Contrary to the Hype—Real Trends in Nontraditional Work

02 Nov. 2018 | Comments (0)

Since about 2015, the term “gig economy” has been everywhere. The growing perception has been that the share of nontraditional workers (or contingent, gig, on-demand, take your pick) has been dramatically rising and will continue to rise. In my presentations to our business members over the past three years, questions about the topic have often come up.

To learn more, read our full report or sign up for our upcoming special webcast.

The large majority of reports by researchers from consulting companies and academia in recent years have been supportive of this optimism. In particular, two of the leading labor economists in the world, Larry Katz and Alan Krueger, conducted a survey together with Rand Corporation and, in a very influential 2016 study, argued that the share of nontraditional workers increased by about 50 percent between 2005 and 2015.

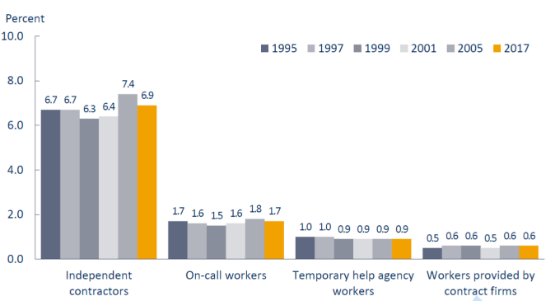

The Conference Board decided to investigate this topic, and this week, we released a new report which may surprise many business executives. We argue that the perception about the growth of the nontraditional workforce is out of line with hard data. By nontraditional we refer to independent contractors, workers in the temp help industry, and workers on premise employed by outsourcing companies (chart 1). It turns out that, according to the Bureau of Labor Statistics (BLS), the share of workers for which nontraditional work was their main job was not that different in 2017 than it was 20 years ago.

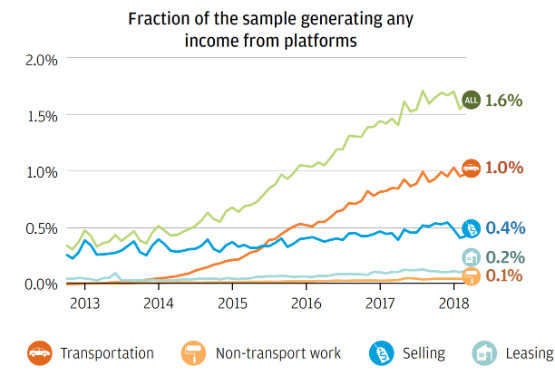

While the number of independent contractors earning income through online labor market platforms (Uber, Upwork, TaskRabbit, Amazon Mechanical Turk) has been growing, except for the transportation sector, these platforms represent a tiny share of income and total hours worked in the US economy, and are highly concentrated in certain specific occupations. In 2016, 50 percent of all job ads on a large labor platform were in occupations that comprised just one percent of US employment.

Chart 1

Source: U.S. Bureau of Labor Statistics.

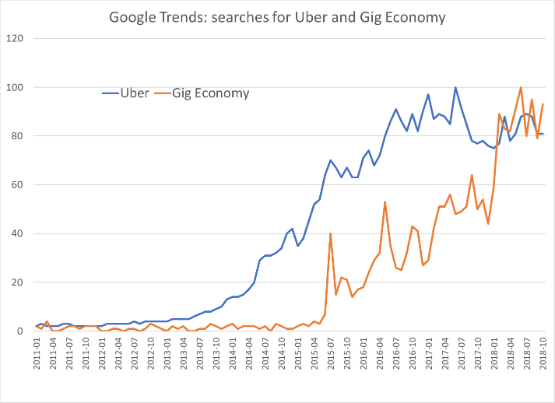

With the benefit of hindsight, why would one expect to see an increase in the share of nontraditional workers? Why did this become a hot topic? Going back a few years to trace the evolution of this perception through the main reports and articles on the topic, we find that it relies very much on the expectations that online labor platforms will rapidly gain share. It was probably driven by the dramatic growth of Uber during 2013-2014 (chart 2). In general, technology dramatically impacted the US labor market between 1995-2010, making it easier to believe that technology would continue to do so in the future.

Chart 2

Source: Google Trends.

So far, there is no doubt that the importance attributed to online labor platforms has been overestimated. Even though online labor market platforms have been around for more than a decade, they are still a tiny share of the labor market, except for transportation platforms. According to a recent JPMorgan report, only about 1 in a 1,000 of their clients earned income through non-transportation online labor platforms (chart 3). And only about 1 in 10,000 earned income in more than 9 months a year. My impression from talking to businesses is that the large majority of companies are still not using online labor platforms in any capacity.

Chart 3

Source: JPMorgan Chase Institute.

Now, things may change in the distant future, but for the near future, we don’t expect online labor platforms to be a major player. Nor do we expect to see a large increase in the share of nontraditional workers in a tight and tightening labor market, where nontraditional workers can more easily find traditional jobs if they wish to.

Our new report unpacks the forces constraining the growth of the nontraditional workforce and discusses the potential for online labor platforms to expand. In addition, we will be sharing our insights in our upcoming special webcast.

While small and concentrated, we believe that the growth in online labor platforms is likely to occur in the occupations where they are currently concentrated in, such as computer services, artists and designers, language and writing related workers, drafters, and clerical and office support occupations. Executives interested in considering online labor platforms should take notice.

-

About the Author:Gad Levanon, PhD

The following is a biography of former employee/consultant Gad Levanon is the former Vice President, Labor Markets, and founder of the Labor Market Institute. He led the Help Wanted OnLine©…

0 Comment Comment Policy