Compensation growth is decelerating, but still elevated

28 Jul. 2023 | Comments (0)

COMMENTARY ON TODAY’S U.S. BUREAU OF LABOR STATISTICS EMPLOYMENT COST INDEX (ECI)

Today’s ECI report showed that deceleration in wages and benefits growth continued in the second quarter of 2023 but growth rates remained above historical trends. The slower pace of compensation appreciation should be looked upon favorably by the Fed, as higher wages likely are contributing to consumer inflation. However, the relief is not coming fast enough, leaving the door open for at least one more interest rate hike before yearend.

Highlights

Wages for private industry workers grew by 4.6 percent over the past year, which was down from 5.1 percent in the first quarter of 2023 and 5.7 percent in the second quarter of 2022 when rate of growth reached its peak. Meanwhile, benefits costs grew by 3.9 percent compared to 4.3 percent in the first quarter of 2023 and 5.3 percent in the second quarter of 2022 – the recent peak.

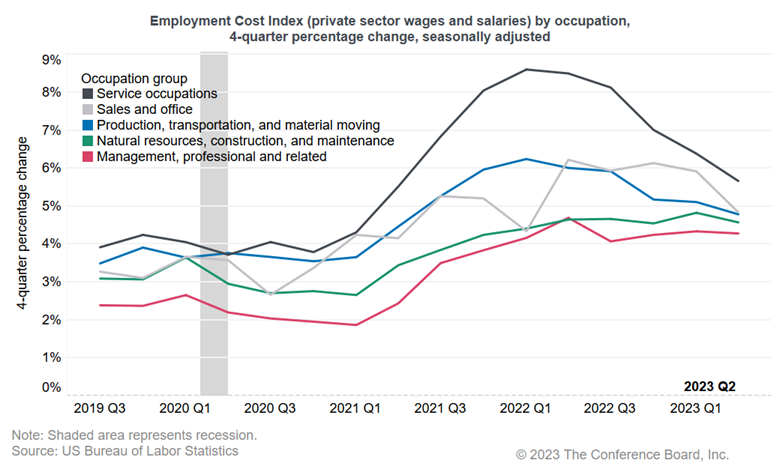

Wages continued to grow the fastest for in-person service workers (including food services, cleaning, and personal care), which increased by 5.7 percent over the last year, but down from 6.4 percent in the first quarter. The second quarter rate was elevated compared to prepandemic levels but below the peak of 8.6 percent reached in the first quarter of 2022.

Wage growth slowed in other sectors as well but not as sharply (see chart). Wages increased by 4.8 percent for sales and office workers (down from 5.9 percent in the first quarter), 4.8 percent for production and transportation workers (down from 5.1 percent in the first quarter), 4.6 percent for construction, natural resource, and maintenance workers (down from 4.8 percent in the first quarter), and 4.3 percent for management and professional workers (no change from the first quarter).

Some Signs of Labor Market Loosening

There are some signs that the labor market is loosening. Job openings are still elevated but have declined since it peaked in March 2022. Workers who switch jobs still have higher wage growth compared to those who stay but the gap is closing and is now below one percent suggesting recruitment challenges are somewhat easing and employers are not feeling the same pressure to give higher increases as they were last year. We see the impact in this report, with wage and benefits growth declining compared to last year. But more work needs to be done. Indeed, wage and benefits growth are still above historic norms and deceleration has been slow in some sectors including construction, natural resource, and maintenance workers as well as management and professional workers.

What is the Wage Outlook?

The peak in wage growth is behind us. We expect that the employment gains will slow over the rest of 2023 and we may see job losses by the end of this year. However, even with a recession, the unemployment rate is projected to rise to only 4.5 percent, which is roughly one million job losses. Companies probably will continue to experience difficulties in attracting and retaining talent due to persistent labor shortages in some industries, putting pressure on wages in those sectors. According to Q2 2023 results from The Conference Board Measure of CEO Confidence™, 75 percent of CEOs expect to increase wages by 3 percent or more over the next year and 52 percent of CEOs report some problems attracting qualified workers. This suggests that while wage growth may decelerate further in the coming months, it may be difficult to bring wage growth back to prepandemic levels quickly.

-

About the Author:Selcuk Eren

The following is a bio of a former employee/consultant Selcuk Eren, PhD, is a Senior Economist at The Conference Board. He is an experienced researcher in labor economics with a focus on demographics…

0 Comment Comment Policy