U.S. Bureau of Labor Statistics Employment Cost Index (ECI)

31 Jan. 2024 | Comments (0)

Today’s ECI report revealed that wages and benefits continued to exhibit elevated growth above historical trends in the fourth quarter of 2023, but the rate of growth decelerated from earlier in the year. An earlier report from the Bureau of Labor Statistics showed that job openings remained high and layoffs were still below historic norms at the end of 2023, but companies slowed hiring suggesting pressure on wage growth might ease later in 2024. However, the ECI report also showed wage growth reaccelerated for some occupations in the goods producing where in-person work is required.

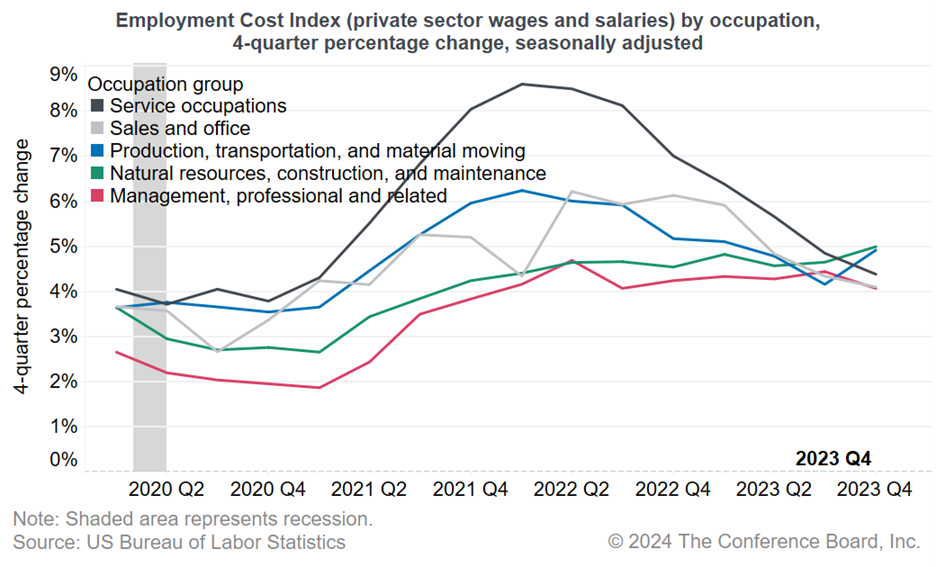

Chart: Wage growth reaccelerated for some occupation groups in Q4 2023

Highlights from the Compensation Report

Wage growth in the private sector stood at 4.1% year-over-year in Q4 2023, slightly lower than the 4.3% rate in Q3 2023 and markedly reduced from 5.1% in Q4 2022. The growth in benefits costs decelerated to 3.6% in Q4 2023 from 3.9% in Q3 2023 and was significantly below the 4.8% growth observed in Q4 2022.

The ECI report indicated that wage growth (year-over-over) for in-person service workers (including food services, cleaning, and personal care) decelerated to 4.5% year-over-over in Q4 2023, notably lower than the peak of 7.9% in Q2 2022. Similarly, wage growth for management and professional workers declined to 4.2% in Q4 2023 (from 4.5% in Q3 2023). Wage growth for sales and office workers also declined to 4.2% in Q4 2023 (from 4.4% in Q3 2023).

Conversely, wage growth for construction, natural resource, and maintenance workers, as well as production and transportation workers, reaccelerated to 4.9% year-over-year in Q4 2023, up from 4.6% and 4.2%, respectively, in Q3 2023.

What Should We Expect for the Wage Outlook?

While we may have passed the peak increases in wage growth witnessed over the last couple of years, there are signs of reacceleration for certain occupations. Furthermore, even for occupations that experienced declaration, wage growth is still above historic norms, and the rate of deceleration is slow.

While we anticipate a slowdown in the labor market in 2024 and foresee some job losses in the H2 2024, we project that the unemployment rate will only rise to 4.3 percent. Many industries will continue to grapple with recruitment and retention difficulties in the coming years. Although the labor market slowdown might somewhat decelerate wage growth, we anticipate elevated wage growth for the next year as 71% of CEOs expect to increase wages by 3% or more over the next year according to The Conference Board Measure of CEO Confidence™.

-

About the Author:Selcuk Eren

The following is a bio of a former employee/consultant Selcuk Eren, PhD, is a Senior Economist at The Conference Board. He is an experienced researcher in labor economics with a focus on demographics…

0 Comment Comment Policy