US Labor Market Continues to Add Jobs

07 Jul. 2023 | Comments (0)

Commentary on today’s U.S. Bureau of Labor Statistics Employment Situation Report

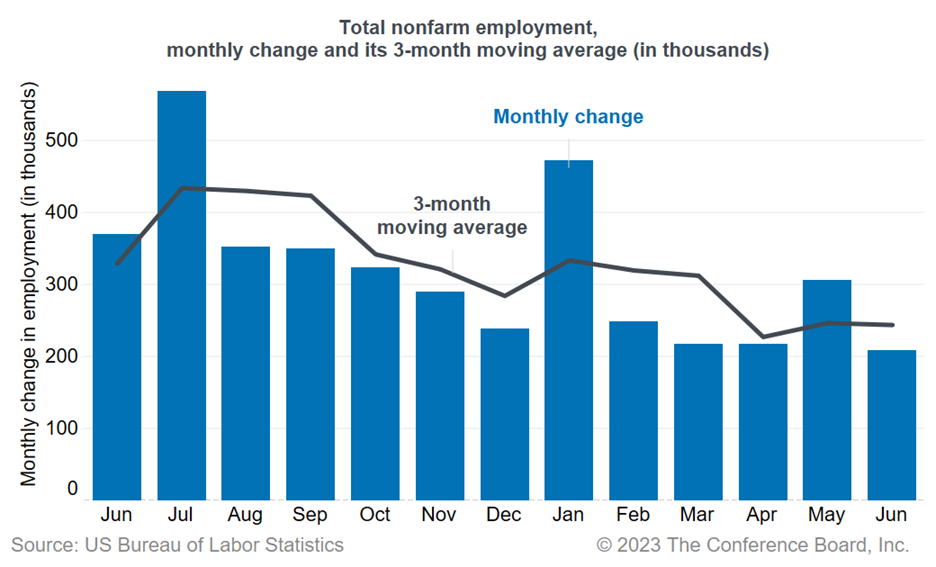

Today’s jobs report revealed the US labor market is still expanding, albeit at a reduced rate, with 209,000 jobs added in June following a downwardly revised 306,000 additions in May. Job growth was concentrated in a few industries, with health care and social assistance and government accounting for the bulk of the increase.

Average hourly earnings increased by 4.4 percent year-over-year in June, same as in May. Wage growth has moderated substantially from its peak in March 2022—when it reached 5.9 percent—but is still well above pre-pandemic levels. With wage growth staying elevated and job growth staying positive, we expect that the Federal Reserve will raise its target rates by at least another 25 to 50 basis points in the coming months—reflecting the inflationary pressures of continued wage growth on consumer prices.

Unemployment rate remains near historic low

The Household Survey revealed that the unemployment rate ticked down to 3.6 percent in June from 3.7 percent in May. The labor force participation rate for prime-age workers (25-54) increased to 83.5 percent—its highest level in the last two decades. However, the labor force participation rate among older-age workers (55+) fell by another 0.1 percentage points in June to 38.3 percent. This rate has been depressed by workers over 65, who continue to retire en masse, while participation among workers 55-64 is still rising. Meanwhile, labor force participation in the 20-24 age group declined 0.5 ppts in June to 71.0 percent—still significantly below its prepandemic level of 73.4 percent (February 2020), likely as a result of many going back to school.

Labor shortages continue to drive some job gains

The Establishment Survey showed that health care and social assistance (65,200), government (60,000), and leisure and hospitality (21,000) accounted for the bulk of June job gains. Together, these sectors were responsible for 70 percent of job additions. In-person services continue to face labor shortages, with job openings still elevated in these industries. In fact, we anticipate jobs will continue to be added in in-person service sectors even if we enter a recession. Other notable job gains were recorded in construction (23,000), professional and business services (21,000), and other services (17,000).

There are very few signs of cooling in the labor market, with June job losses largely concentrated in a few select industries, including retail trade (−11,200) and transportation and warehousing (−6,900). Temporary help services—a leading indicator for hiring—lost 12,600 jobs in June and has shed 109,500 jobs in total since November 2022. Nonetheless, layoffs in these sectors are consistent with the shift in consumer demand away from goods and towards services. Additionally, weakness in temporary help services point to further slowing in the overall labor market ahead.

Overall, average weekly hours ticked up from 34.3 hours in May to 34.4 hours in June, but has been on a declining trend since the beginning of 2021. This suggests companies are continuing to retain and add to their workforce, but are not increasing weekly hours. That’s consistent with CEOs in a slowing economy choosing to hold onto workers, potentially with reduced hours, rather than let them go for fear of future hiring difficulties.

-

About the Author:Selcuk Eren

The following is a bio of a former employee/consultant Selcuk Eren, PhD, is a Senior Economist at The Conference Board. He is an experienced researcher in labor economics with a focus on demographics…

0 Comment Comment Policy