Tighter labor markets for blue-collar and low-paid service occupations

28 Sep. 2018 | Comments (1)

In this blog we present a view of the US labor market that was inconceivable just a few years ago; the threat of labor shortages is more acute in blue-collar and low-paid services occupations than in white-collar occupations.

Defining blue-collar and white-collar occupations:

Blue collar occupations include: construction, extraction, farming, installation, maintenance, repair, production, transportation, material moving, as well as low-pay services such as healthcare support, protective service, food preparation and serving, building and grounds cleaning, and personal care and service occupations. White-collar occupations include management, business, financial, professional, sales, office and administrative support occupations.

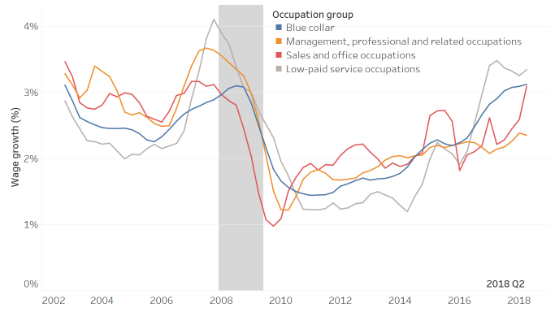

As discussed in an earlier blog, wage growth in recent years has been stronger for blue-collar and low-paid services occupations than for white-collar occupations. Displayed in Chart 1, wage trends based on Employment Cost Index measures show a significant acceleration over the past few years for blue collar and low-paid services occupations. The wage growth rate is comparable to the 2007 level. However, the acceleration in the wage growth of management and professional occupations, which consists about 40 percent of all workers and a large majority of all labor compensation, was much milder and is about 1.5 percentage point lower than in 2007.

Chart 1 – wage growth by occupation group.

Source: Employment Cost Index and calculations by The Conference Board.

The faster growth in wages for blue-collar workers is the exact opposite of the trend in recent decades when white-collar wage growth was higher. This result is consistent with labor market tightness measures by occupation group (Chart 2).

Chart 2 – Unemployment rates gaps versus 2007 average.

Source: Bureau of Labor Statistics.

In recent years, labor market tightening has been much more visible in blue-collar occupations. Over the past 12 months, the unemployment rate for these occupations was between 0.8% to 1.2%, below the 2007 average rate and dropping rapidly. In some blue-collar occupations, the current unemployment rate is even lower than in 2000, the year with the tightest labor market in 50 years. In contrast, the unemployment rate for management and professional occupations in the past year was no lower than in 2007, and barely declining at all since 2016.

Why are labor markets for blue-collar occupations tighter? It turns out that several trends converged in a perfect storm to significantly tighten the labor market for blue-collar and low pay services occupations.

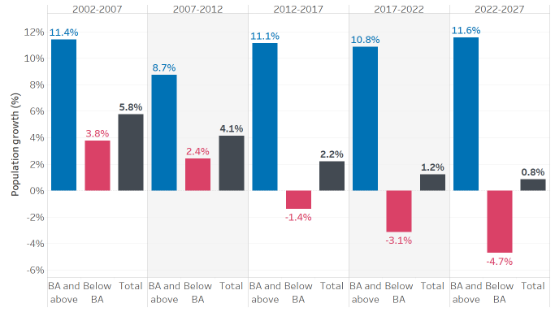

The main reason for the overall tightening in the US labor market in recent years is that the working age population is barely growing at all, explained by the aging of the large baby boomer generation. However, it turns out that the growth in working-age population is very different for people with or without a college degree. For those with a college degree, the working age population is solidly and uninterruptedly growing at about a 2 percent annual rate. For those without a college degree, it is shrinking and will continue to shrink even more rapidly over the next decade (chart 3). Importantly, people with a college degree are very unlikely to end up working in a blue-collar job, especially in a tight labor market like the US is experiencing today.

Chart 3 – Historical and projected working-age population growth by educational attainment.

Source: US Census, American Community Survey, calculations by The Conference Board.

On top of the US working-age population becoming more educated, another development is reducing the supply of non-college degree workers. The share of disabled population among non-college graduates has been rapidly increasing over the past couple of decades and is much higher than for college graduates.

Adding to the shortage in blue-collar occupations is the stigma of manual labor, insufficient vocational educational opportunities, and changed immigration policy that reduces the availability of undocumented immigrants, who are mostly employed in blue-collar and low-paid services occupations.

As a result, the share of the labor force without a college has been rapidly shrinking. Shrinking labor force of non-college graduates would not have been a problem if the demand for blue-collar and low-paid services occupations would have declined as well. But since the Great Recession, employment in these occupations has been continuously and solidly increasing.

In sum, there are simply not enough people in the labor force who are choosing to work in blue-collar jobs. There are already labor shortages in many blue-collar occupations and demographic projections suggest that for employers it will only become harder to recruit blue-collar workers in the coming decade. US businesses have proven again and again that are able to adopt to changes in the environment they operate in. In future blogs we will expand on the challenges they are facing, and describe how they have been reacting to these challenges.

-

About the Author:Gad Levanon, PhD

The following is a biography of former employee/consultant Gad Levanon is the former Vice President, Labor Markets, and founder of the Labor Market Institute. He led the Help Wanted OnLine©…

-

About the Author:Frank Steemers

The following is a bio or a former employee/consultant Frank Steemers is a Senior Economist at The Conference Board where he analyzes labor markets in the US and other mature economies. Based in New …

1 Comment Comment Policy

Great Post as always. It got me thinking about so many things

1. Is there any sense of how many of these blue color jobs can be automated over the next 5 years? (Some jobs lend themselves to automation while others do not). It seems that would be relevant to the "immigration as a solution" discussion. i.e., will automation bring demand into closer balance with supply.

2. Does this mean that reduced immigration is contributing to wage growth? (The Trump administration hypothesis)

3. Is wage growth desirable? Will higher wages make blue collar work more desirable and attract more people to these roles through substitution, or from off the sidelines (disability population). i.e., increase supply

What is "blue collar" work anyway? It seems like a lot of lower-end software coding, app development, data cleaning, etc, may be the NEW blue collar jobs. These jobs require certain aptitude, but increasingly only 6-24 months of certification or technical training - not a college degree.

Lastly, I noticed that Amazon is raising hourly rates, but at the same time they are actively trying to automate those same jobs - - that are now more expensive!