Retail sales stumbled in January

15 Feb. 2024 | Comments (0)

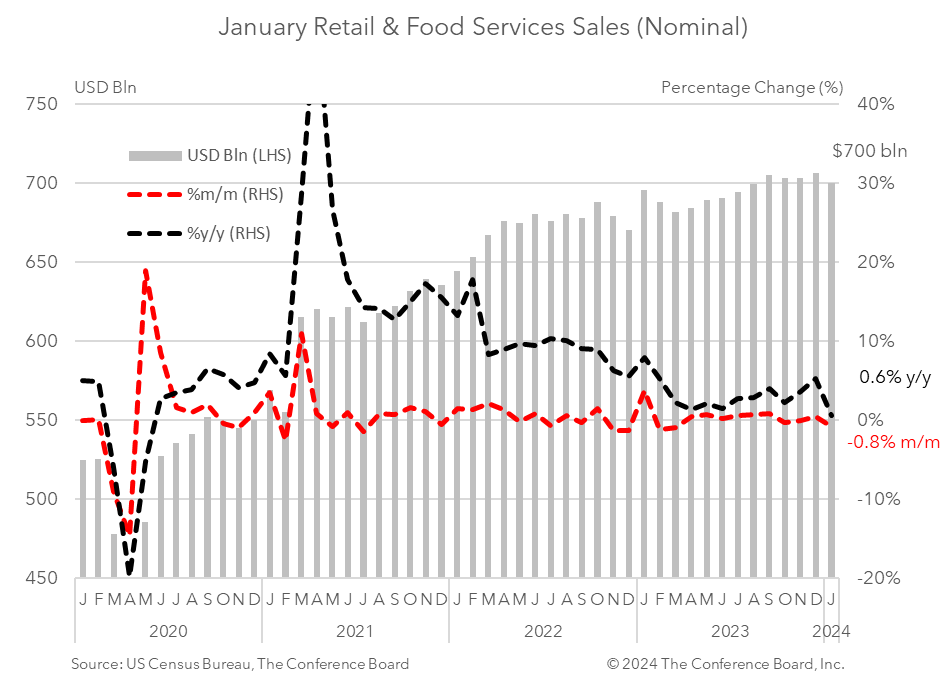

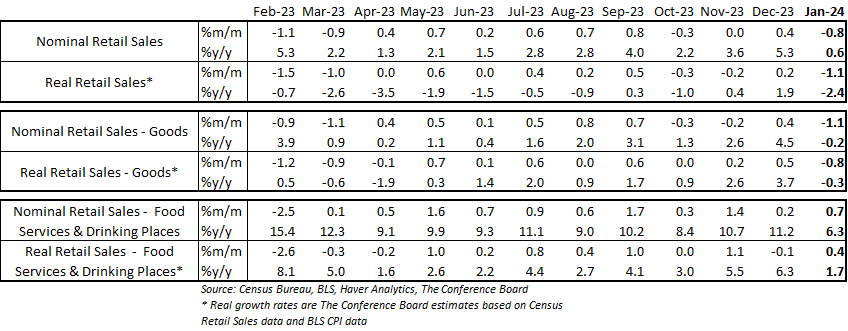

Following a strong holiday spending period, nominal retail sales stumbled in January. Retail spending fell by 0.8% from the previous month, following a 0.4% m/m increase in December (revised down from +0.6%). After adjusting for inflation using CPI data, real December spending growth was down 1.1% from December and down 4.3% annualized from the Q4 2023 average.* The decline in retail spending is consistent with our expectation of slower consumer spending in Q1 2024.

These data show a pullback in spending activity following the strong, but not as strong as previously thought, holiday period. While most categories saw a decline in January, several were notably weaker – including building supplies. Colder-than-usual weather may have played a role here. The decline in spending may also be the result of over indulgence during the holidays as consumers work to confront historically high credit card debt and a surge in ‘buy now-pay later’ purchases. While an uptick in CPI inflation in January will likely be a cause of concern for the Federal Reserve as it mulls interest rate cuts, softer consumer spending may impart some confidence that tight monetary policy is slowing the economy.

Key drivers of retail sales in January:

Consumer demand for goods fell 1.1% from the month prior in nominal terms. Spending on motor vehicles and parts fell by 1.7% in January from December, while retail sales excluding motor vehicles fell by 0.9%. Spending at gasoline stations fell 1.7% from the month prior due to a downtick in gasoline prices. Retail sales, less motor vehicles, gasoline, and building supplies (known as “Retail Control”) declined by 0.4% from the previous month. Except for a few categories, sales were down among a broad range of establishments. When adjusting goods spending for CPI inflation, the real growth rate was about -0.8%.*

Meanwhile, spending at food services and drinking places rose by 0.7% month-over-month in January. After adjusting for CPI inflation the real growth rate was about +0.4%.*

* Real growth rates are The Conference Board estimates based on Census Retail Sales data and BLS CPI data.

-

About the Author:Erik Lundh

Erik Lundh is Senior Global Economist for The Conference Board Economy, Strategy & Finance Center, where he focuses on monitoring global economic developments and overseeing the organization&rsquo…

0 Comment Comment Policy