the Fed sees little passthrough of wage increases to consumer prices, and that consumer price rises are mainly due to passthrough of costs from supply chain issues and outsized demand for goods and select services. Importantly, Chair Powell appeared to view as pivotal the duration of the tightness of the labor market in sparking passthrough of wages to prices. Chair Powell’s statements are in contrast to soundings The Conference Board is hearing from members, who are sighting bottlenecks, transportation costs, high commodity prices, and wages for their increases in prices for customers.

- The Fed stands ready to battle inflation if needed. Chair Powell reiterated that the Fed has been and will continue to adapt to the economic situation, including the evolution of inflation. Moreover, that while it remains patient regarding achieving its dual mandate it will use tools to get inflation under control as needed. Until then the Fed will remain patient in achieving maximum employment, which is desired to be broad and inclusive (i.e., considering the progress of labor market metrics of different demographic groups, including women, ethnic minorities, and the youngest and oldest workers), and inflation moderately above 2 percent for some time so that inflation averages 2 percent over time and longer?term inflation expectations remain well anchored at 2 percent. While Chair Powell did state that risks are presently skewed towards higher inflation, the Fed continues to be patient about the labor market recovery. Also that when the full employment mandate is met, the inflation mandate might also be achieved. However, if Chair Powell’s five-point checklist on inflation – (1) lack of broad-based pressures; (2) lower moves in high-inflation items; (3) low wage pressures; (4) tepid inflation expectations, and (5) long-lasting forces that have kept inflation low globally – continues to be challenged, then we could see aggressive actions to tamp down inflation sooner rather than later.

-

About the Author:Dana M. Peterson

Dana M. Peterson is the Chief Economist and Leader of the Economy, Strategy & Finance Center at The Conference Board. Prior to this, she served as a North America Economist and later as a Global …

0 Comment Comment Policy