PCE Report Supports Further Fed Rate Hikes Ahead

30 Jun. 2023 | Comments (0)

Highlights: Consumer Spending Showing Signs of Slowing, But Incomes and Inflation Remain Elevated

Nominal personal income rose in May, and real incomes continued to rise year-over-year supporting continued spending by US consumers in the month. Although nominal personal consumption expenditures (PCE) increased, real spending was unchanged in May signaling slower momentum in consumer spending in the second quarter of 2023 following the first quarter surge. Nonetheless, the spending that did occur was largely for services, a space the Fed is struggling to calm. While headline PCE inflation continued to slow (to 3.4 percent year-over-year), the core measure was roughly unchanged at 4.6 percent year-over-year, a pace well above the Fed’s 2-percent target. Core services inflation continued to keep PCE inflation less food and energy notably elevated.

Insights for What’s Ahead

- Today’s data support the Fed’s desire to continue raising interest rates to return inflation back to the 2-percent target. Slower overall real spending notwithstanding, much of the spending was on services. Moreover, core PCE inflation – the Fed’s preferred consumer inflation gauge – remained sticky.

- We forecast at least one more interest rate hike, and leave the door open for more, given the stubbornness of inflation, and continued supports for consumer spending, including a robust labor market and rising real incomes. Another hike as soon as the July meeting is possible.

- Although markets continue to price in rate cuts if the recession we continue to forecast occurs, we posit the Fed will allow a lengthy pause in rates after achieving a peak this year, and not consider any rate reductions until well into 2024.

Spending Potentially Losing Some Momentum

Nominal personal consumption expenditures rose by just 0.1 percentage point in May after a sizable 0.6 percentage point increase in April. All the increase in nominal spending was on services, consistent with the swing in household demand from primarily goods during the pandemic, to more services postpandemic. In real terms (i.e., after adjusting for inflation) consumer spending was flat in the month, and between April and May suggest slowing real spending in Q2 following the 4.2 percent annualized surge in Q1 of this year.

Rising Real Incomes Still Lending Support

The nominal spending in May was supported by a 0.4 percent increase in nominal income. Wages and salaries were up 0.5 percentage point in the month and supplements to wages and salaries increased by 0.4 percentage point. Real income increased by 0.3 percent in the month, as was real disposable income (i.e., total income less taxes). Compared to last year, real personal income increased by 1.6 percent marking five months of positive year-over-year income growth after spending much of the prior two years in negative territory.

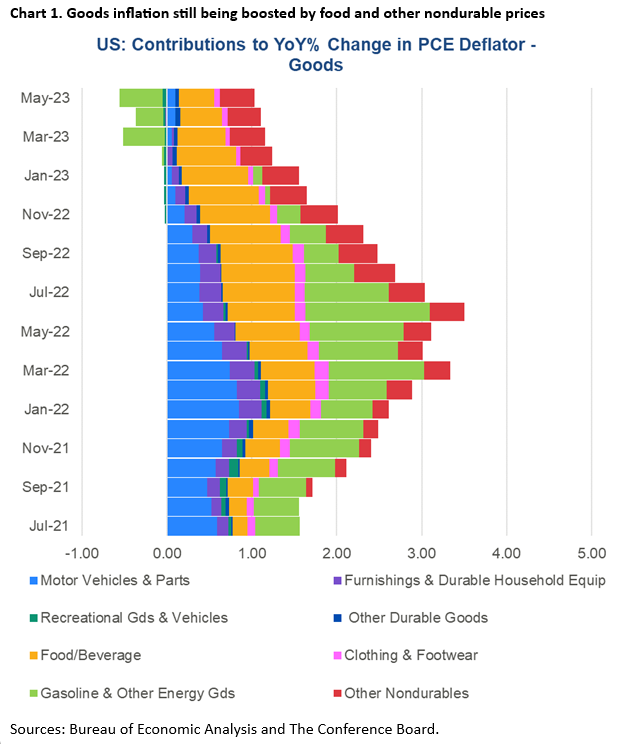

Falling Energy, Slower Food Price Increases Taming Total Inflation

Headline PCE inflation continue to slow in May, reflecting less pressure from gasoline, but also food prices. Total PCE inflation rose by just 0.1 percent month-over-month after a 0.4 percent increase and slowed from 4.3 percent to 3.4 percent year-over-year. Energy prices fell by 3.4 percent month-over-month and fell from -6.3 percent to -13.5 percent year-over-year. Food prices ticked up by 0.1 in the month but slowed dramatically from 6.9 to 5.8 percent year-over-year.

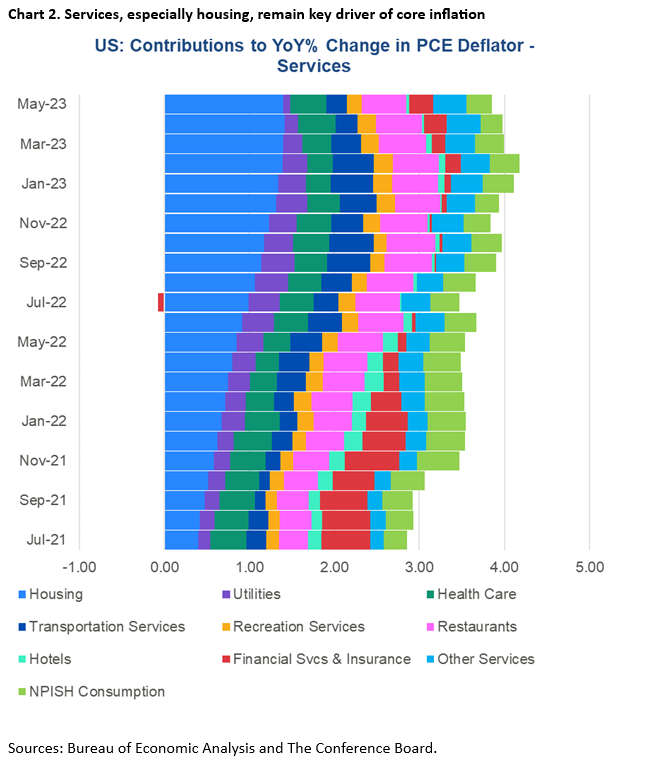

Core Inflation Remains Challenged by Stubborn Services Prices

However, core inflation, which excludes food and energy remained sticky at 4.6 percent year-over-year. The gauge has remained in a tight range of 4.6 to 4.7 percent year-over-year for the last six months. This is because month-over month changes have continued to exceed 0.3 percentage points. Housing costs, in the form of rents, continue to contribute to monthly and year-over-year increases in inflation. Behaviors in rent prices tend to lag that of new and existing home prices by about 18 months. The good news is that within a few months cooling home prices that has already occurred will start to be reflected in consumer price indexes for rents.

Even away from rents, food and other nondurable goods continue to boost goods price inflation, and in-person services like hotels, restaurants, and health care continued to buoy services inflation. Services inflation away from housing (i.e., ‘super core’) are particularly difficult for the Fed to address with interest rate hikes, because consumers do not usually finance services. Indeed, even credit card use is difficult to curb as interest rates on credit do not move with the federal funds rate.

-

About the Author:Dana M. Peterson

Dana M. Peterson is the Chief Economist and Leader of the Economy, Strategy & Finance Center at The Conference Board. Prior to this, she served as a North America Economist and later as a Global E…

0 Comment Comment Policy