In Today’s Deep Recession, Consumer Spending On Goods Is Above Pre-Pandemic Levels. Why?

24 Aug. 2020 | Comments (0)

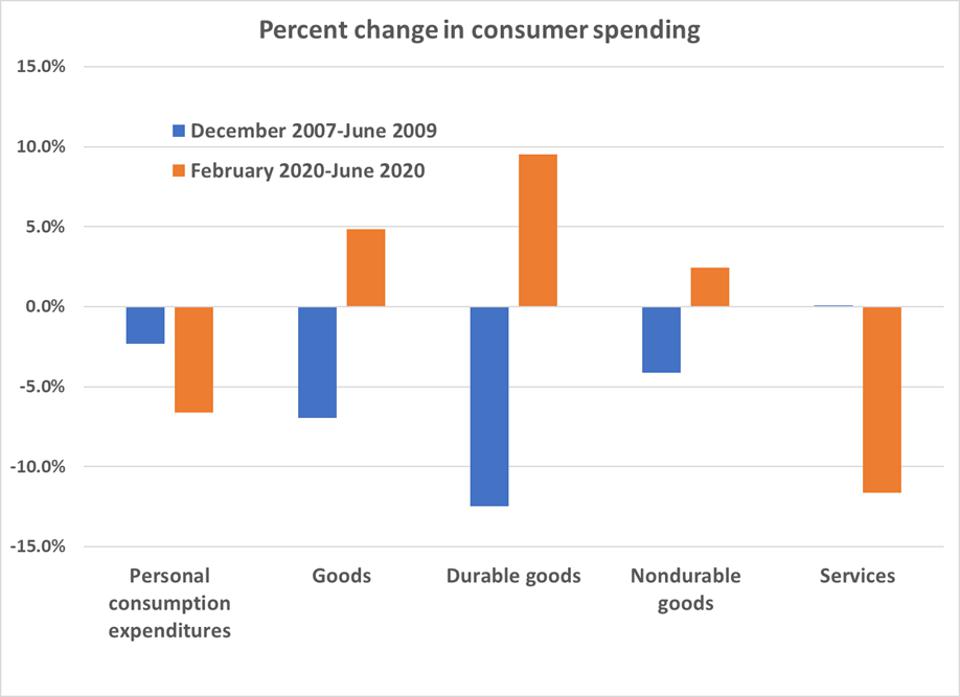

One of the categories that experiences the largest decline in a typical recession is consumer spending on goods. The US is now enduring the worst recession in 80 years: Employment in July was about 13 million below February’s number while GDP dropped by 11 percent in the first half of 2020. Yet in June, consumer spending on goods was 5 percent above pre-Covid-19 levels. Why?

First, and most importantly, as a result of the pandemic, spending on in-person, leisure-related services, like travel, restaurants and entertainment, took a dive, leaving US consumers with ample funds to spend on other categories, and leading to a shift from services to goods.

Second, the US consumer has been supported by the largest government stimulus in our history. Despite the huge loss in labor income, personal income in June was 4 percent higher than in February, providing US households more funds for spending.

Finally, pent-up demand spurred the high level of spending on goods in June. Some of the spending that did not occur in March, April or May, due to retail shutdowns and other reasons, took place instead in June.

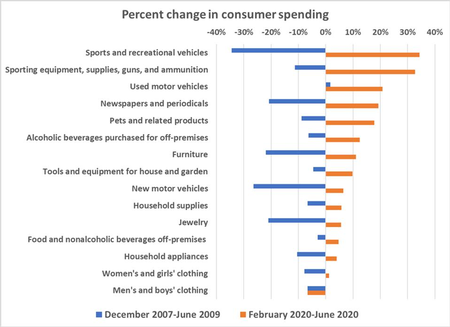

Consumers were unwilling or unable to spend on leisure-related services from February to June so instead they spent on leisure-related goods, such as sports and recreational vehicles, sporting equipment, newspapers and periodicals, pets and related products, and alcoholic beverages. Recessions typically hit these goods hard, so the current spending spree is a nice surprise for their manufacturers and importers.

Spending on motor vehicles, another recession-sensitive category, is also experiencing a large spike, as well as furniture and tools and equipment for houses and gardens. The shutdown of many restaurants and bars is leading to a large increase in consumer spending on food and beverages, especially alcoholic beverages.

Spending on jewelry, another category that has been typically hard-hit during recessions, is also experiencing growth in this crisis. And while expenditures on men’s clothing took a big hit between February and June, consumers spent slightly more than they had been on women’s clothes. Spending on household supplies, including pandemic-related cleaning supplies, are also well above February levels.

Will the high level of spending on goods continue?

On the one hand, the weak spending on services is likely to continue in the coming months as new infections remain widespread, state and local governments keep restrictions in place and consumers remain cautious about engaging in high-risk activities.

On the other hand, the government stimulus is likely to become less generous and the pent-up demand that powered June’s numbers may gradually decline.

All in all, the drop in spending on services is so large that even if the stimulus becomes much less generous, households would still be able to maintain high spending on goods, especially leisure-related products, which are perceived as replacements for leisure-related services. Spending on consumer goods may not grow further in 2020, but it is likely to continue defying the typical recession trajectory.

The shift from spending on services to goods bodes well for the manufacturing sector and is reflected in the rapid increase in new orders, as reported by the Institute for Supply Management. The surprisingly strong outlook for consumer spending data on goods may also partially reverse earlier decisions by manufacturers to cut back on investment.

In sum, despite the deep recession, stronger than expected spending on consumer goods should continue as long as the fear of engaging in leisure-related services remains high, which may continue well into 2021.

This article was originally published in Forbes. Read all of Gad Levanon's columns here

-

About the Author:Gad Levanon, PhD

The following is a biography of former employee/consultant Gad Levanon is the former Vice President, Labor Markets, and founder of the Labor Market Institute. He led the Help Wanted OnLine©…

0 Comment Comment Policy