US Job Growth Continues, but Slows, in July

04 Aug. 2023 | Comments (0)

Commentary on today’s US Bureau of Labor Statistics Employment Situation Report

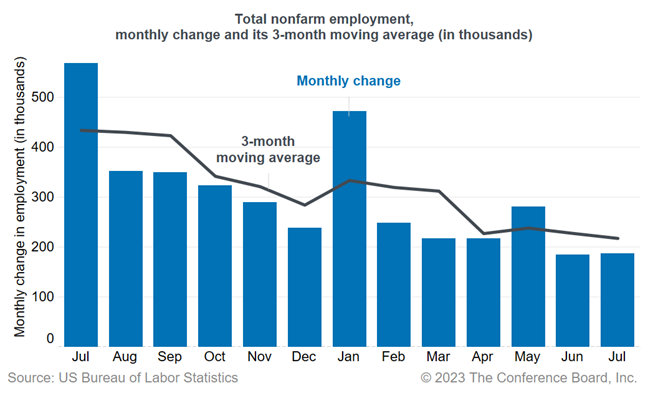

Today’s jobs report revealed that the US labor market continues to expand, but at a slower rate, with 187,000 jobs added in July. This follows a downwardly revised 185,000 additions in June. Job gains in July were concentrated in service industries, with health care, social assistance, leisure and hospitality, and other services accounting for the bulk of the increase.

Average weekly hours, which have been declining since the beginning of 2021, ticked down to 34.3 hours in July from 34.4 hours in June. This suggests that, in a slowing economy, companies are possibly opting to retain their workforce with reduced hours, rather than resort to layoffs amid concerns about future challenges in hiring.

Average hourly earnings increased by 4.4 percent year-over-year in July. Wage growth has changed very little since the beginning of 2023—a rate that is still above prepandemic levels but substantially below its peak in March 2022, when it reached 5.9 percent. With wage growth still elevated and likely feeding through to consumer inflation, we expect that the Federal Reserve will raise its target rates one more time by 25 basis points in the fourth quarter of 2023.

Unemployment rate remains near historic low

The Household Survey revealed that the unemployment rate declined to 3.5 percent in July from 3.6 percent in June. The labor force participation rate has remained stagnant since March at 62.6 percent, which is 0.7 percentage points below its prepandemic level in February 2020. The labor force participation rate for prime-age workers (25-54) ticked down to 83.4 percent—still above prepandemic levels and on an overall increasing trend.

The labor force participation rates among older-age workers (both 55-64 and 65+) increased in July, but the 65+ cohort still remains well below prepandemic levels. In the 20-24 age group, labor force participation declined by 0.4 percentage points in July to 70.6 percent and by 0.6 ppts to 35.7 percent in the 16-19 age group. Both rates are below their prepandemic levels, likely because many are going back to school.

Services account for bulk of job gains

The Establishment Survey revealed that health care (63,000), social assistance (24,100), other services (20,000), and leisure and hospitality (17,000) accounted for the bulk of June job gains. Together, these sectors were responsible for 70 percent of job additions. In-person services continue to face labor shortages, with job openings still elevated in these industries. In fact, we anticipate jobs will continue to be added in in-person service sectors even if we enter a recession. Other notable job gains were recorded in construction (19,000), financial activities (19,000), wholesale trade (17,900), and government (15,000).

With the slowing job growth, there are signs of cooling in some segments of the labor market. Industries that grew rapidly during the pandemic—including information services (-12,000) and transportation and warehousing (−8,400)—continue to shed workers as consumer demand shifts away from goods and towards services. Additionally, temporary help services—a leading indicator for hiring—lost another 22,100 jobs in July and has shed 205,000 jobs in total since its peak in March 2022. This suggests that the overall labor market will continue to slow down in the coming months.

We anticipate that monthly payroll gains will continue to slow and that negative readings are likely in early 2024. Relatedly, the unemployment rate is likely to start ticking higher also in early 2024 and rise to 4.2 percent, which is about 700,000 job losses.

-

About the Author:Selcuk Eren

The following is a bio of a former employee/consultant Selcuk Eren, PhD, is a Senior Economist at The Conference Board. He is an experienced researcher in labor economics with a focus on demographics…

0 Comment Comment Policy