Dec spending & inflation data encouraging, but risks remain

26 Jan. 2024 | Comments (0)

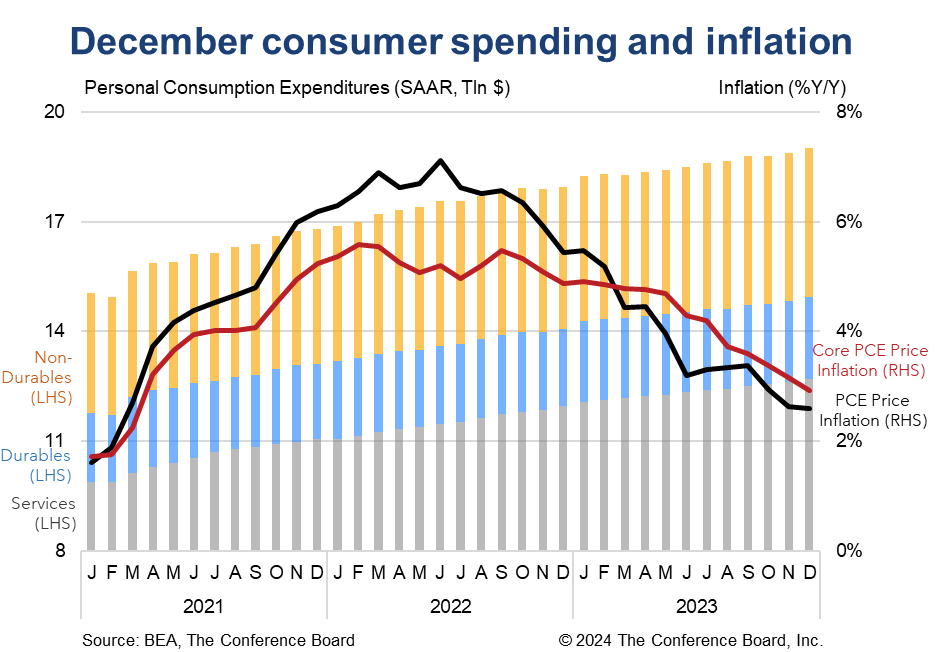

Consumer spending remained robust in December, but real disposable personal income cooled from earlier in the quarter. While both headline and core inflation rates ticked up slightly from the month prior, they remain within an encouraging month-on-month range. Both measures continue to converge toward the Fed’s 2% target. The Fed will likely be pleased by these data, but not to the extent that rate cuts are imminent. We expect the first cut to occur in Q2 2024.

Highlights

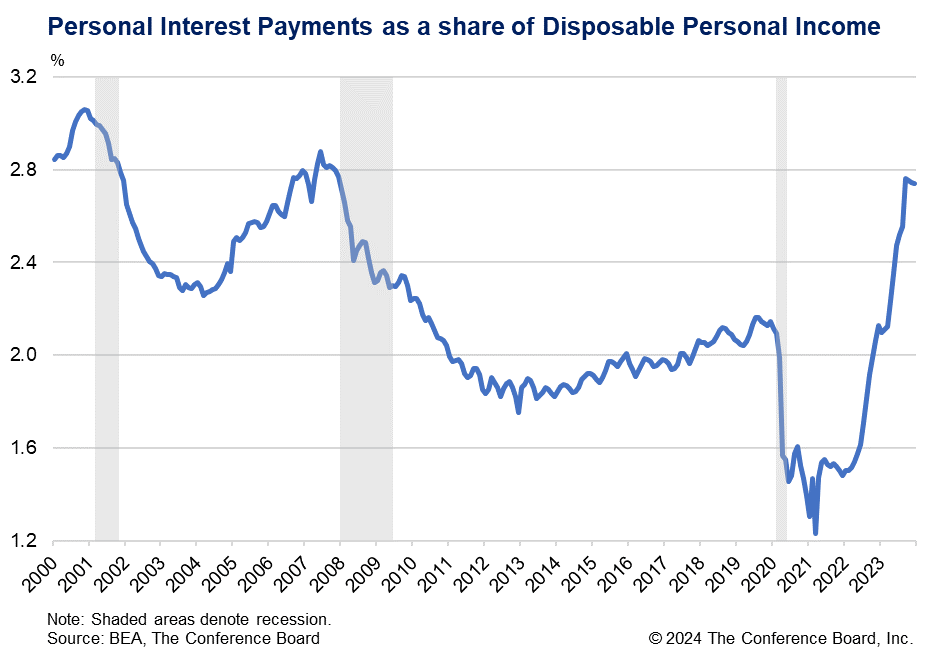

Collectively, these data showed an economy that continued to grow as inflation rates tempered. Consumer spending was robust over the holiday period with particular strength in goods spending. However, income growth (once again) failed to keep pace. Indeed, on an 6 month annualized basis real spending rose 3.8% while real disposable personal income was up just 1.7%. This mismatch in spending and income growth is not sustainable. The increased reliance on savings and debt cannot go on indefinitely. Savings rates remain far lower than they were prior to the pandemic and a sharp rise in Personal Interest Payments (household nonmortgage interest payments) is concerning (see below). A deviation from the ongoing spending to income trend is needed to achieve a soft landing for the economy. However, at this point, we are not confident that this will occur and a broader pullback in consumer spending may await later this year.

Fortunately, the inflation news for December remained encouraging. While both the headline and core PCE deflators ticked up in month-on-month terms from their November readings, the reported rates were within the band needed to drive inflation down. Indeed, year-on-year inflation rates continued to converge to the Fed’s 2% target. While continued disinflation is likely, it’s too early to celebrate and the Fed will likely err on the side of caution and keep interest rates steady into Q2 2024.

Inflation

Headline PCE price inflation remained unchanged at 2.6% y/y in December but core PCE price inflation (which excludes food and energy) slowed from 3.2% to 2.9% y/y. On a month-over-month basis, headline PCE inflation increased from -0.1% to 0.2% and core PCE inflation rose from 0.1% to 0.2%. Prices for goods fell 0.2% m/m and services rose 0.3 percent m/m. Energy prices rose 0.3% m/m.

Incomes

Overall personal income rose 0.3% m/m (in nominal terms) in December, vs. 0.4% m/m in November. When factoring in inflation, the real month-over-month growth rate was 0.1% m/m. In year-over-year terms, real personal income rose 2.0% in December, vs. 1.9% in November. Meanwhile, real disposable personal income (which is personal income less taxes) rose by 0.1% m/m, vs. 0.5% m/m in November. Finally, the savings rate fell to 3.7% from 4.1% of disposable personal income.

Interest Payments

Personal interest payments (PIP), which represent nonmortgage interest paid by households, rose 0.7% m/m in December, vs. 0.9% m/m in November. However, in year-over-year terms these payments are up 37% (vs. a peak of 66.5% y/y in June 2023). Consumer’s growing reliance on debt, and specifically credit card debt, and the surge in interest rates over the last two years are responsible for these gains. As of December, PIP accounted for 2.7% of overall Disposable Personal Income. Rates this high have not been seen since 2007.

Spending

Personal consumption expenditures jumped by 0.7% m/m (in nominal terms) in December, vs. 0.4% m/m percent in November. Spending on services rose by 0.6% m/m while spending on goods rose 0.9% m/m. After accounting for inflation, real consumer spending was up 0.5% m/m in December with spending on services rising 0.3% m/m and spending of goods rising 1.1% m/m.

-

About the Author:Erik Lundh

Erik Lundh is Senior Global Economist for The Conference Board Economy, Strategy & Finance Center, where he focuses on monitoring global economic developments and overseeing the organization&rsquo…

0 Comment Comment Policy