Strong Job Gains in June, But Participation Still Disappoints

02 Jul. 2021 | Comments (0)

Commentary on June U.S. Bureau of Labor Statistics Employment Situation Report

by Frank Steemers, Senior Economist, The Conference Board

Today’s jobs report showed the strongest increase in job growth so far in 2021. Wages accelerated further in June, but labor force participation is still not picking up. Employers continue to struggle with recruitment and retention difficulties, while workers benefit from increased bargaining power and job opportunities.

Nonfarm payroll employment increased by 850,000 in June, after an upwardly revised increase of 583,000 in May. The published unemployment rate ticked up from 5.8 to 5.9 percent, and the true rate, after adjusting for the misclassification error, remained at 6.1 percent in June. The labor force participation rate also held steady in June, at 61.6 percent. The number of jobs is still 6.8 million below February 2020 levels, with women representing 56 percent of these employment losses.

June’s job gains were once again driven by the leisure and hospitality industry, which added 343,000 jobs— representing 40 percent of all jobs gained in the month. Construction showed employment losses for the third consecutive month, while retail saw growth for the second month in a row. While the unemployment rate slightly ticked up, the number of people working part-time for economic reasons declined and is nearing prepandemic levels.

Recruitment and retention difficulties continue to be a growing concern for employers. Wages are accelerating, with average hourly earnings up 5.9 percent (annual rate) over the past three months, signaling employers are offering stronger incentives to attract qualified workers. In addition, other labor market data shows that job openings, quits, and employers reporting hiring difficulties are historically high. Especially in the in-person services industries, demand is outpacing labor supply.

Pandemic-related reasons are still constraining labor supply. Currently, some workers are not joining the labor market because of the fear of contracting COVID-19, the need to take care of young children during school closures or remote learning, elder care, and/or elevated federal unemployment benefits. In addition, older workers are retiring early and some people are still discouraged over job prospects, further limiting the supply of available workers. While this demand-supply mismatch is expected to be temporary and pandemic-related, it could result in the short-term to price inflation if employers transfer wage increases to prices.

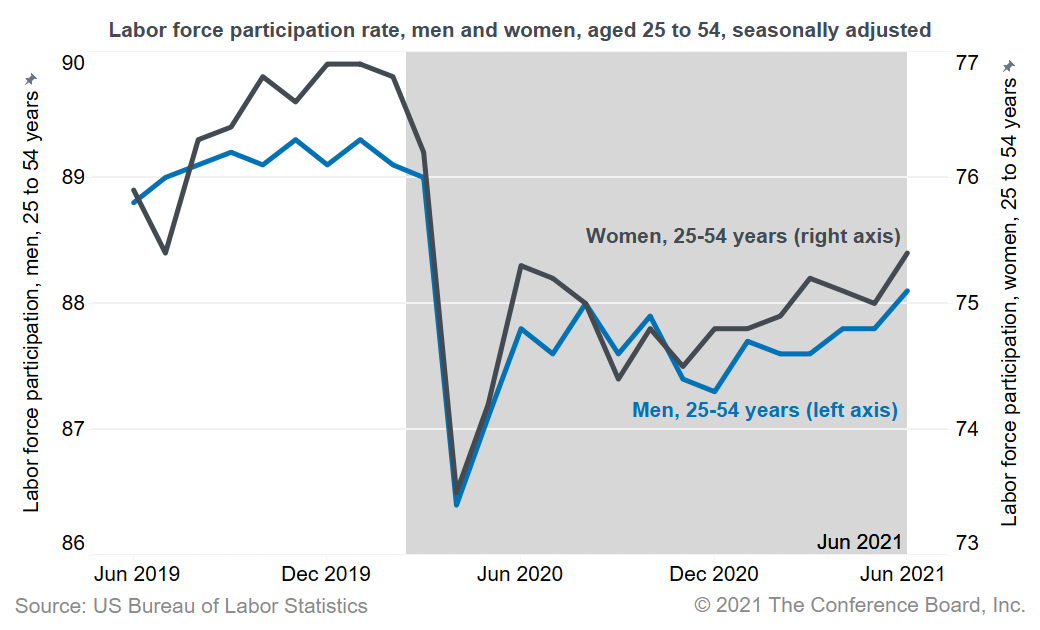

The labor force participation rate shows that many people have not yet reentered the workforce. Although there appears to be some improvement in the participation rate for men and women aged 25 to 54, participation has not significantly picked up over the past year and remains at 61.6 percent, well below the prepandemic rate of 63.3 percent seen in February 2020. In June, the number of people not in the labor force was 5.1 million higher compared to February 2020.

Towards the end of 2021, the current pandemic-induced labor shortages should become less severe. More job openings will have been filled by then and more workers will likely be available to work as these pandemic-related supply constraints disappear or begin easing. This means that labor force participation should start to rise in the second half of 2021, although some workers may have permanently dropped out of the labor force.

-

About the Author:Frank Steemers

The following is a bio or a former employee/consultant Frank Steemers is a Senior Economist at The Conference Board where he analyzes labor markets in the US and other mature economies. Based in New …

0 Comment Comment Policy